Time Sheet Import and RUN Powered

by ADP®

Processing Your Payroll

GTSG - V0418A

Trademarks

The ADP Logo, ADP, and RUN Powered by ADP are registered trademarks of ADP, LLC.

Small Business OnLine Payroll Powered by ADP are trademarks of ADP, Inc. Adobe, Acrobat, and Reader are either

registered trademarks or trademarks of Adobe Systems Incorporated in the United States and/or other countries.

Android, Google Chrome browser, and Google Play are trademarks of Google, Inc. Intuit and QuickBooks are

registered trademarks and/or registered service marks of Intuit Inc. or one of its subsidiaries. Microsoft, Windows, and

Windows NT are registered trademarks of Microsoft Corporation. Firefox is a registered trademark of Mozilla

Foundation. Sage, Sage 50 Accounting and related Sage marks are the trademarks of Sage Software, Inc. VISA is a

registered trademark of Visa.

All other trademarks are the property of their respective owners.

Copyright © 2012 - 2018 ADP, LLC. ADP Proprietary and Confidential. All Rights Reserved. These materials may not

be reproduced in any format without the express written permission of ADP, LLC.

ADP provides this publication “as is” without warranty of any kind, either express or implied, including, but not limited

to, the implied warranties of merchantability or fitness for a particular purpose. ADP is not responsible for any

technical inaccuracies or typographical errors which may be contained in this publication. Changes are periodically

made to the information herein, and such changes will be incorporated in new editions of this publication. ADP may

make improvements and/or changes in the product and/or the programs described in this publication at any time

without notice.

GTSG - V0418A

Time Sheet Import and RUN Powered by ADP® i Processing Your Payroll

Contents

Time Sheet Import ...................................................................................................... 1

Choose an Employee Identifier ................................................................................... 2

Assign Employee Time Clock IDs ...................................................................................... 2

Set Up Your Time Sheet Import File ........................................................................... 3

Time Sheet Import Template .............................................................................................. 3

Data Resources for Set Up ................................................................................................ 3

File Specifications .............................................................................................................. 4

Time Sheet File Record Layout Using a Payroll Assigned Identifier ................................... 5

Header Record ............................................................................................................... 5

Title Record .................................................................................................................... 5

Detail Record ................................................................................................................. 6

Sample Data .................................................................................................................. 7

Time Sheet File Record Layout Using Your Own Assigned Identifier ................................. 8

Header Record ............................................................................................................... 8

Title Record .................................................................................................................... 8

Detail Record ................................................................................................................. 9

Sample Data .................................................................................................................10

The Payroll Process .................................................................................................. 11

Perform Employee Maintenance ............................................................................... 12

Update Employee and Contractor Information ...................................................................12

Add Employees .................................................................................................................12

How Do I Add a Contractor? .............................................................................................13

Rehire Employees .............................................................................................................14

Terminate Employees .......................................................................................................14

Pay Your Employees and Contractors ...................................................................... 15

Import Time Sheet Data from My Time and Attendance System .......................................15

Fix Errors in the Time Sheet Import File ............................................................................16

Enter Payroll Information ...................................................................................................17

Run Reports .............................................................................................................. 18

Printing Paychecks ................................................................................................... 19

Print Paychecks ................................................................................................................19

Print Direct Deposit Vouchers ...........................................................................................20

Move the Pay Cycle to the Next Pay Period ............................................................. 21

Appendix: Understanding Time Sheet Import Errors ................................................. 22

Time Sheet Import and RUN Powered by ADP® 1 Processing Your Payroll

Time Sheet Import

Time Sheet Import is a feature that allows you to import data from your time and

attendance system into RUN Powered by ADP® each payroll, saving you valuable

time and reducing the risk of data entry errors. You can include imported payroll

data in both regular and special payrolls.

We have time sheet import templates as well as a guide you can use to help walk

you through the process.

To use this feature, Time Sheet Import must be selected on the Company >

Features Overview page.

For information on how to set up Time Sheet Import, contact your Payroll Service

team.

Time Sheet Import and RUN Powered by ADP® 2 Processing Your Payroll

Choose an Employee Identifier

Choose an Employee Identifier

When you import data from your time and attendance system into RUN Powered by

ADP®, the data is mapped to the correct employee using an employee identifier.

You can choose to use one of the following identifiers:

Employee ID, which is assigned by the payroll application

Employee Time Clock ID, which is assigned by your time and attendance

system

If you choose the Employee Time Clock ID, you need to assign the unique ID to

each employee using the Employee Time Clock ID Entry page in the payroll

application.

Assign Employee Time Clock IDs

Starting Point: Employees > Enter EE Time Clock IDs

If you add or change the Employee Time Clock ID while an import is in progress for

the employee's pay frequency, the change won't be included until the next import.

1 Enter the employee's time clock ID in the Clock ID field.

The Clock ID field is displayed on both the Payroll Info page and the Employee

Time Clock ID Entry page. If you enter or change the ID on one page it will be

updated automatically on the other page.

2 Click Save.

Time Sheet Import and RUN Powered by ADP® 3 Processing Your Payroll

Set Up Your Time Sheet Import File

Set Up Your Time Sheet Import File

Before you can import time and attendance data into the payroll application, you

must configure your time and attendance system to output a properly formatted .csv

file. The file specifications and record layout are included in the following sections.

Time Sheet Import Template

For your convenience, we have provided two .csv templates for you to customize.

The template you choose is determined by the employee identifier you use:

Employee ID - assigned automatically by the payroll application

Employee Time Clock ID - assigned by your time and attendance system

You can access the templates after the feature has been activated for your

company.

1 In the payroll application, go to Help & Support, and then open the Payroll &

HR page.

2 Under Time Sheet Import, click the template you want to open the file.

We recommend that you include the pay frequency and pay period start and end

dates in the filename, for example: Biweekly-08172013-08302013.csv

Data Resources for Set Up

RUN Powered by ADP® includes a number of reports that provide the data you

need to set up your time sheet import file:

Department Numbers Report - Lists all the departments set up for your

company, if any.

Employee Codes Report - Includes the employee information (such as

employee code, pay frequency, and status) necessary to integrate data

maintained in your time and attendance system.

Earnings Codes Report - Lists all the earnings codes available in the payroll

application, which can be included in the time sheet import file.

For details on how to run a report, see Run Reports on page 18.

Time Sheet Import and RUN Powered by ADP® 4 Processing Your Payroll

Set Up Your Time Sheet Import File

File Specifications

The pay data file you import into the payroll application must meet the following

specifications:

The file must be in .csv format (comma delimited).

The file type must be .csv.

There are no specifications for the filename you use, but we recommend that

you include the pay frequency and pay period start and end dates in the

filename, for example: Biweekly-08172013-08302013.csv.

The file can include data for only one pay frequency.

The file can include only active employees. Employees with a status of

Leave of Absence will be excluded from payroll processing. Employees with a

status of Terminated before the pay period start date will also be excluded from

payroll processing.

If a number includes a decimal, you must enter the decimal.

Include a minus sign in front of negative numbers.

Client code (IID, or branch code+ADP Code), pay frequency, and the pay

period start date and pay period end date must be the same on every row of

the file.

The file must include rate codes only, not rate values.

The first row of the data file must contain a version number. The second row

must contain the column heading. The third row and subsequent rows must

contain time sheet data.

Time Sheet Import and RUN Powered by ADP® 5 Processing Your Payroll

Set Up Your Time Sheet Import File

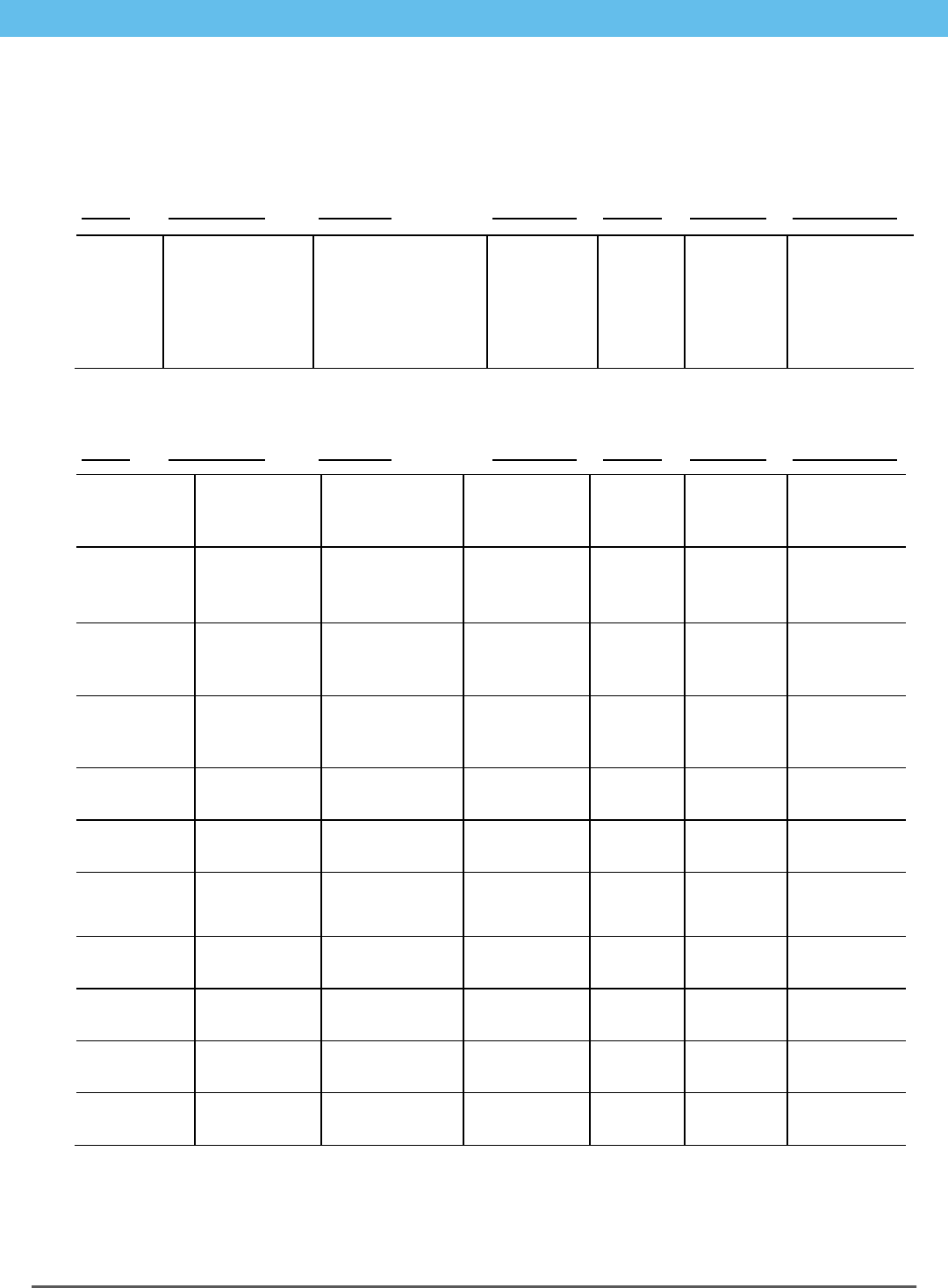

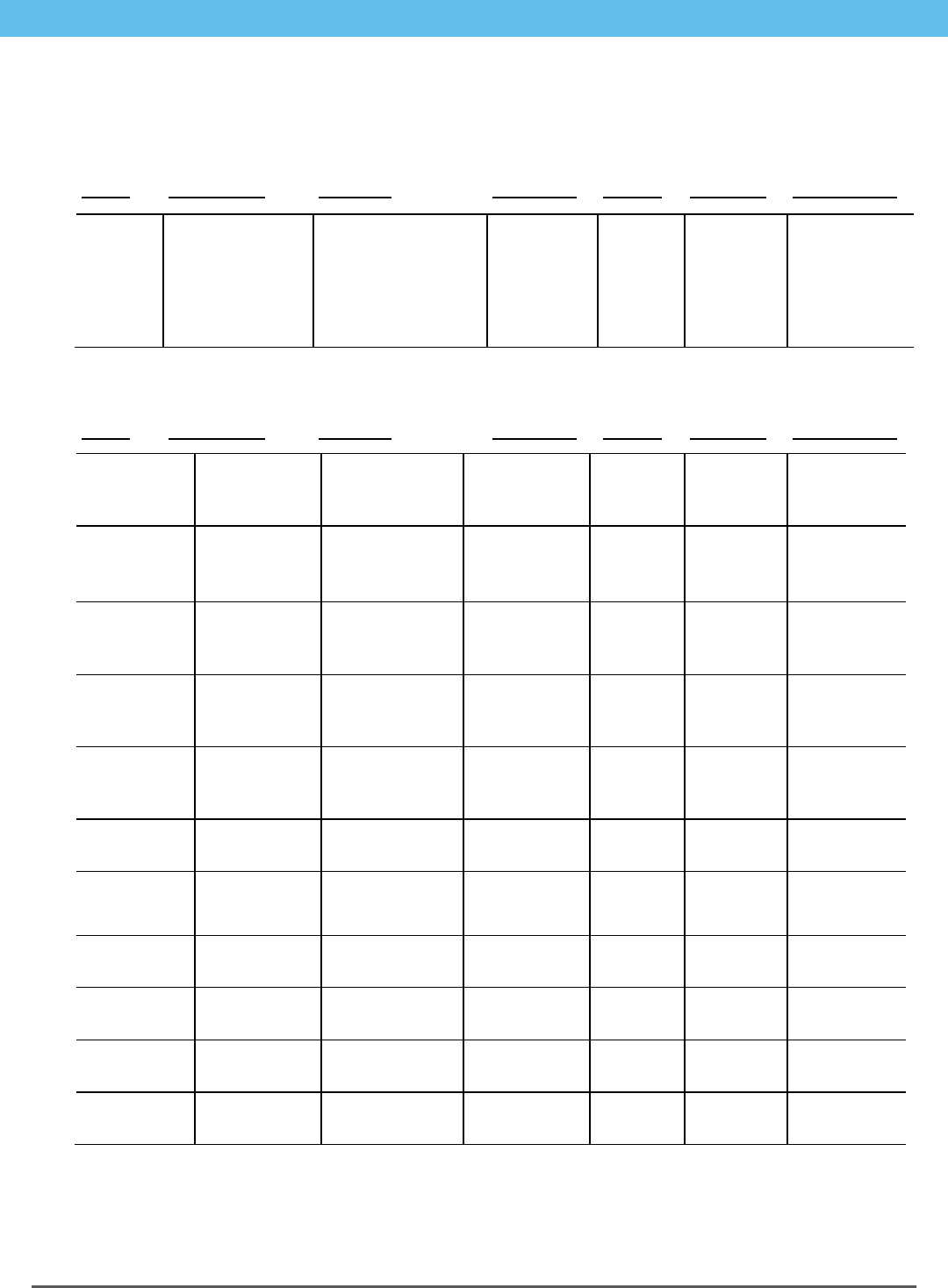

Time Sheet File Record Layout Using a Payroll Assigned Identifier

Header Record

Name

Description

Example

Data Type

Length

Required

File Position

File

Identifier

Identifies the file

as a valid Time

Sheet Import file.

This row must

contain a version

number.

##GENERIC## V1.0

Text

16

Y

Row 1

Field 1

Title Record

Name

Description

Example

Data Type

Length

Required

File Position

Company

Code Label

Column Title

IID, or Branch

Code+ADP

Code

Alphanumeric

15

Y

Row 2

Field 1

Pay

Frequency

Label

Column Title

Pay Frequency

Alphanumeric

13

Y

Row 2

Field 2

Pay Period

Start Date

Label

Column Title

Pay Period Start

Date

Alphanumeric

16

Y

Row 2

Field 3

Pay Period

End Date

Label

Column Title

Pay Period End

Date

Alphanumeric

14

Y

Row 2

Field 4

Employee ID

Label

Column Title

Employee ID

Alphanumeric

10

Y

Row 2

Field 5

Earnings

Code Label

Column Title

Earnings Code

Alphanumeric

13

Y

Row 2

Field 6

Hours Label

Column Title

Pay Hours

Alphanumeric

9

Y

Row 2

Field 7

Dollars Label

Column Title

Dollars

Alphanumeric

7

Y

Row 2

Field 8

Separate

Check Label

Column Title

Separate Check

Alphanumeric

14

Y

Row 2

Field 9

Worked In

Dept Label

Column Title

Worked In Dept

Alphanumeric

17

Y

Row 2

Field 10

Rate Code

Label

Column Title

Rate Code

Alphanumeric

9

Y

Row 2

Field 11

Time Sheet Import and RUN Powered by ADP® 6 Processing Your Payroll

Set Up Your Time Sheet Import File

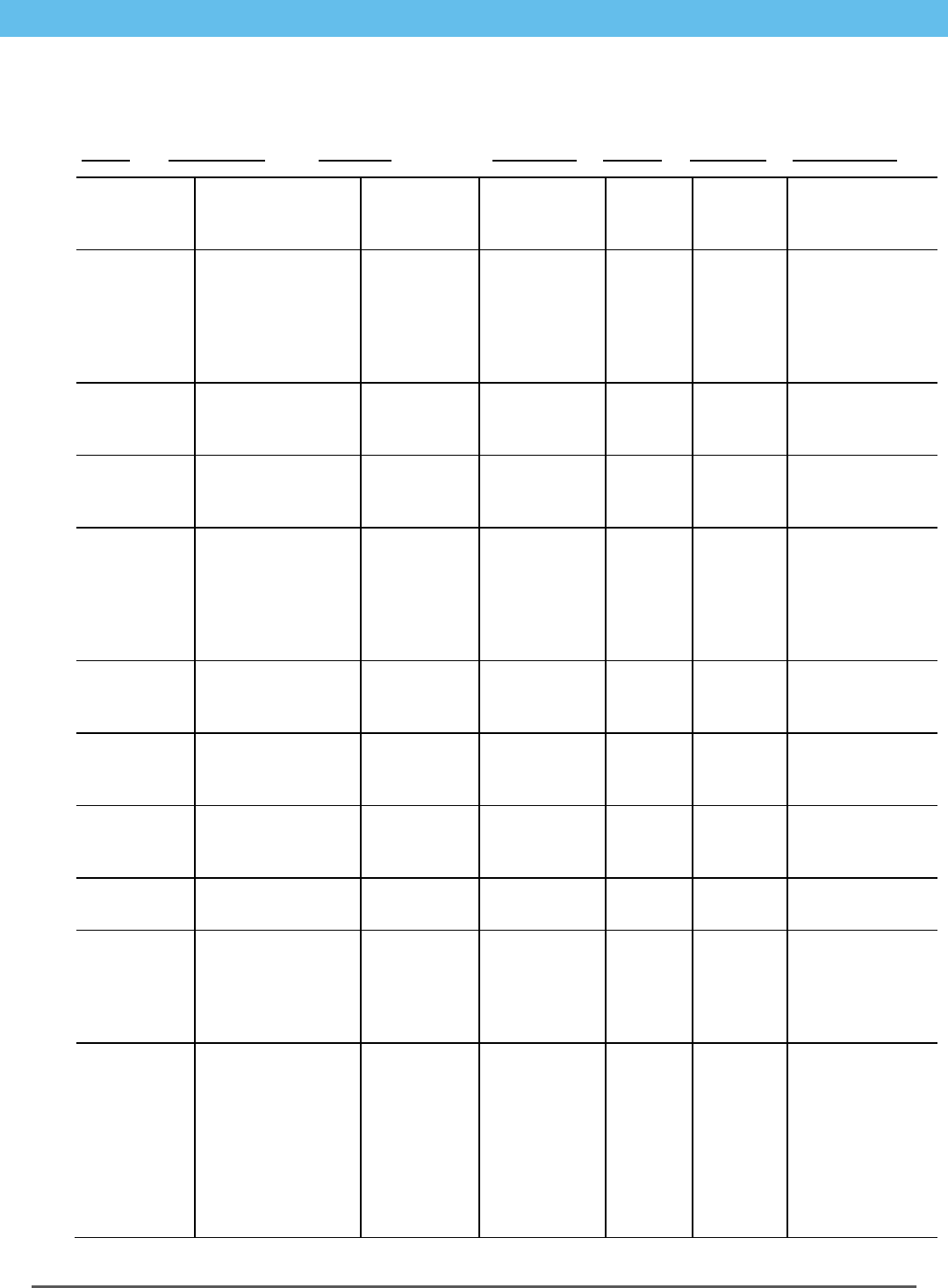

Detail Record

Name

Description

Example

Data Type

Length

Required

File Position

Company

Code

A unique code

used to identify the

client.

RFCAV or

20026487

Text

10

Y

Pay

Frequency

Pay frequency for

the employees

included in the file.

The file can include

only one pay

frequency.

W

Text

10

Y

B = Biweekly

W = Weekly

S = Semimonthly

M = Monthly

Q = Quarterly

Pay Period

Start

The first date of the

pay period included

in the file.

02/14/2012

Date

10

Y

Pay Period

End

The end date of the

pay period included

in the file.

02/18/2012

Date

10

Y

Employee ID

A unique code,

assigned by the

payroll application,

used to identify the

employee.

2

Text

15

Y

Earnings

Code

Earnings code

associate with

hours on record.

REG

Text

10

Y

* See the

Earnings Codes

report

Pay Hours

Total hours worked

in pay period for

earnings code.

80.00

Numeric

[11.2]

N

Dollars

Total dollars paid in

the pay period for

earnings code.

2000.00

Numeric

[11.2]

N

Separate

Check

Separate check

value.

0

Numeric

2

Y

0-9

Worked

Department

Department where

employee worked.

Applicable only if

departments are

set up for company.

Numeric

6

N

* See the

Department

Numbers report

Rate Code

Pay rate that

should be applied

to the hours

worked.

BASE

Text

10

Y

BASE: First pay

rate defined for

hourly employee

RATE_2: Second

pay rate defined

for hourly

employee

RATE_3: Third

pay rate defined

for hourly

Time Sheet Import and RUN Powered by ADP® 7 Processing Your Payroll

Set Up Your Time Sheet Import File

employee

RATE_4: Fourth

pay rate defined

for hourly

employee

RATE_5: Fifth

pay rate defined

for hourly

employee

HRLY4SLRY1:

First hourly rate

defined for

salaried

employee

* For more information about these reports, see Data Resources for Set Up on page 3.

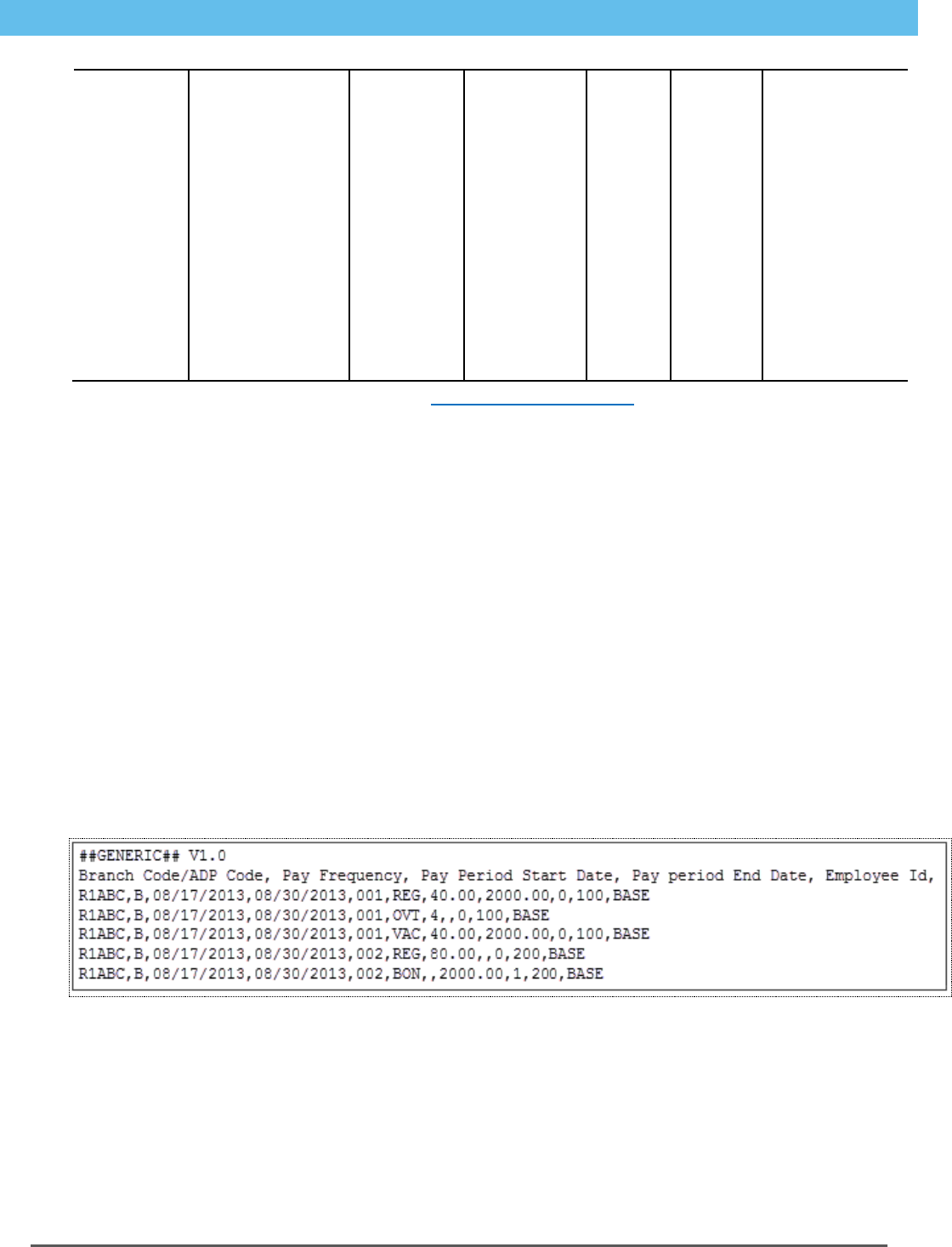

Sample Data

Company code ABC must create a time sheet import file to pay two employees for

the bi-weekly pay period starting on April 17, 2013.

Pay details for employee 001

Payroll check, Department 100, 40 regular hours, $2000 bi-weekly salary

amount

Payroll check, Department 100, 4 overtime hours

Payroll check, Department 100, 40 vacation hours

Pay details for employee 002

Payroll check, Department 200, 80 regular hours, $2000 bi-weekly salary

amount

Separate check, Department 200, $2000 bonus amount

Here is an example of company code ABC's time sheet import file, including the

header, title, and detail rows:

Time Sheet Import and RUN Powered by ADP® 8 Processing Your Payroll

Set Up Your Time Sheet Import File

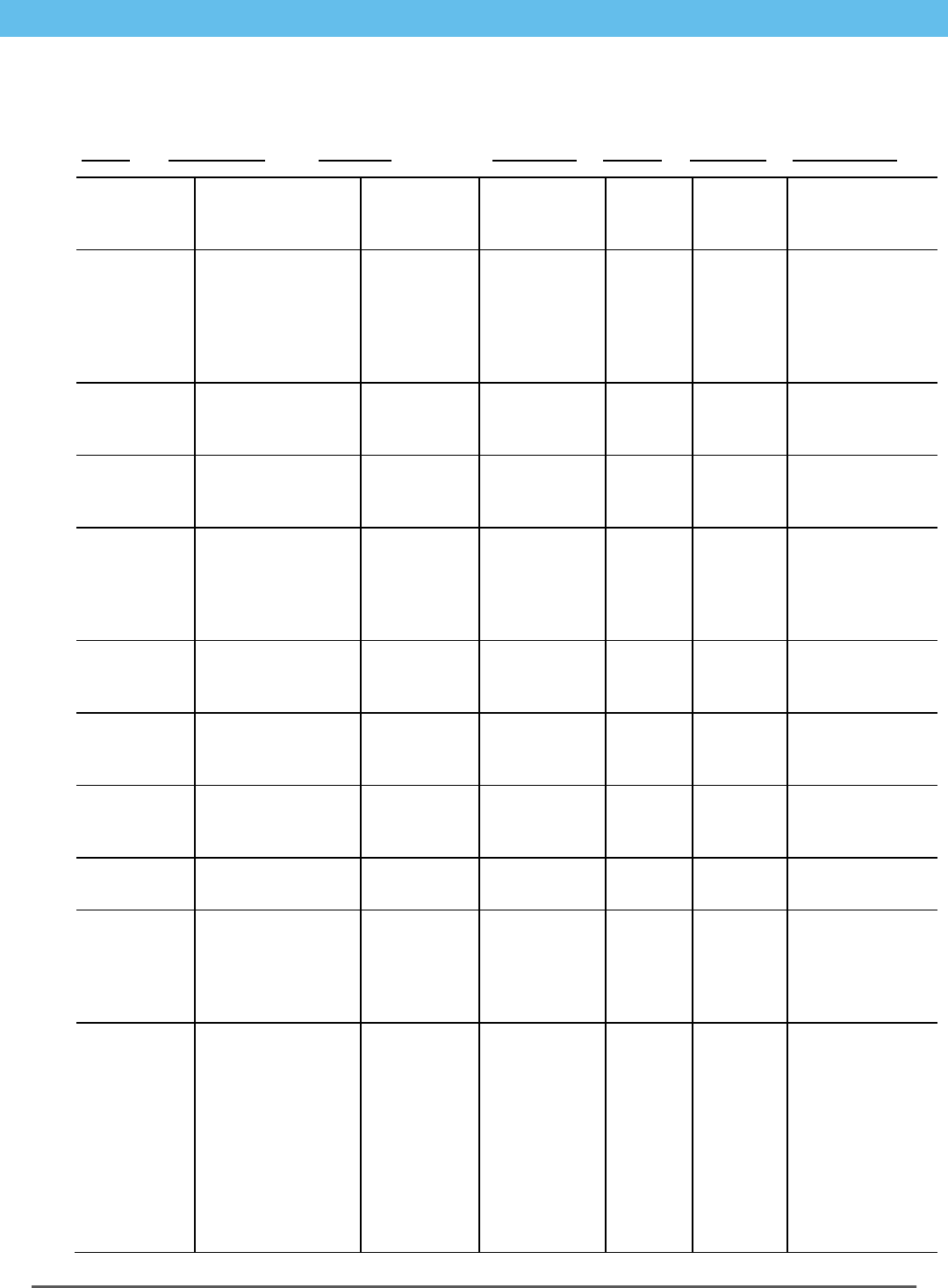

Time Sheet File Record Layout Using Your Own Assigned Identifier

Header Record

Name

Description

Example

Data Type

Length

Required

File Position

File

Identifier

Identifies the file

as a valid Time

Sheet Import file.

This row must

contain a version

number.

##GENERIC## V1.0

Text

16

Y

Row 1

Field 1

Title Record

Name

Description

Example

Data Type

Length

Required

File Position

Company

Code Label

Column Title

IID, or Branch

Code+ADP

Code

Alphanumeric

15

Y

Row 2

Field 1

Pay

Frequency

Label

Column Title

Pay Frequency

Alphanumeric

13

Y

Row 2

Field 2

Pay Period

Start Date

Label

Column Title

Pay Period Start

Date

Alphanumeric

16

Y

Row 2

Field 3

Pay Period

End Date

Label

Column Title

Pay Period End

Date

Alphanumeric

14

Y

Row 2

Field 4

Employee

Time Clock

ID Label

Column Title

Employee Time

Clock ID

Alphanumeric

22

Y

Row 2

Field 5

Earnings

Code Label

Column Title

Earnings Code

Alphanumeric

13

Y

Row 2

Field 6

Hours Label

Column Title

Pay Hours

Alphanumeric

9

Y

Row 2

Field 7

Dollars Label

Column Title

Dollars

Alphanumeric

7

Y

Row 2

Field 8

Separate

Check Label

Column Title

Separate Check

Alphanumeric

14

Y

Row 2

Field 9

Worked In

Dept Label

Column Title

Worked In Dept

Alphanumeric

17

Y

Row 2

Field 10

Rate Code

Label

Column Title

Rate Code

Alphanumeric

9

Y

Row 2

Field 11

Time Sheet Import and RUN Powered by ADP® 9 Processing Your Payroll

Set Up Your Time Sheet Import File

Detail Record

Name

Description

Example

Data Type

Length

Required

File Position

Company

Code

A unique code

used to identify the

client.

RFCAV or

20026487

Text

10

Y

Pa

Frequency

Pay frequency for

the employees

included in the file.

The file can include

only one pay

frequency.

W

Text

10

Y

B = Biweekly

W = Weekly

S = Semimonthly

M = Monthly

Q = Quarterly

Pay Period

Start

The first date of the

pay period included

in the file.

02/14/2012

Date

10

Y

Pay Period

End

The end date of the

pay period included

in the file.

02/18/2012

Date

10

Y

Employee

Time Clock

ID

A unique code,

assigned by your

time and

attendance system,

used to identify the

employee.

JSmith1

Text

15

Y

Earnings

Code

Earnings code

associate with

hours on record.

REG

Text

10

Y

* See the

Earnings Codes

report

Pay Hours

Total hours worked

in pay period for

earnings code.

80.00

Numeric

[11.2]

N

Dollars

Total dollars paid in

the pay period for

earnings code.

2000.00

Numeric

[11.2]

N

Separate

Check

Separate check

value.

0

Numeric

2

Y

0-9

Worked

Department

Department where

employee worked.

Applicable only if

departments are

set up for company.

Numeric

6

N

* See the

Department

Numbers report

Rate Code

Pay rate that

should be applied

to the hours

worked.

BASE

Text

10

Y

BASE: First pay

rate defined for

hourly employee

RATE_2: Second

pay rate defined

for hourly

employee

Time Sheet Import and RUN Powered by ADP® 10 Processing Your Payroll

Set Up Your Time Sheet Import File

RATE_3: Third

pay rate defined

for hourly

employee

RATE_4: Fourth

pay rate defined

for hourly

employee

RATE_5: Fifth

pay rate defined

for hourly

employee

HRLY4SLRY1:

First hourly rate

defined for

salaried

employee

* For more information about these reports, see Data Resources for Set Up on page 3.

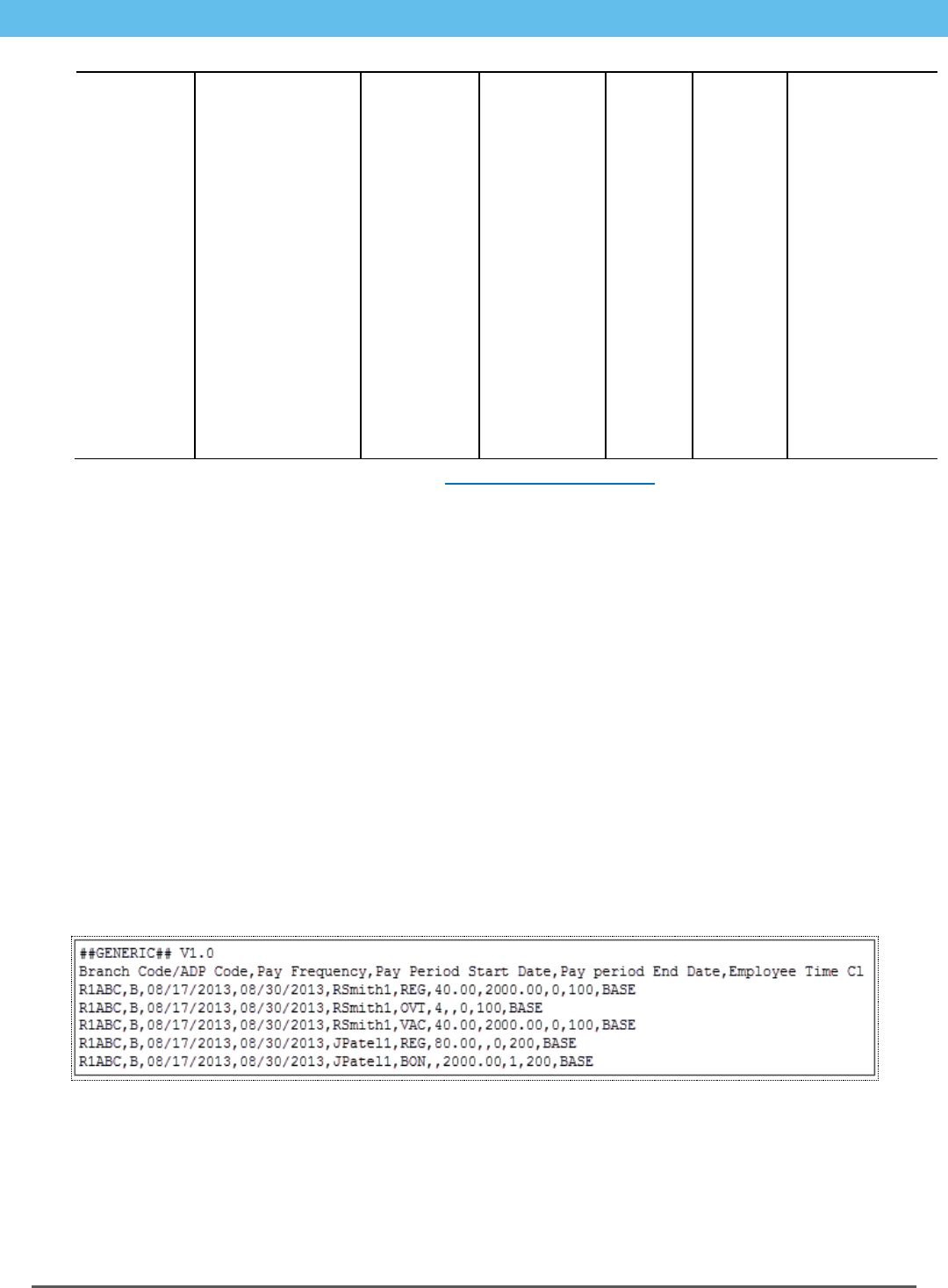

Sample Data

Company code ABC must create a time sheet import file to pay two employees for

the bi-weekly pay period starting on April 17, 2013.

Pay details for employee RSmith1

Payroll check, Department 100, 40 regular hours, $2000 bi-weekly salary

amount

Payroll check, Department 100, 4 overtime hours

Payroll check, Department 100, 40 vacation hours

Pay details for employee JPatel1

Payroll check, Department 200, 80 regular hours, $2000 bi-weekly salary

amount

Separate check, Department 200, $2000 bonus amount

Here is an example of company code ABC's time sheet import file, including the

header, title, and detail rows:

Time Sheet Import and RUN Powered by ADP® 11 Processing Your Payroll

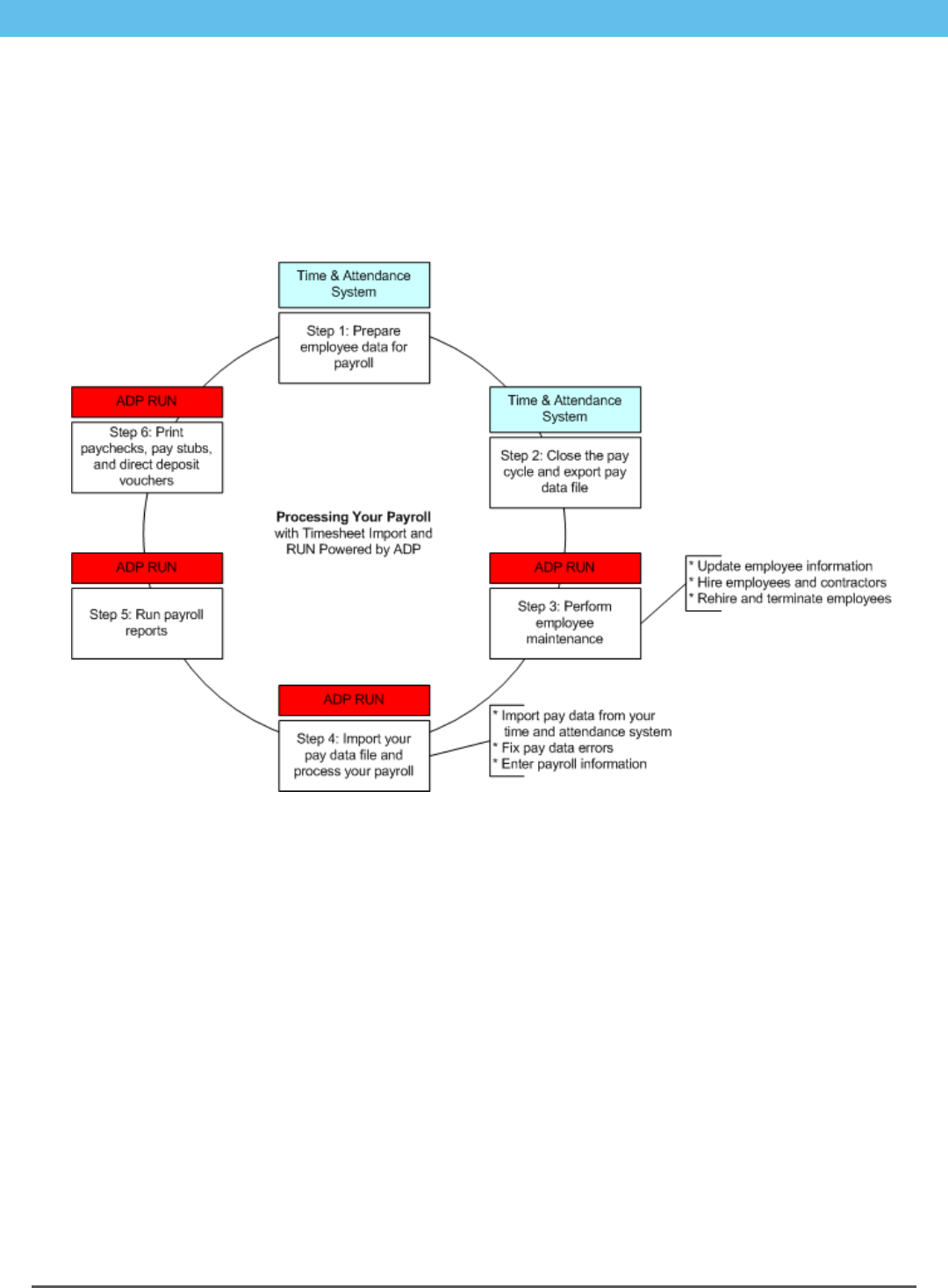

The Payroll Process

The Payroll Process

The following diagram provides an overview of the steps you will take to pay your

employees with the payroll application using data imported from your time and

attendance system.

Time Sheet Import and RUN Powered by ADP® 12 Processing Your Payroll

Perform Employee Maintenance

Perform Employee Maintenance

Before you process your payroll, you must update any employee information in the

payroll application that has changed since the last payroll.

Update Employee and Contractor Information

To ensure that paychecks are accurate, make sure you update information for all

employees and contractors before you process the payroll. For example, if an

employee moves from one jurisdiction to another, the taxation rules for that new

jurisdiction may impact the employee’s paycheck. It's easier to change the

jurisdiction before you process the payroll instead of tracking down and correcting

any errors later. You should also complete the New Hire Wizard for any new

employees or contractors that you want to include in the payroll.

Add Employees

The New Hire Wizard guides you through each of the pages that you need to

complete to set up your employees successfully. For help on a particular field or

page, click . The Help window includes help for the current page. To search for

additional help, click the Search tab.

Starting Point: Employees > Add Employee

The steps to add the employee are displayed across the top of the page. The

highlighted step shows you where you are in the process.

1 On each page, complete each of the required fields, and any additional fields as

necessary for the employee.

2 When you complete a page, click Next to go to the next page.

Tip: If you need to take a break, click Finish Later in the bottom-right corner of the

page. When you are ready to continue hiring the employee, click the next task in the

To Do section on the Payroll Home page. The New Hire Wizard opens on the page

where you left off.

Time Sheet Import and RUN Powered by ADP® 13 Processing Your Payroll

Perform Employee Maintenance

How Do I Add a Contractor?

Before You Begin: This procedure describes how to add a contractor after you set

up your company and employees and begin processing payrolls. If you are setting

up the payroll application and have not yet set up your contractors, search for

Setting Up Employees and Contractors in the online help.

The New Hire Wizard guides you through each of the pages that you need to

complete to set up your contractors successfully. If you need help on a field,

click . The Help window includes help for the current page. To search for

additional help, click the Search tab.

Starting Point: Employees > Add Contractor

The steps to add the contractor are displayed across the top of the page. The

highlighted step shows you where you are in the process.

1 On each page, complete each of the required fields, and any additional fields as

necessary for the contractor.

2 When you complete a page, click Next to go to the next page.

Tip: If you need to take a break, click Finish Later in the bottom-right corner of the

page. When you are ready to continue hiring the contractor, click the next task in the

To Do area on the Payroll Home page. The New Hire Wizard opens on the page

where you left off.

Time Sheet Import and RUN Powered by ADP® 14 Processing Your Payroll

Perform Employee Maintenance

Rehire Employees

Important: To be sure that the employee's former earnings, deductions, and tax

information are reactivated, follow these steps rather than using the New Hire

Wizard to rehire an employee.

Starting Point: Employees > Directory

1 In the Status field, select All to include terminated employees in the list.

2 Click the employee you want to rehire.

3 In the left menu, click Personal Information > Employment Info.

4 To the right of the Termination Date field, click Rehire.

5 Click OK to confirm that you want to reactivate the earnings, deductions, and tax

information.

The Employee Status is automatically changed from Terminated to Active, and

the Termination date is deleted.

6 In the Hire Date field, enter the date the employee was rehired.

7 Review the remaining fields and make any necessary changes.

8 Click Save to save your changes.

9 On each of the Employee pages, verify the employee's information--especially

taxes, deductions, and direct deposit information--and make any necessary

changes.

The employee will be included in the Payroll Worksheet, starting with the pay period

that includes the rehire date.

Terminate Employees

Starting Point: Employees > Directory

1 Click the employee to open the Employee Info page.

2 In the left menu, click Personal Information > Employment Info.

3 In the Employee Status field, select Terminated as the employee’s new status.

4 In the Termination Date field, enter the date of the employee’s last day of work.

5 In the Termination Reason field, select the reason that best explains why the

employee was terminated.

6 Click Save to save your changes.

Time Sheet Import and RUN Powered by ADP® 15 Processing Your Payroll

Pay Your Employees and Contractors

Pay Your Employees and Contractors

The following tasks outline the process of paying your employees using the payroll

application. Details are provided for each task.

Import Time Sheet Data from My Time and Attendance System on page 15.

Fix Errors in the Time Sheet Import File on page 16.

Enter Payroll Information on page 17.

Import Time Sheet Data from My Time and Attendance System

Important: You can only import time sheet data for one pay frequency at a time. If

there is already a file for the pay frequency that is Pending or Approved, you must

finish importing that file before you can import another one. You can import multiple

files only if each one is for a different pay frequency.

Starting Point: Home > Time Sheet Import

1 On the Time Sheet Import page, if your company has only one pay frequency,

go to Step 3.

2 If your company has more than one pay frequency, select the pay frequency for

the time sheet data you want to import from your time and attendance system.

3 On the Pay Data Import page, click Browse, and then locate the file you want to

import.

4 Click Import Pay Data.

If there are errors, the Pay Data Errors page is displayed. See Fix Errors in the

Time Sheet Import File on page 16.

If there are no errors or warnings, the Pay Data Approval page is displayed.

5 On the Pay Data Approval page, review the time sheet import data and verify

that it is correct.

The Regular Hours Payroll column lists any hours that were generated

automatically or entered in the Payroll Worksheet.

The Regular Hours Import column lists the hours that were imported from your

time and attendance system.

If you imported the wrong time sheet import file, click Delete this Pay Data File

to delete the file and go back to the Pay Data Import page.

6 To combine the Regular Hours Imported and the Regular Hours Payroll for all

employees, click Combine Payroll and Import.

To use only the Regular Hours Imported and not the Regular Hours Payroll,

click Accept Import Only.

Time Sheet Import and RUN Powered by ADP® 16 Processing Your Payroll

Pay Your Employees and Contractors

7 Click Approve to open the Payroll Worksheet for this payroll.

The data displayed in the grid includes imported data, plus any data that was

already entered for this payroll or that was generated automatically. If there are

employees who are paid in this pay frequency but are not set up in your time

and attendance system, they will be included in the Payroll Worksheet.

8 Make any necessary changes, and continue processing your payroll.

Fix Errors in the Time Sheet Import File

When you import your time sheet import file from your time and attendance system,

you may encounter file and data errors on the Pay Data Errors page.

For some errors, you will have to import another time sheet import file or make

configuration changes. For other errors, you may want to:

Fix the data in your time and attendance system. If you need fix the error in

your time and attendance system, you will need to re-create the file in that

system and then import the new time sheet import file into the payroll

application.

Fix the error in the payroll application. You can cancel the import and fix the

errors in the payroll application. When the errors are fixed, you can continue

with the import where you left off.

Ignore the error and continue importing the time sheet import file. If the

error is for a specific employee, earning, or rate, you can ignore the error and

continue. Depending on the error, you may be able to fix it for the payroll by

entering or changing data in the Payroll Worksheet.

Important: If you make a change in the payroll application, make sure you make the

same change in your time and attendance system.

Time Sheet Import and RUN Powered by ADP® 17 Processing Your Payroll

Pay Your Employees and Contractors

Enter Payroll Information

After you import the time sheet import file from your time and attendance system

and correct any import error, the Payroll Worksheet is displayed.

Active employees and contractors are listed in rows down the left side of their

respective pages in the Worksheet. If you are entering payroll information for both

employees and contractors, you must enter the employee information first. When

you have completed all employee payroll entries, click Next to go to the contractor

page of the Payroll Worksheet.

Earnings are listed in columns across the top of the Worksheet. There is a column

representing each earning that is set up for the company on the Earnings and

Deductions Info page. For contractors, there is a column representing each type of

1099 earning. The Payroll Worksheet is already filled in with the standard hours set

up for employees on the Payroll Info page, and any data that you imported from

your time and attendance system.

For each employee and contractor, review the amount or number of hours for each

applicable earning and make changes as necessary.

For details on how to change an employee’s taxes or deductions for this pay period

only, set up a second check for an employee, or pay an employee who works in

more than one department or who has more than one pay rate, click in the

upper-right corner of the page.

Time Sheet Import and RUN Powered by ADP® 18 Processing Your Payroll

Run Reports

Run Reports

Before You Begin: You must process at least one payroll before you can run most

reports.

Starting Point: Reports

1 Click the name of the report you want to run.

2 The report is displayed using the default report parameters.

3 In the Report Parameters area, select the parameters you want to use to run the

report, and then click Refresh.

4 Some reports include blue links that you can click to display additional report

information. For example, the Payroll Summary report lists a summary of the

employer tax and deductions totals, which are listed by check date. To see

detail amounts for a specific employee, click Check Date in the Summary report

to open the detailed report for that employee.

5 To print the report, click Print Report in the bottom-left corner of the report

page. To export the report, click Export to Excel in the bottom-left corner of the

report page.

6 When you're done, click Close to close the report and go back to the Reports

Home page.

Time Sheet Import and RUN Powered by ADP® 19 Processing Your Payroll

Printing Paychecks

Printing Paychecks

After you process your payroll, you can print the paychecks. You can also print

vouchers for any employees or contractors who have some or all of their net pay

deposited directly to a bank or a financial institution such as a credit union.

For more information on printing paychecks, pay stubs, or pay vouchers, search for

How Do I Print Paychecks?, How Do I Print Pay Stubs?, or How Do I Print

Direct Deposit Vouchers? in the online help.

Print Paychecks

This topic applies only if you print your own paychecks.

Before You Begin: Load your check stock and, if necessary, print a test check. For

more information, search for How Do I Print a Test Check? In the online help.

The process for printing checks and vouchers varies a bit depending on the browser

you are using. For details, search for Requirements for Printing Checks and

Vouchers in the online help.

Starting Point: Home > Checks

1 At the top of the page, verify the Date and the Pay Frequency of the payroll.

2 In the Check Stock Type field, select the check stock type you use for checks.

3 To see a sample of the options available, click View Types.

4 In the Next Check Number field, enter the number of the first check you are

printing for this pay period. If you are using pre-printed check stock, enter the

number of the first check.

5 Depending on your browser, verify that the option selected in the Printer or

Check Alignment field is correct.

6 Select the check box for each of the checks you want to print. Checks are listed

alphabetically by the employee's or contractor's name. You can only select

checks with a status of Ready in the Status column on the grid.

7 To print all the paychecks in your payroll that are ready for printing, select the

check box at the top of the check box column in the grid.

8 At the bottom of the page, click Create PDF to Print. In the Print window, click

Print to print your checks and then close the window.

9 If you have checks to print for another payroll, click Next to go to the Print

Checks page.

10 If you don't want to print any more checks, click Cancel to go back to the Payroll

Home page.

Time Sheet Import and RUN Powered by ADP® 20 Processing Your Payroll

Printing Paychecks

Print Direct Deposit Vouchers

This topic applies only if you print your own paychecks.

The process for printing checks and vouchers varies a bit depending on the browser

you are using. For details, search for Browser Requirements for Printing Checks

and Vouchers in the online help.

Starting Point: Home > Direct Deposit Vouchers

1 Select the Check Stock Type you are using.

2 Verify that the option selected in the Voucher Alignment field is correct.

3 Verify the date and the pay frequency of the payroll at the top of the page.

4 Select the check box for each of the direct deposit vouchers you want to print.

Note: Vouchers are listed alphabetically by employee last name. To print all the

vouchers that are ready for printing, select the check box at the top of the

column in the grid. The check box is not available for any voucher that has

already been printed.

5 At the bottom of the page, click Create PDF to Print. In the Print window, click

Print to print your checks and then close the window.

6 A single direct deposit voucher is printed for employees and contractors who

deposit all of their pay into a single account in a bank or other financial

institution. A single direct deposit voucher is also printed for employees and

contractors whose pay is distributed among multiple direct deposit accounts. All

direct deposit distributions for the employee or contractor are shown on the

single voucher.

Important: A direct deposit voucher is not available for employees and

contractors who deposit some of their pay and who receive the remainder as a

check. When you print the check for these employees and contractors, the direct

deposit information is listed on the pay stub for the check.

7 When all the direct deposit vouchers you selected have printed, click Next to

display another pay frequency with the same check date. If your payroll does not

include another pay frequency, direct deposit voucher information for your next

payroll is displayed and vouchers are available for printing. When all direct

deposit vouchers have been printed, click Cancel to go back to the Payroll

Home page.

Time Sheet Import and RUN Powered by ADP® 21 Processing Your Payroll

Move the Pay Cycle to the Next Pay Period

Move the Pay Cycle to the Next Pay Period

After you verify that your paychecks are accurate, move the pay cycle to the next

pay period in your time and attendance system.

Time Sheet Import and RUN Powered by ADP® 22 Processing Your Payroll

Appendix: Understanding Time Sheet Import Errors

Appendix: Understanding Time Sheet Import Errors

The following chart provides information on how to fix the errors you might

encounter when you import time sheet import files. Errors are listed in the order of

the error number, for example 34612.

Information that changes depending on the message, such as a company code, pay

frequency, or employee identifier is represented using the %% symbol.

Message

What to Do Next

35015: We noticed that your pay data

import file doesn't include a company

code. Please select a different file.

Make sure you selected the correct file or update the

company code in your time and attendance system, and

then import the file again.

35096: We noticed the pay data import

file you selected includes more than one

company code. Only one company code

can be imported at a time.

Update your time and attendance system to include only

one company code, and then import the file again.

34608: This file type isn't valid. Make

sure you select the file type that you

exported from your time and attendance

system...

If you continue to get this error, contact your Payroll

Service team.

34609: It looks like the company code,

%%1, in your pay data import file isn't

correct. Try selecting a different file, or if

you selected the correct file, try updating

the data in your time and attendance

system with the correct company code.

Then, import the file again.

If you continue to get this error, contact your Payroll

Service team.

34610: Your pay data import file includes

data for more than one company code.

We didn't import data for company code

(%%1).

We imported data only for the company code that matches

the current company in your payroll application. We didn't

import data for company code (%%1).

34611: It looks like the pay frequency

(%%1) in your pay data import file

doesn't match the pay frequency of this

payroll. Make sure you selected the

correct time sheet file for this pay

frequency.

If this is the correct file, then check the Pay Frequency

page from the Company tab and add the correct pay

frequency, if needed. If you continue to get this error,

contact your Payroll Service team.

34612: The pay period start and end

dates (%%1 - %%2) in payroll don't

match the pay period start and end dates

(%%3 - %%4) in your time and

attendance system for this payroll. Make

sure you imported the current pay data

import file or correct the pay periods

dates in time and attendance. We will

use (%%3-%%4) for this payroll.

Make sure you imported the current pay data import file or

correct the pay periods dates in time and attendance. We

will use (%%3-%%4) for this payroll.

Time Sheet Import and RUN Powered by ADP® 23 Processing Your Payroll

Appendix: Understanding Time Sheet Import Errors

Message

What to Do Next

34613: It looks like your pay data import

file contains an employee (%%1) that

does not exist in your payroll. Pay data

was not imported for this employee.

To pay this employee, verify you have the correct

employee number or try hiring the employee in the payroll

application and entering the hours in the Payroll Worksheet

34614: We noticed that the employee’s

hire date (%%1) is after the period end

date (%%2) for the current payroll. Pay

data was not imported for this employee.

To include this employee's pay data,

change the hire date in payroll and

reimport the pay data

To pay this employee, change the hire date on the Payroll

Info page.

34616: There aren't any employees that

match the pay frequency (%%1) in this

pay data file. Make sure you have the

correct file or make any needed changes

to your employees' pay frequency on the

Payroll Info page and import the pay data

file again.

If you still get this error, contact your Payroll Service team.

34617: This employee's pay frequency

%%1 doesn't match the pay frequency

%%2 in the time sheet file, and we

couldn't import this employee's time. Try

changing the employee's pay frequency

in payroll and, if necessary, adjust the

pay rate. Then, enter the employee's

hours in the Payroll Worksheet.

For the next payroll, make sure the pay frequency on the

Payroll Info page matches the pay group in your time and

attendance system.

35102: We couldn't import this

employee's time because the employee's

status is Leave of Absence in payroll.

Try changing the status to Active in the payroll application

on the Employment Info page. Then, enter the employee's

hours in the Payroll Worksheet.

35105: It looks like this employee has

time included in the pay data file, but has

a Terminated status in payroll. If the

employee's termination date is after the

start date of the next payroll, then time

will be imported for this employee

If pay data wasn't imported and you want to pay the

employee, try changing the termination date on the

Employment Info page so it is during or after the pay period

dates, and update the employee's hours in the Payroll

Worksheet. If you don't want to pay the employee, then

delete the pay data in the Payroll Worksheet.

34622: It looks like the earnings code

%%1 isn't correct and we couldn't import

pay data for this earning.

Contact your Payroll Service team for assistance with this

earning.

34623: It looks like the earnings code

%%1 isn't active in the payroll

application, and the pay data can't be

imported. Can you change %%1 to an

active earning code?

Make sure the earning is set up and active for the company

on the Company Earnings and Deductions page, and enter

pay data for the employee in the Payroll Worksheet.

Time Sheet Import and RUN Powered by ADP® 24 Processing Your Payroll

Appendix: Understanding Time Sheet Import Errors

Message

What to Do Next

34624: We couldn't import hours for this

earning. It looks like the %%1 earning

isn't valid for this employee, because the

payroll application supports an amount,

not hours, for this earning

Try updating the earning on the Company Earnings and

Deductions page in the payroll application, or contact your

Payroll Service team.

34625: We couldn't import the amount for

this earning. It looks like the %%1

earning isn't valid for this employee

because the payroll application supports

hours, not an amount, for this earning.

Try updating the earning on the Company Earnings and

Deductions page in the payroll application, or contact your

Payroll Service team.

34626: It looks like department %%1 isn't

valid and we couldn't import pay data for

this department.

Try setting up the department in RUN and assigning it to

the employee. Then, manually add the department to your

time and attendance system.

34631: This file type is not valid. Try

saving it as a valid file type or try

selecting a different file.

If you continue to get this error, contact your Payroll

Service team.

34636: We couldn't import pay data for

this earning because the %%1 earning is

used for employees and not for

contractors.

To pay the contractor in the current payroll, enter pay data

in the Payroll Worksheet. For the next payroll, assign a

different earnings code in the time card, or contact your

Payroll Service team to set up a new earnings code.

34637: We couldn't import pay data for

this earning because the %%1 earning is

used for contractors and not for

employees.

To pay the employee in the current payroll, enter pay data

in the Payroll Worksheet. For the next payroll, assign a

different earnings code in the time card, or contact your

Payroll Service team to set up a new earnings code.

34638: It looks like you don't have the

correct number of hours for this earning

and the hours weren't imported. The

%%1 hours earning must be from %%2

to %%3.

Try entering the correct number of hours in the Payroll

Worksheet. You can also correct the earnings hours in

your time and attendance system, regenerate the time

sheet import file, and import it into the payroll application

again.

34639: It looks like the %%1 earnings

amount isn't correct and it wasn't

imported. The %%1 earnings amount

must be from %%2 to %%3.

Try entering the correct amount for the earning in the

Payroll Worksheet. You can also correct the earnings

hours in your time and attendance system, regenerate the

time sheet import file, and import it into the payroll

application again.

34640: We couldn't import pay data for

the separate check %%1.

Try creating an additional check for the employee in the

Payroll Worksheet. You can enter up to nine additional

checks for an employee in the payroll application.

34656: We couldn't import pay data for

the rate code %%1.

Contact your Payroll Service team for assistance with this

error.

Time Sheet Import and RUN Powered by ADP® 25 Processing Your Payroll

Appendix: Understanding Time Sheet Import Errors

Message

What to Do Next

34680: We couldn't import pay data for

the %%1 rate %%2. To pay the

employee, enter the correct rate in the

Payroll Worksheet.

For the next payroll, enter the rate on the Payroll Info page

in the payroll application. If you need to correct the rate

configuration in your time and attendance system, contact

your Payroll Service team.