DFO-03 02-24 THE PENNSYLVANIA DEPARTMENT OF REVENUE

PROPERTY TAX/RENT REBATE

PREPARATION GUIDE

APPLY FOR THE REBATE ONLINE

portal at myPATH.pa.gov.

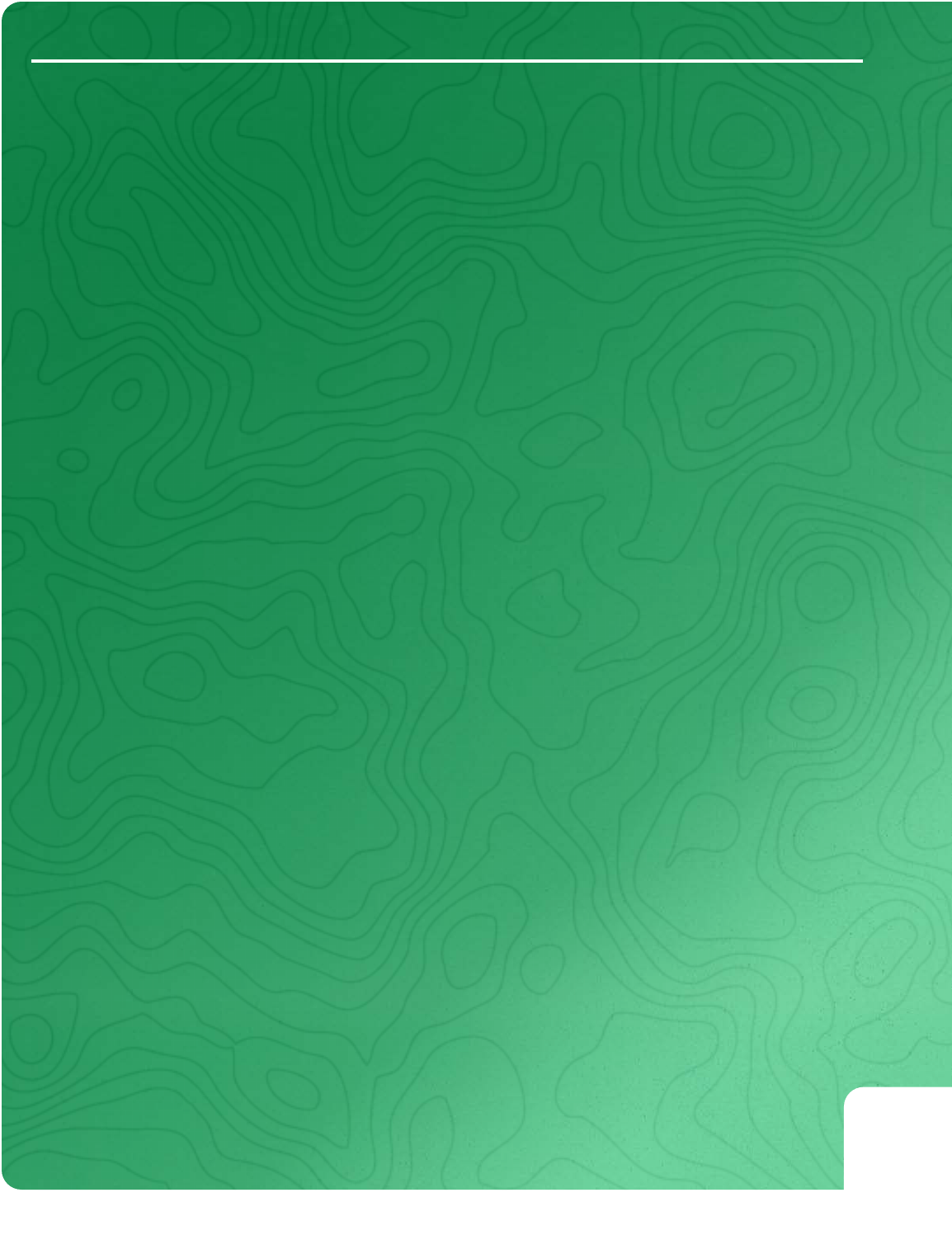

Rebates

Apply for a Property Tax/

Rent Rebate for 2023

NOTE: myPATH is the only way to electronically le the PA-1000, Property Tax/Rent Rebate Application as

this feature has not been added to any ling software packages.

• Convenience.

• Security.

• Accuracy.

• Proof of Filing.

• Direct Deposit.

YOUR ONLINE PORTAL FOR ALL YOUR PROPERTY TAX/RENT REBATE NEEDS

PENNSYLVANIA TAX HUB

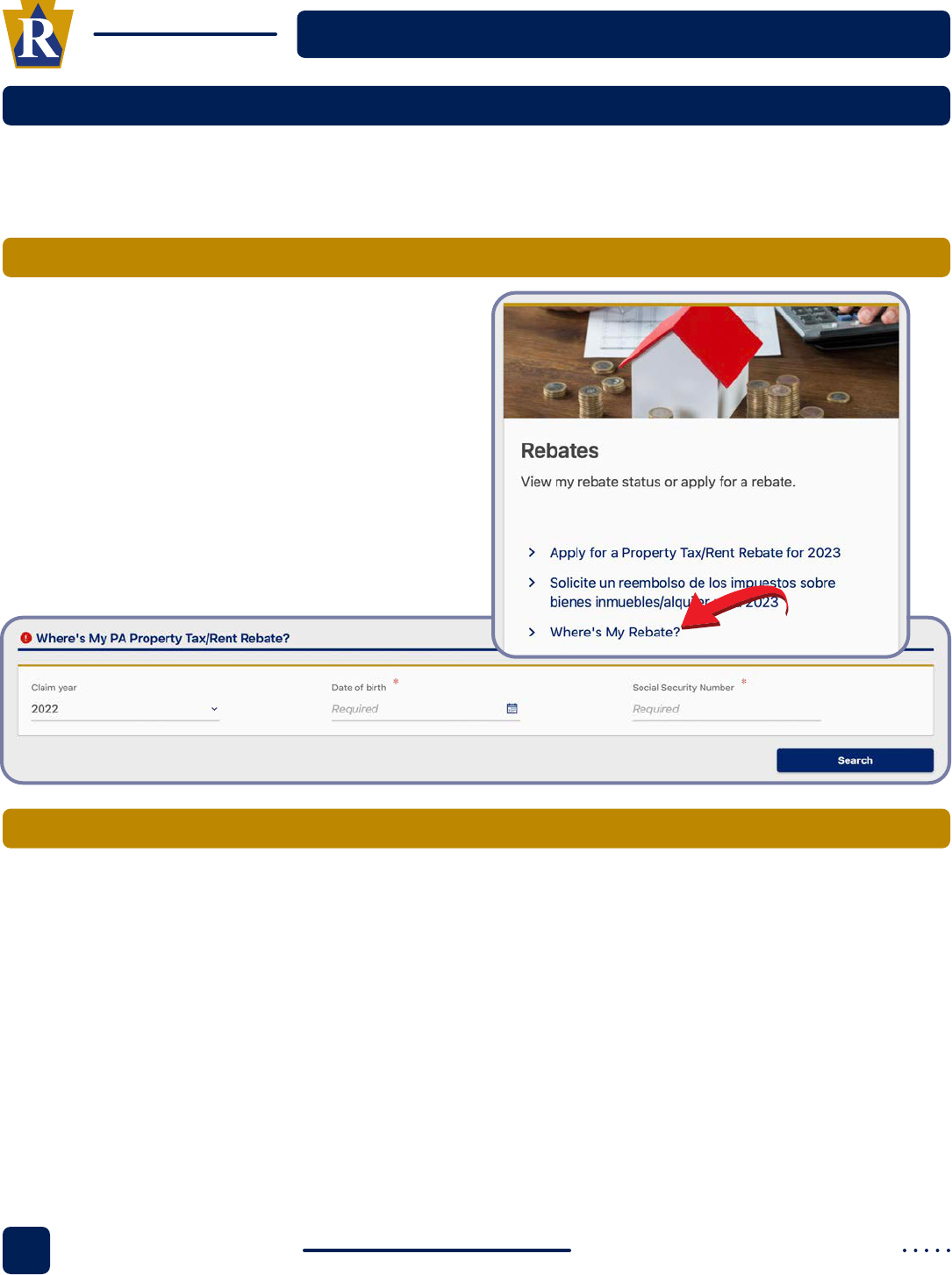

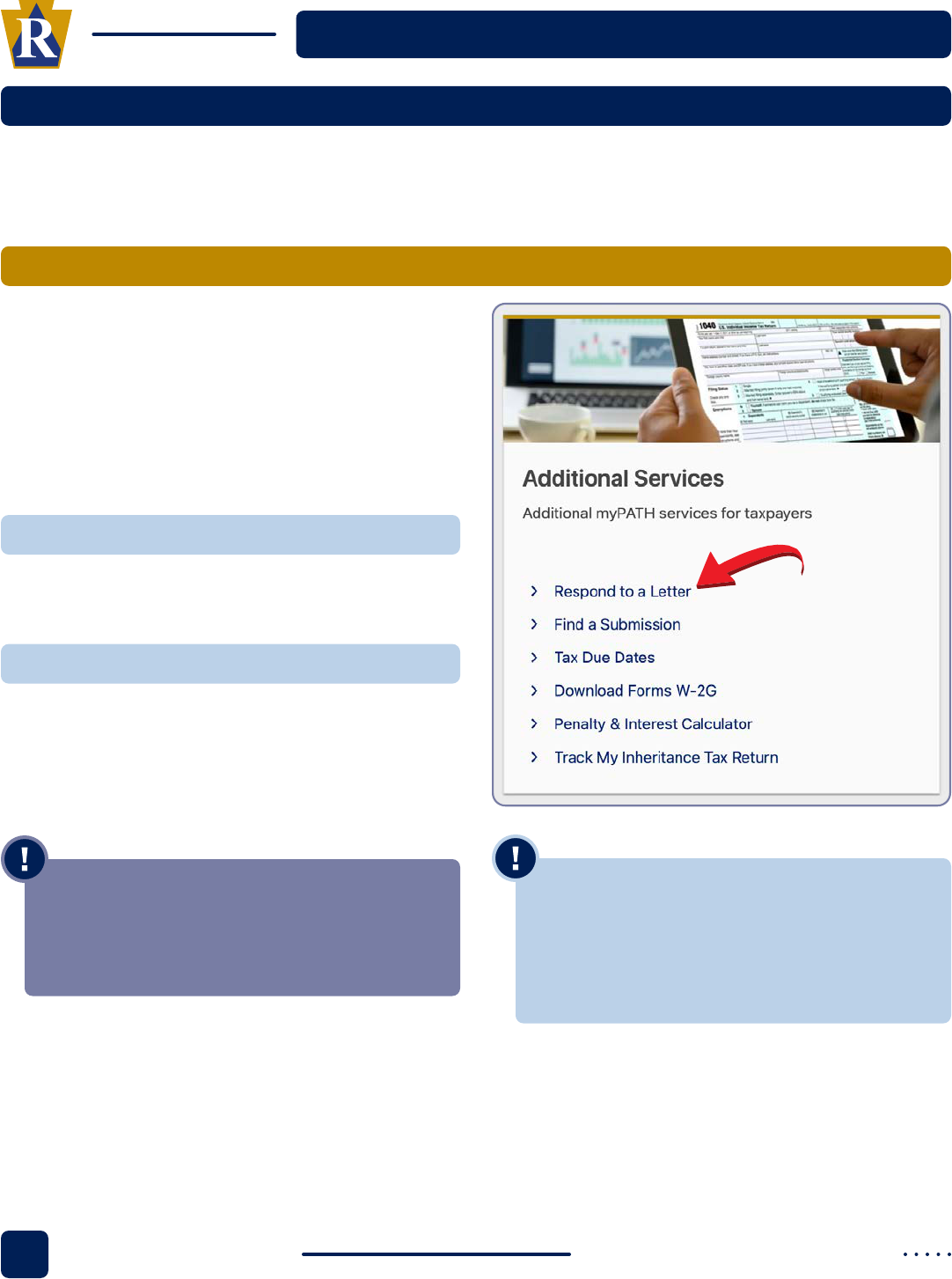

OTHER ONLINE FUNCTIONS

RESPOND TO A LETTER

myPATH.pa.gov

Addional Services

Respond to a Leer

FIND A SUBMISSION

myPATH.pa.gov Addional Services

Find a Submission.

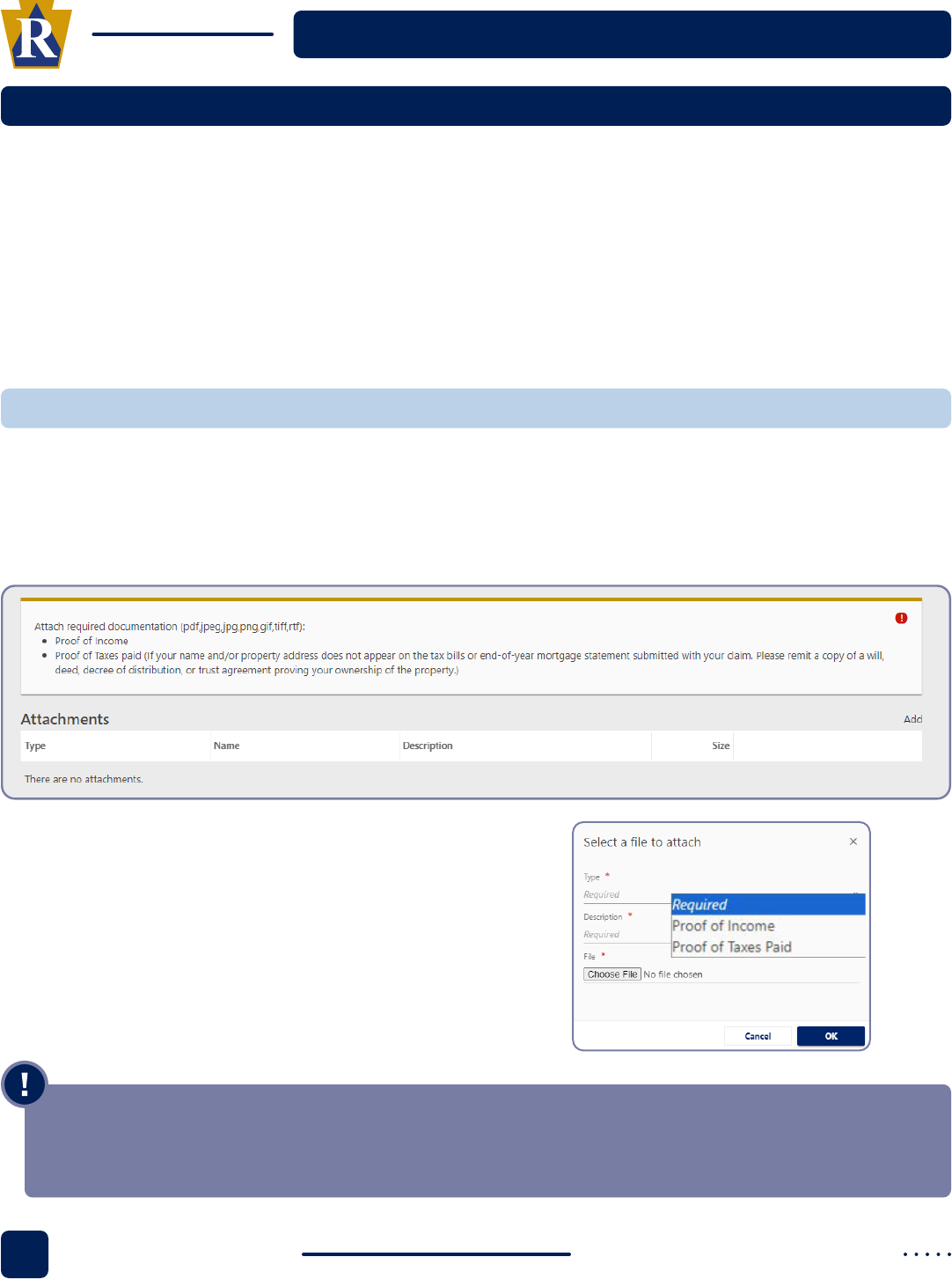

CHECK REBATE STATUS

myPATH.pa.govRebates panel. From

Where’s My Rebate

YOUR ONLINE PORTAL FOR ALL YOUR PROPERTY TAX/RENT REBATE NEEDS

PENNSYLVANIA TAX HUB

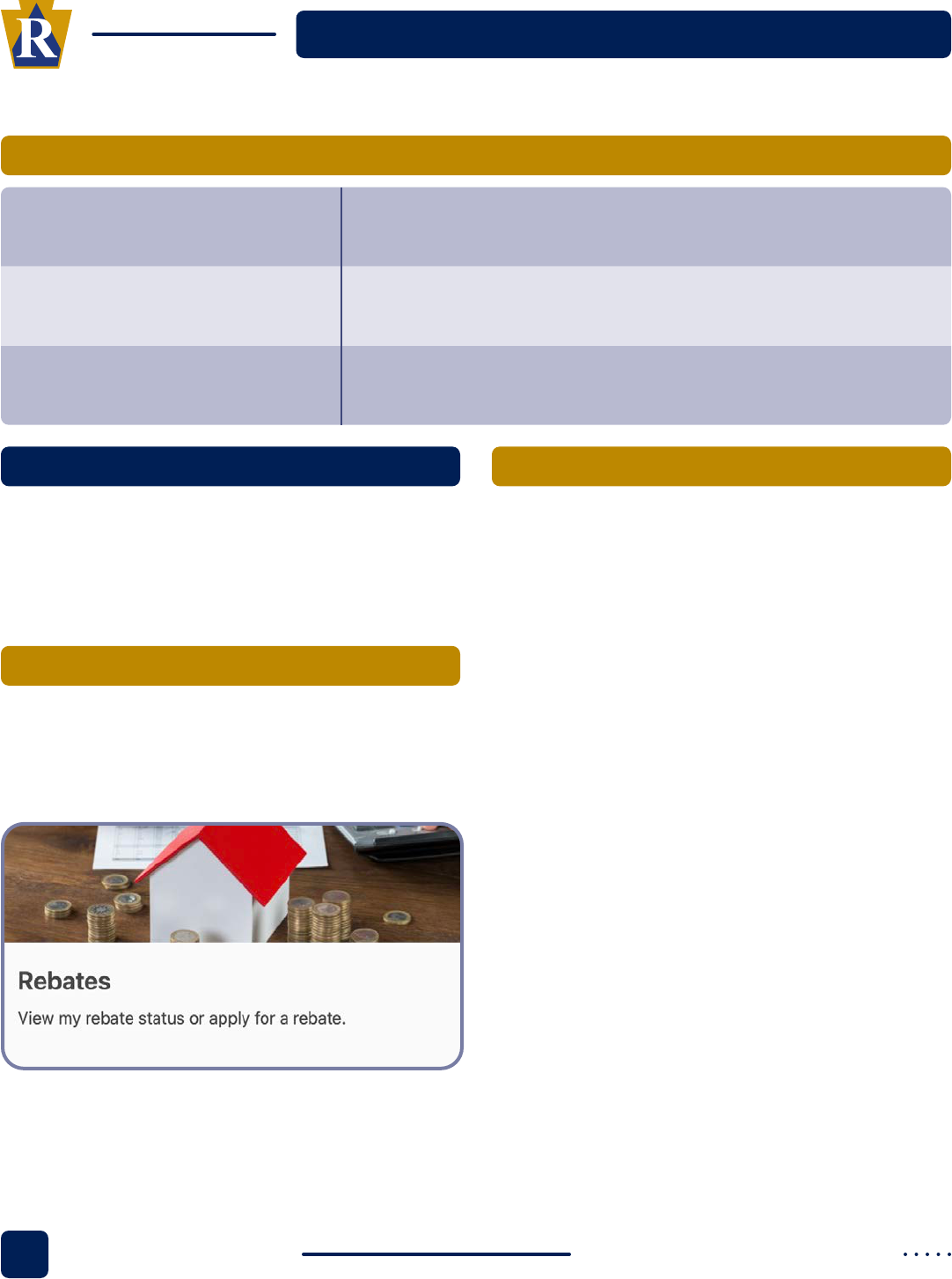

TABLE OF CONTENTS

1

2

3

4a

4b

5a

General

Overview ..................................................... 6

Introduction to PTRR

Overview of the Program

........................................ 8

What’s New for 2024

........................................... 8

Calendar of Events

.............................................. 9

Eligibility

The Basics

.................................................... 12

Type of Filer

................................................... 12

Rebate Type

................................................... 14

Income Qualication

........................................... 15

Filing on Behalf of a Deceased Individual

.......................... 15

Surviving Spouse is Not Eligible to File on Their Own

............... 16

Getting a Check Reissued Under the Spouse, Estate, or Personal

Representative Name

........................................... 17

Preparing the Application

Ways to File

................................................... 20

Documents to Include

Proof of Age

................................................... 22

Proof of Widow/Widower

....................................... 22

Proof of Disability

.............................................. 22

Proof of Income

................................................ 23

Documents Required for Rebate Due to Decedent

.................. 24

Applying as a Renter (Rent Rebate)

............................... 25

Applying as an Owner (Property Tax Rebate)

...................... 26

Applying as an Owner/Renter

.................................... 28

Line by Line Instructions

General Guidelines

............................................. 32

TABLE OF CONTENTS

5b

5c

6

7

8

9

Supporting Schedules

Order of Completion ............................................ 42

PA-1000 RC, Rent Certicate

.................................... 43

Schedule A, Deceased Claimant and/or Multiple Home Prorations

..... 46

Schedule B, Widow or Widower Prorations . . . . . . . . . . . . . . . . . . . . . . . . 47

Schedule D, Public Assistance Prorations

.......................... 48

Schedule E, Business Use Prorations

.............................. 49

Schedule F, Multiple Owner or Lessor Prorations

................... 50

Schedule G, Income Annualization

................................ 51

Submitting the Application

Submitting the Application

...................................... 54

Conrmation

.................................................. 55

Changing an Application

Updating/Amending Applications

................................ 58

Submitting Missing Info

......................................... 58

Contacting the Department

Checking Rebate Status

......................................... 60

Obtaining a Copy of the Application

.............................. 61

Responding to a Letter

......................................... 62

Resources

PTRR Forms Ordering

.......................................... 64

PTRR Forms Guide

............................................. 65

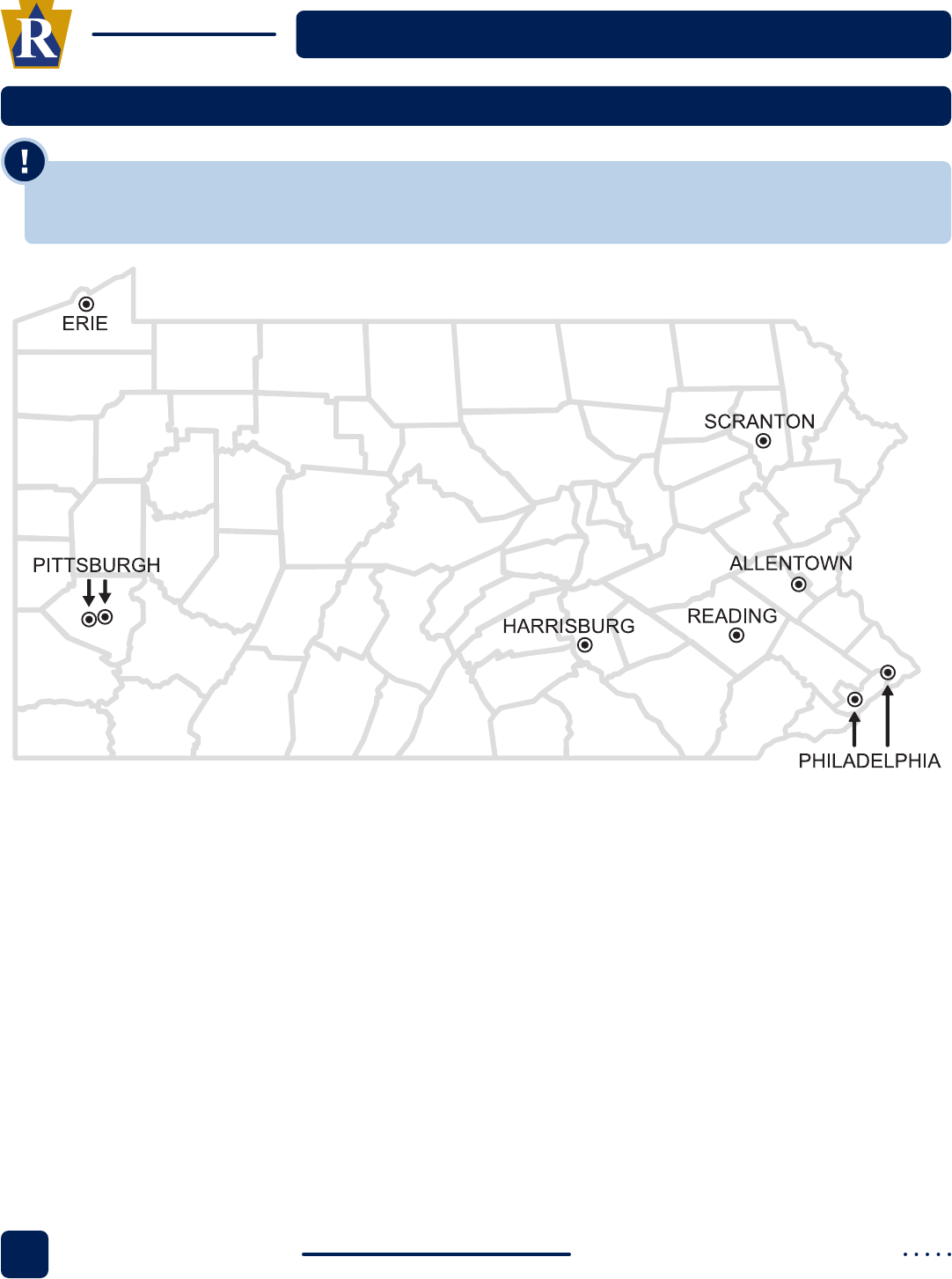

Tables and District Offices

School District and County Codes

................................ 68

PA Department of Revenue District Ofces

........................ 72

PTRR Prep Guide Return to Table of Contents6

GENERAL

OVERVIEW

WHO RECEIVES A BOOKLET IN THE MAIL

WHO RECEIVES A REMINDER LETTER

OTHER HELPFUL HINTS

INCLUDE THE APPLICANT’S PHONE NUMBER

INCLUDE THE APPLICANT’S SSN

SIGN AS THE PREPARER

THE PENNSYLVANIA DEPARTMENT OF REVENUE

INTRODUCTION

PTRR Prep Guide Return to Table of Contents8

INTRODUCTION

OVERVIEW OF THE PROGRAM

WHAT’S NEW FOR 2024

income eligibility table.

SUPPLEMENTAL REBATES (KICKERS)

SPANISH RESOURCES

mypath.pa.gov

Rebates panel.

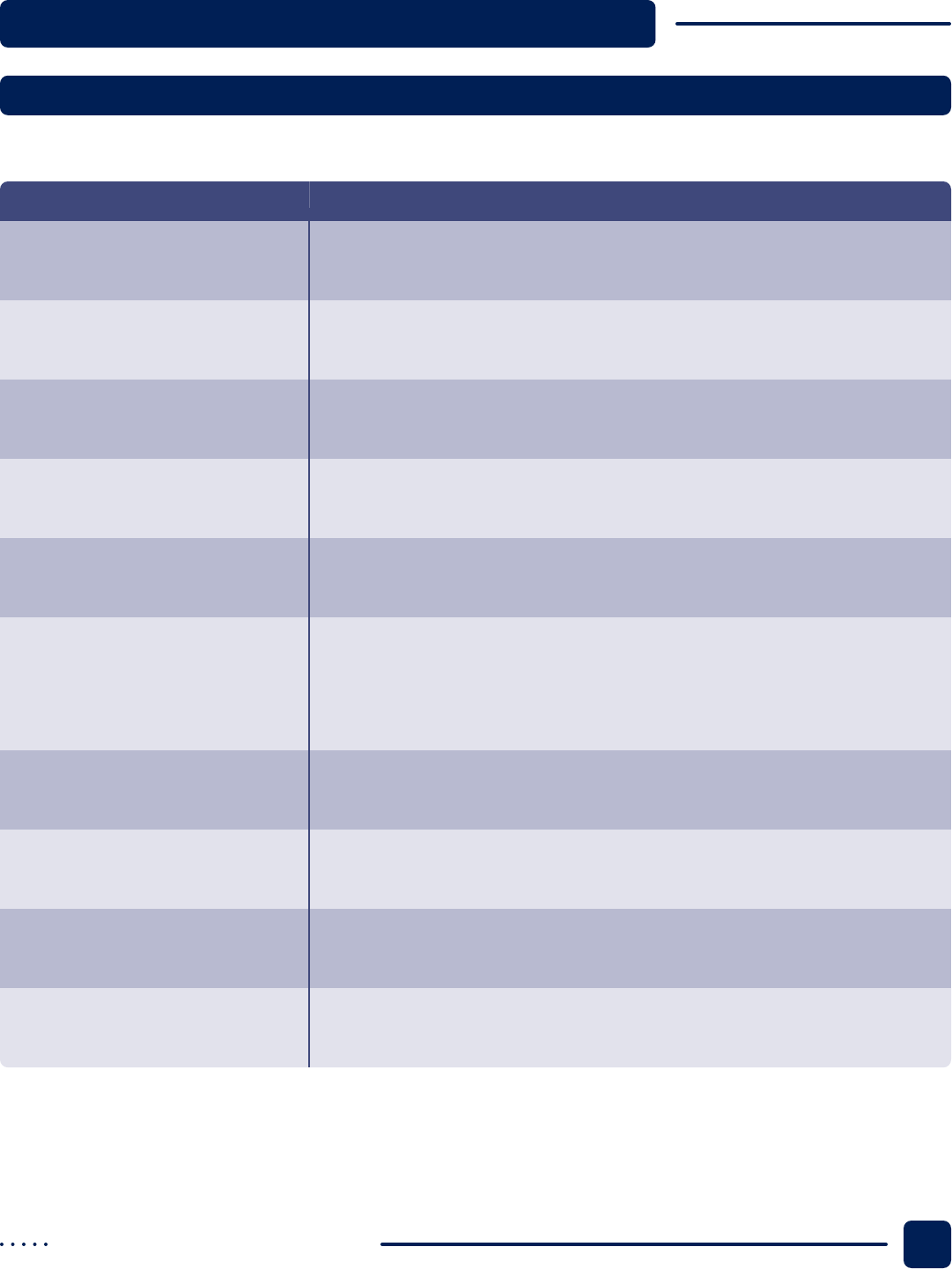

INCOME

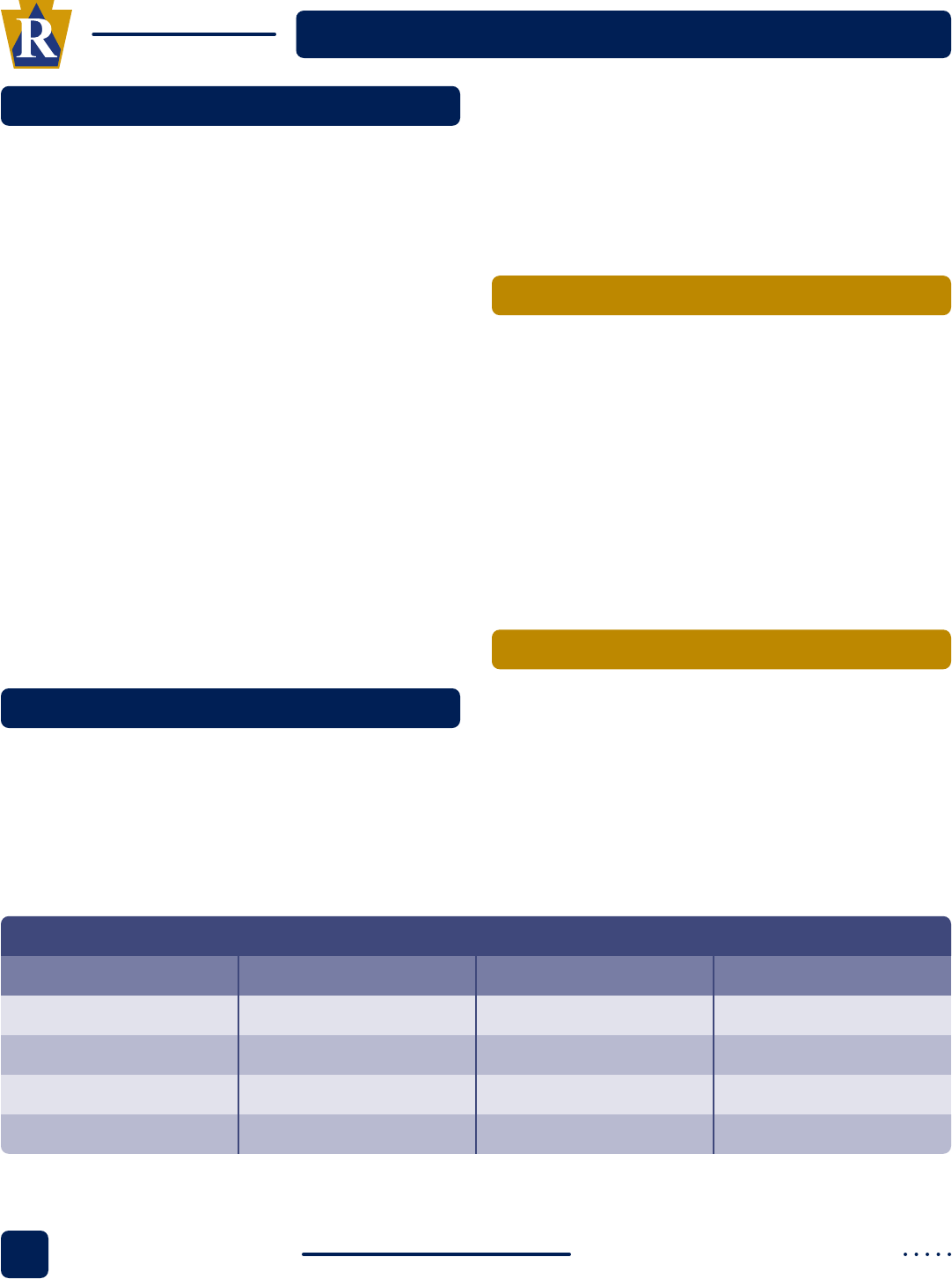

SUPPLEMENTAL REBATE

(KICKER)

$8,001 - $15,000 $385

$18,001 - $45,000 $190

$0 - $8,000 $500

$15,001 - $18,000 $230

STANDARD REBATE TOTAL MAX REBATE

$770 $1,155

$380 $570

$1,000 $1,500

$460 $690

2024 ELIGIBILITY TABLE

Return to Table of Contents 9

revenue.pa.gov

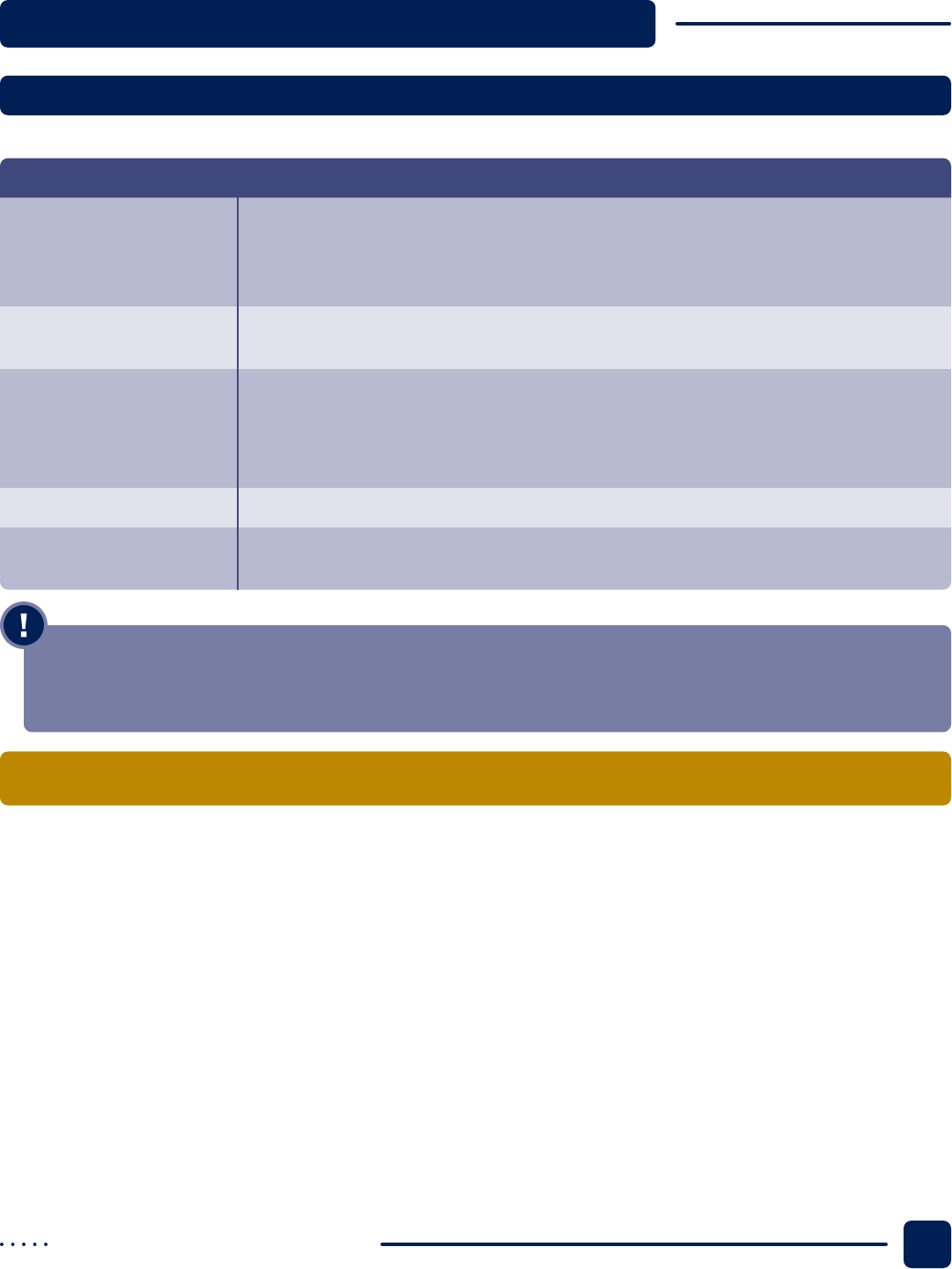

CALENDAR OF EVENTS

MONTH EVENT

JANUARY

JUNE

AUGUST

FEBRUARY

JULY

• The department begins accepting applications (for taxes or rent paid in the previous year).

• myPATH opens for 2023 rebate applications.

• PA-1000 booklets are mailed out to applicants who filed previously via paper.

• Reminder letters are mailed out to applicants who filed via myPATH or preparer.

• Forms are published on the department’s website and online forms ordering is available.

• Due date for applications is June 30th. In the beginning of June, the Governor will decide

whether to extend the application deadline to December 31st.

• Press release will be issued if extension is granted.

• The department begins making a second round of automated phone calls to let applicants

know that their rebate application was approved.

• August 15th is the first day the department can request a stop payment on a rebate issued on

July 1st. Stop payments can only be requested 45 days past the date the rebate was issued.

• Posting/processing of applications begins.

• The department begins making automated phone calls to advise that the application was received.

• PA Treasury will begin to mail or direct deposit rebates on July 1st.

IMPORTANT: If the application is not postmarked or led electronically by the due date (or extended due

date), the individual may not apply for the program. This means that an application cannot be submitted

for a previous year.

PROPERTY TAX/RENT REBATE

AUTOMATIC REMINDERS

ELIGIBILITY

THE PENNSYLVANIA DEPARTMENT OF REVENUE

PTRR Prep Guide Return to Table of Contents12

ELIGIBILITY

THE BASICS

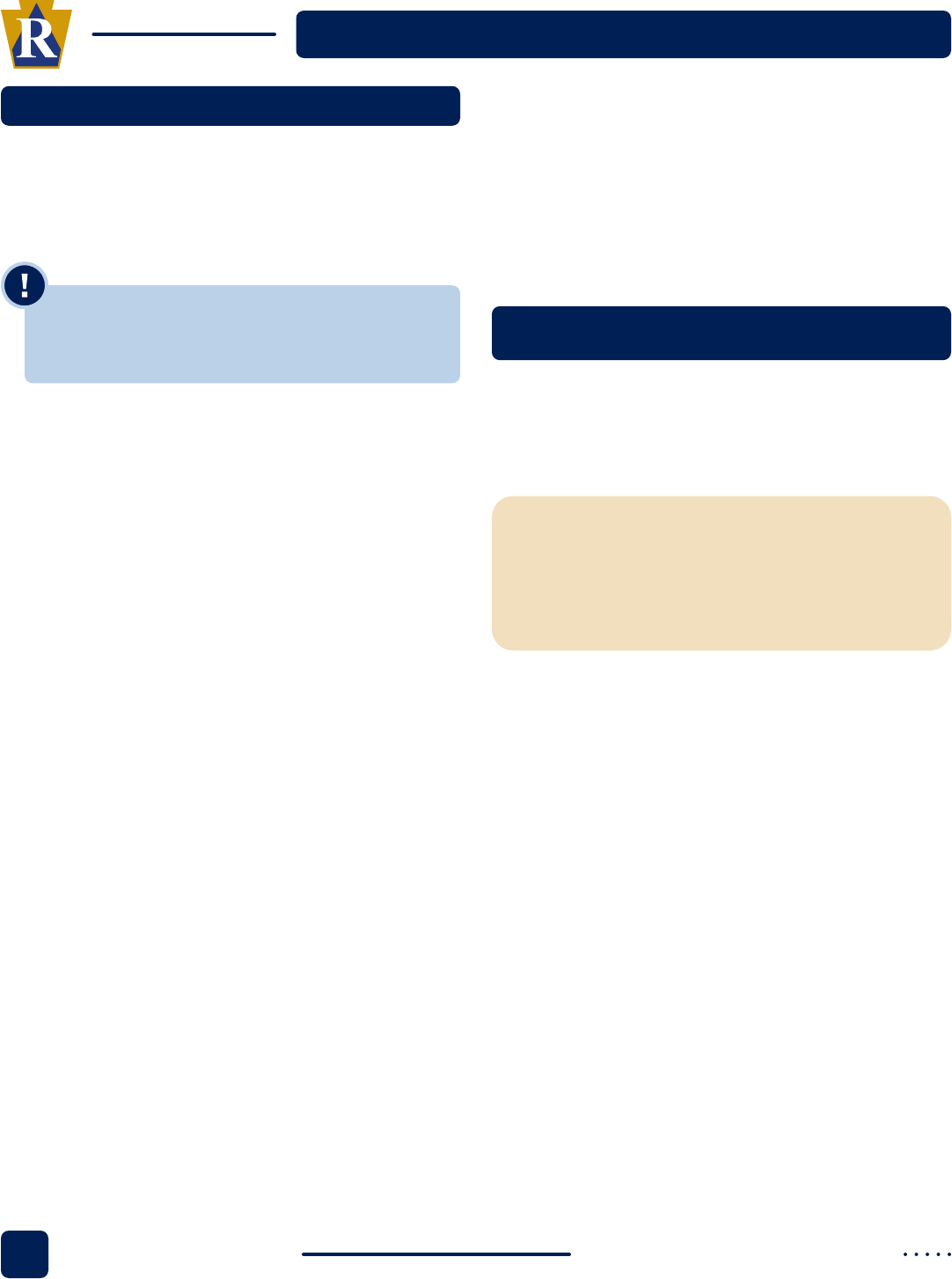

NOTE: If electronically ling via myPATH, the

application will not allow you to proceed if the

applicant does not qualify.

TYPE OF FILER – AGE AND/OR

DISABILITY QUALIFICATION

Documents to Include Proof

Document Checklist

Return to Table of Contents 13

revenue.pa.gov

AGE 65 OR OLDER

WIDOW/WIDOWER AGE 50-64

MARRIED TO INDIVIDUAL AGE 65 OR OLDER

NOTE: Under Title 23 of the Pennsylvania Consolidated

Statutes, Section 1103, eliminated the establishment of

Common Law Marriages contracted Jan. 1, 2005, and later. If

a common law marriage was established and the conditions

fulfilled prior to that date, it is valid.

Category A on the application is the age qualifier. If selecting this

option, the applicant must be 65 or older by December 31st of

the application year. This is the most common category selected.

• If the applicant is a first-time filer and falls into this category,

remit proof of age along with their application

Category C is used by a widow or widower who is anywhere

between the ages of 50 and 64 by December 31st of the

application year. This category only applies if the couple was still

married at the time of the spouse passing.

• If the applicant is a first-time filer and falls into this category,

remit proof of age along with a copy of their spouse’s death

certificate.

Category B should be used if the applicant is under 65 but their

spouse is 65 or older by December 31st of the application year.

This category is the least common because typically the person

who is 65 will file as the primary applicant.

• If the applicant is a first-time filer and falls into this category,

remit proof age for the spouse.

PERMANENTLY DISABLED AGE 18-64

If the applicant applied to the Social Security Administration

and was denied disability benefits, they are not eligible for a

rebate as permanently disabled.

The Department of Revenue has the legal authority to require

additional evidence of an applicant’s disability, including all

medical records, to determine eligibility for a rebate.

EXAMPLE: If the applicant receives their award letter on

Dec. 31 of the application year but do not begin receiving

payments until the following year, they are eligible to file

a rebate. The receipt of payments is not necessary to

qualify. If they have an award letter from SSI confirming the

disability date for that year, they are eligible for a rebate if

all other requirements are met.

Category D should be used if the applicant is 18 to 64 years

old by December 31st of the application year and they are

permanently disabled.

• For Social Security disability, SSI permanent and total

disability, Railroad Retirement permanent and total

disability, or Black Lung disability, provide a copy of the

applicant’s award letter.

• For Veterans Administration disability, provide a letter

from the Veterans Administration stating that the applicant

is 100 percent disabled.

• For Federal Civil Service disability, provide a letter from

Civil Service stating the applicant is 100 percent disabled.

• If the applicant receiving disability benefits under the

“Welfare Aid to the Permanent and Totally Disabled”

program, provide a copy of the applicant’s medical

assistance card or a letter from the Department of Human

Services verifying the applicant is receiving disability

benefits.

• If the applicant does not qualify under any of the above,

they should have their physician complete a PA-1000 PS

(See the PA-1000 PS guidance under the Preparing the

Application section.)

PTRR Prep Guide Return to Table of Contents14

ELIGIBILITY

HOUSEHOLDS WITH MORE THAN ONE QUALIFIED APPLICANT

REBATE TYPE - PROPERTY TAX AND/OR RENT PAID QUALIFICATION

DEFINITIONS

RENTER

PROPERTY OWNER

OWNER/RENTER

• Applicant must have rented and occupied the residence.

• Applicant must have a true landlord/tenant relationship.

• Rent must have been paid by someone for the application year.

• The property owner must have been liable for the payment of real estate taxes or payment in

lieu thereof on the rental property.

• Applicant may not have received cash public assistance for the months being claimed (see

Schedule D)

• Applicant must have owned the home.

• Applicant must have occupied the home as a primary residence.

• Real estate taxes must have been paid by someone for the application year.

• Applicant owned, occupied, and paid taxes for part of year and paid rent for other portion of

the year.

• Applicant owned, occupied, and paid taxes on a home and paid rent for the land upon which

the home is situated (such as, but not limited to, a mobile home in a mobile home park or a

home on which land rent is paid).

• Applicant paid rent for the home they occupied and paid property taxes on the land upon

which it stood (such as, but not limited to, a mobile home).

NOTE: If an applicant transferred the property to their offspring (often to avoid the payment of inheritance tax),

they are not eligible for a rebate unless a life estate or a lifetime lease is created that provides proof that the

applicant still has the right of ownership until death. Proof of the life estate’s creation must be provided with

the application. To document ownership via a life estate or lifetime lease, completed copies of the deed, trust

agreement, will or decree of distribution showing the language providing for the applicant’s rights of ownership

are required.

Return to Table of Contents 15

revenue.pa.gov

INCOME QUALIFICATION

What’s New

2024 ELIGIBILITY TABLE

INCOME

$8,001 - $15,000

$18,001 - $45,000

$0 - $8,000

$15,001 - $18,000

MAXIMUM STANDARD REBATE

$770

$380

$1,000

$460

FILING ON BEHALF OF A DECEASED INDIVIDUAL

Schedule A

Schedule G

SURVIVING SPOUSE

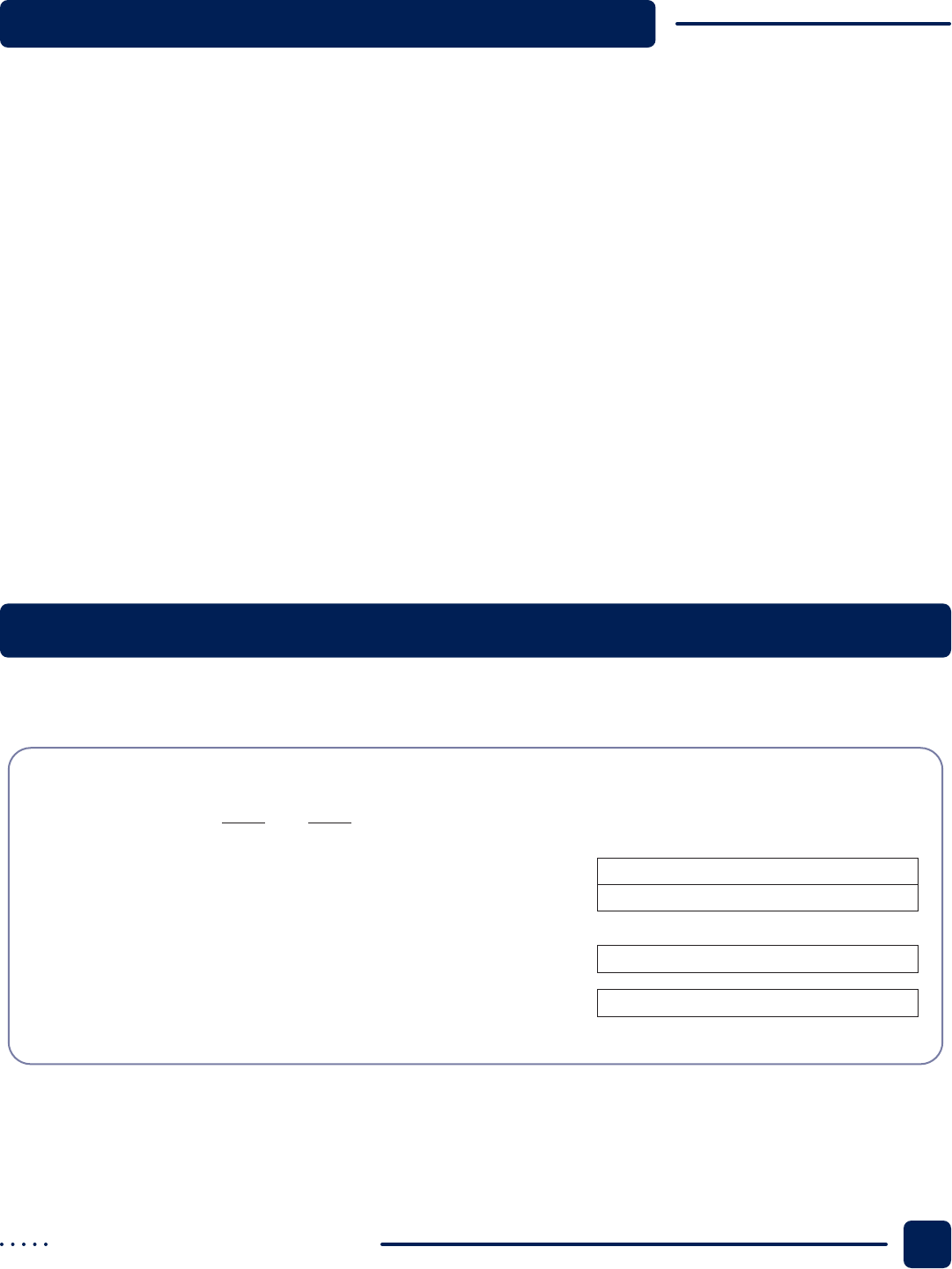

SURVIVING SPOUSE IS ELIGIBLE TO FILE ON THEIR OWN

NOTE: If the surviving spouse is eligible to le on their own, do not mark the oval in Section II, Line 3 that reads,

“Filing on behalf of a decedent.”

PA-1000

Property Tax or Rent

Rebate Claim 03-23

PA Department of Revenue

P.O. Box 280503

Harrisburg PA 17128-0503

OFFICIAL USE ONLY

Spouse’s Social Security NumberYour Social Security Number

Check your label for accuracy. If incorrect, do not use the label. Complete Section I.

Fill in only one oval in each

section.

I

III

II

If Spouse is

Deceased, fill

in the oval.

1. I am filing for a rebate as a:

P. Property Owner – See

instructions

R. Renter – See instructions

B. Owner/Renter – See

instructions

2. I Certify that as of Dec. 31, 2023,

I am (a):

A. Claimant age 65 or older

B. Claimant under age 65,

with a spouse age 65 or

older who resided in the

same household

C. Widow or widower, age

50 to 64

D. Permanently disabled

and age 18 to 64

3.

Filing on behalf of a

decedent

Dollars Cents

4.

5.

6.

8.

7.

9.

11a.

10.

11b.

13.

IMPORTANT: You must submit proof of the income you reported – See the instructions on Pages 7 to 9.

11c.

11d.

11e.

11f.

11g.

12.

2023

4. Social Security, SSI and SSP Income (Total benefits $ divided by 2) . . . . . . . . . .

5. Railroad Retirement Tier 1 Benefits (Total benefits $ divided by 2) . . . . . . . . . . .

8. Gain or Loss on the Sale or Exchange of Property. . . . . . . . . If a loss, fill in this oval. . . . .

7. Interest and Dividend Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11a. Salaries, wages, bonuses, commissions, and estate and trust income. . . . . . . . . . . . . . . . . . . . .

12. Claimants with Federal Civil Service Retirement System Benefits enter $9,948 or $19,896.

See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

LOSS

9. Net Rental Income or Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . If a loss, fill in this oval. . . . .

10. Net Business Income or Loss . . . . . . . . . . . . . . . . . . . . . . . . . If a loss, fill in this oval. . . . .

LOSS

LOSS

11b. Gambling and Lottery winnings, including PA Lottery winnings, prize winnings and the value

of other prizes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11c. Value of inheritances, alimony and spousal support. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11d. Cash public assistance/relief. Unemployment compensation and workers’ compensation,

except Section 306(c) benefits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11e. Gross amount of loss of time insurance benefits and disability insurance benefits,

and life insurance benefits, except the first $5,000 of total death benefit payments. . . . . . . . . . . .

11f. Gifts of cash or property totaling more than $300, except gifts between

members of a household. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11g. Miscellaneous income and annualized income amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Income.

13. TOTAL INCOME. Add only the positive income amounts from Lines 4 through 11g and subtract

the amount on Line 12. See Page 3 for income limitations. Enter this amount on Line 23. . . . . . . .

6. Total Benefits from Pension, Annuity, IRA Distributions and Railroad Retirement Tier 2 (Do not

include federal veterans’ disability payments or state veterans’ payments.) . . . . . . . . . . . . . . . . . . .

TOTAL INCOME received by you and your spouse during 2023

CODES

REQUIRED

*

**

(FI)

Claimant’s Birthdate Spouse’s Birthdate

Spouse’s First Name MI

PLEASE WRITE IN YOUR SOCIAL SECURITY NUMBER(S) ABOVE

Last Name First Name MI

First Line of Address

Second Line of Address

State ZIP CodeCity or Post Office

Daytime Telephone Number

2305010056

2305010056

School District CodeCounty Code

Country Code

START

➜

MM/DD/YY

MM/DD/YY

PRINT

NEXT PAGE

TOP OF PAGE

Reset Entire Form

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

PTRR Prep Guide Return to Table of Contents16

ELIGIBILITY

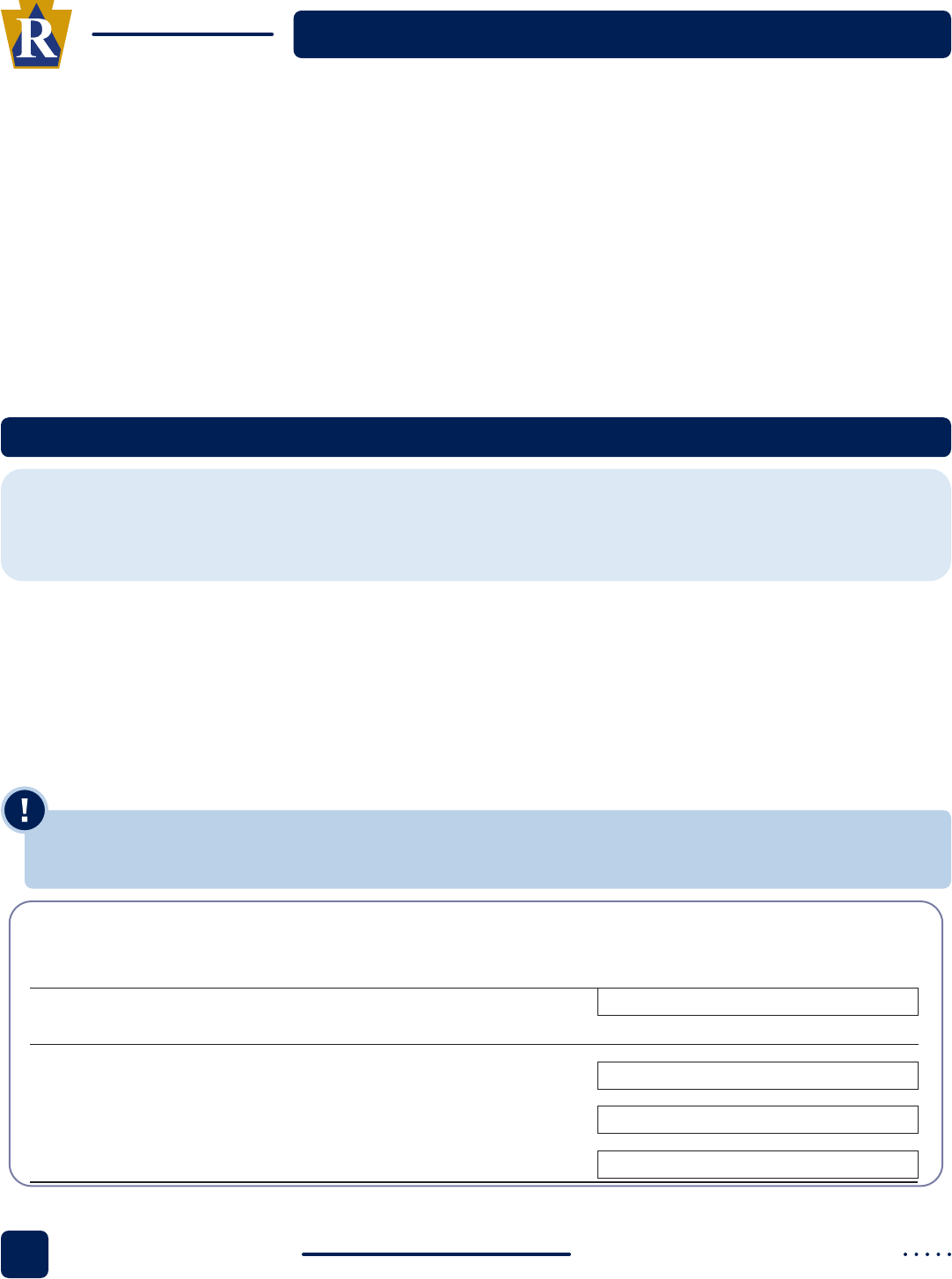

SURVIVING SPOUSE IS NOT ELIGIBLE TO FILE ON THEIR OWN

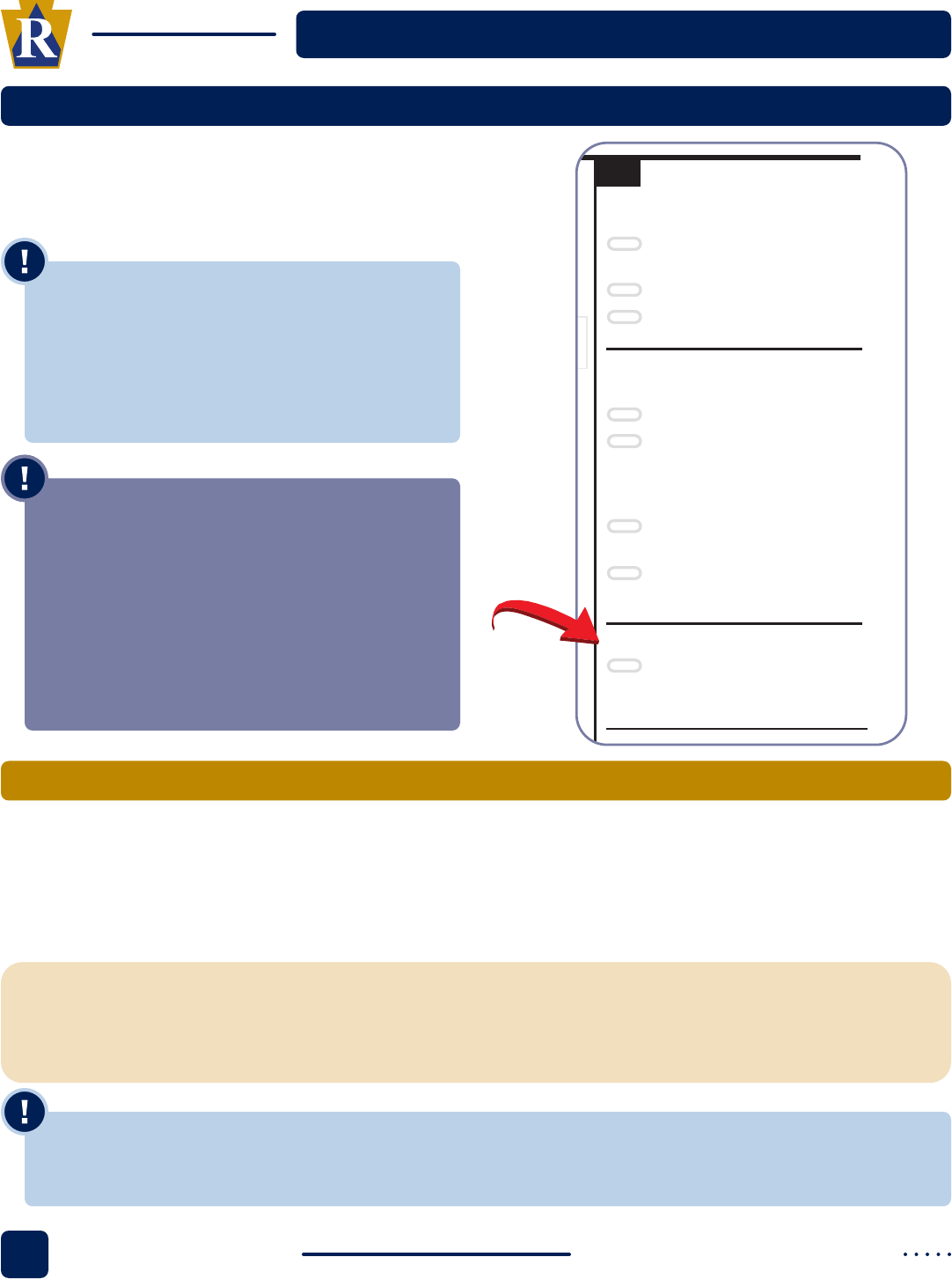

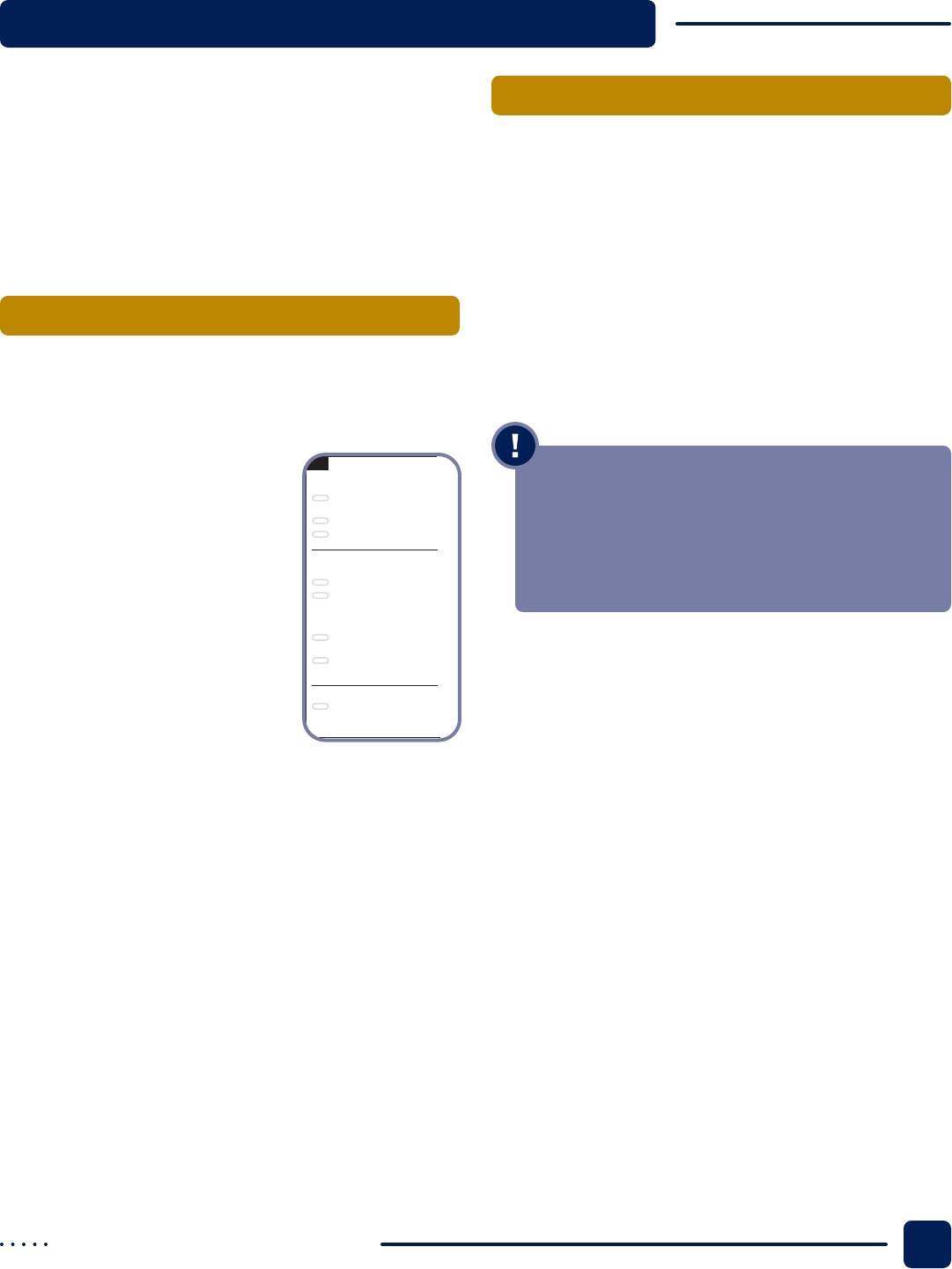

NOTE: In this situation, ll in the oval under

Section II of the PA-1000, Line 3 “Filing on behalf

of a decedent.” Additionally, include a completed

DEX-41, copy of the death certicate (showing

their name listed as the spouse), a letter stating

they were the spouse of the applicant at the time

of death, and the applicant should sign on the

applicant signature line.

IMPORTANT: This method should only be

used for a surviving spouse if the decedent

passed away during the application year or

during the filing year prior to the application

being submitted. If the decedent passed away

during the application year, the income must

be annualized using the Schedule G and taxes

paid must be prorated using the Schedule

A. For more information on completing

these schedules, see the guidance under the

Preparing the Application section.

PA-1000

Property Tax or Rent

Rebate Claim 03-23

PA Department of Revenue

P.O. Box 280503

Harrisburg PA 17128-0503

OFFICIAL USE ONLY

Spouse’s Social Security NumberYour Social Security Number

Check your label for accuracy. If incorrect, do not use the label. Complete Section I.

Fill in only one oval in each

section.

I

III

II

If Spouse is

Deceased, fill

in the oval.

1. I am filing for a rebate as a:

P. Property Owner – See

instructions

R. Renter – See instructions

B. Owner/Renter – See

instructions

2. I Certify that as of Dec. 31, 2023,

I am (a):

A. Claimant age 65 or older

B. Claimant under age 65,

with a spouse age 65 or

older who resided in the

same household

C. Widow or widower, age

50 to 64

D. Permanently disabled

and age 18 to 64

3.

Filing on behalf of a

decedent

Dollars Cents

4.

5.

6.

8.

7.

9.

11a.

10.

11b.

13.

IMPORTANT: You must submit proof of the income you reported – See the instructions on Pages 7 to 9.

11c.

11d.

11e.

11f.

11g.

12.

2023

4. Social Security, SSI and SSP Income (Total benefits $ divided by 2) . . . . . . . . . .

5. Railroad Retirement Tier 1 Benefits (Total benefits $ divided by 2) . . . . . . . . . . .

8. Gain or Loss on the Sale or Exchange of Property. . . . . . . . . If a loss, fill in this oval. . . . .

7. Interest and Dividend Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11a. Salaries, wages, bonuses, commissions, and estate and trust income. . . . . . . . . . . . . . . . . . . . .

12. Claimants with Federal Civil Service Retirement System Benefits enter $9,948 or $19,896.

See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

LOSS

9. Net Rental Income or Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . If a loss, fill in this oval. . . . .

10. Net Business Income or Loss . . . . . . . . . . . . . . . . . . . . . . . . . If a loss, fill in this oval. . . . .

LOSS

LOSS

11b. Gambling and Lottery winnings, including PA Lottery winnings, prize winnings and the value

of other prizes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11c. Value of inheritances, alimony and spousal support. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11d. Cash public assistance/relief. Unemployment compensation and workers’ compensation,

except Section 306(c) benefits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11e. Gross amount of loss of time insurance benefits and disability insurance benefits,

and life insurance benefits, except the first $5,000 of total death benefit payments. . . . . . . . . . . .

11f. Gifts of cash or property totaling more than $300, except gifts between

members of a household. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11g. Miscellaneous income and annualized income amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Income.

13. TOTAL INCOME. Add only the positive income amounts from Lines 4 through 11g and subtract

the amount on Line 12. See Page 3 for income limitations. Enter this amount on Line 23. . . . . . . .

6. Total Benefits from Pension, Annuity, IRA Distributions and Railroad Retirement Tier 2 (Do not

include federal veterans’ disability payments or state veterans’ payments.) . . . . . . . . . . . . . . . . . . .

TOTAL INCOME received by you and your spouse during 2023

CODES

REQUIRED

*

**

(FI)

Claimant’s Birthdate Spouse’s Birthdate

Spouse’s First Name MI

PLEASE WRITE IN YOUR SOCIAL SECURITY NUMBER(S) ABOVE

Last Name First Name MI

First Line of Address

Second Line of Address

State ZIP CodeCity or Post Office

Daytime Telephone Number

2305010056

2305010056

School District CodeCounty Code

Country Code

START

➜

MM/DD/YY

MM/DD/YY

PRINT

NEXT PAGE

TOP OF PAGE

Reset Entire Form

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

NOTE: If the decedent passed away during the application year, the income must be annualized using the

Schedule G and taxes paid must be prorated using the Schedule A. See the guidance under the Preparing the

Application section for more information on completing these schedules.

• If there is a will

• If there is no will

ESTATE

Return to Table of Contents 17

revenue.pa.gov

PERSONAL REPRESENTATIVE

NOTE: If the decedent passed away during the application year, the income must be annualized using the

Schedule G and taxes/rent paid must be prorated using the Schedule A. See the guidance under the Supporting

Schedules section for more information on completing these schedules.

GETTING A CHECK REISSUED UNDER THE SPOUSE, ESTATE, OR PERSONAL REPRESENTATIVE NAME

PREPARING

THE APPLICATION

THE PENNSYLVANIA DEPARTMENT OF REVENUE

PTRR Prep Guide Return to Table of Contents20

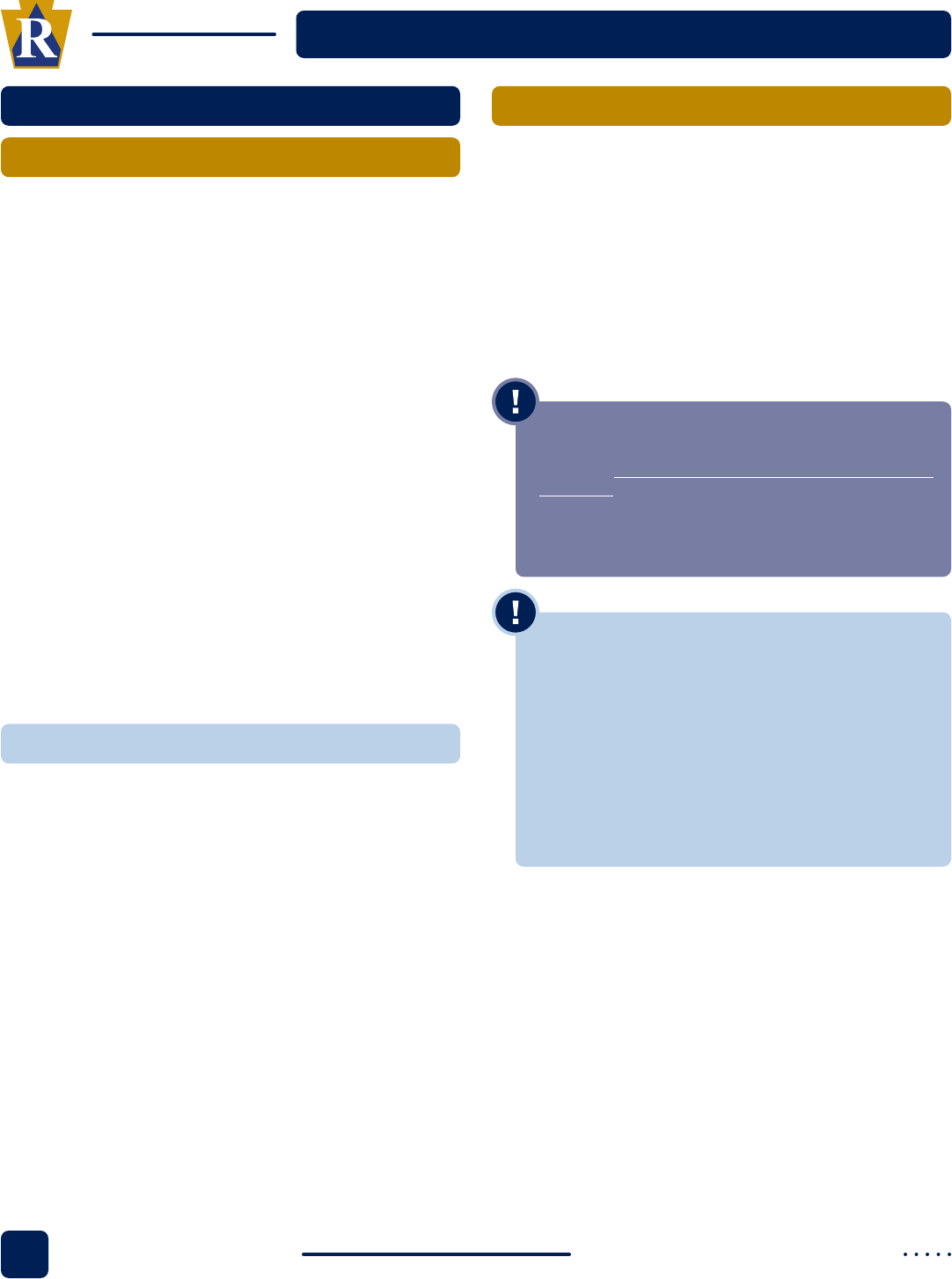

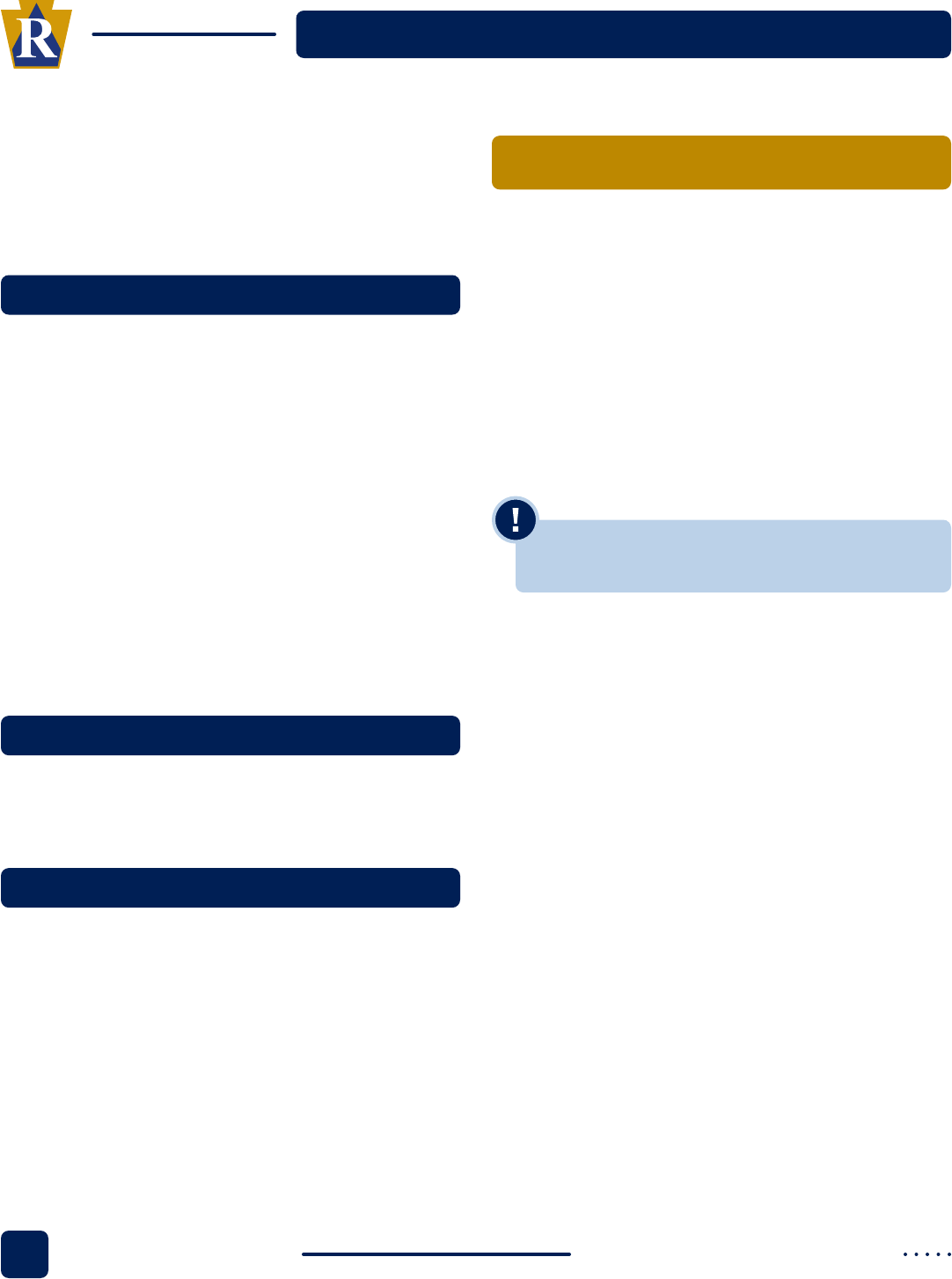

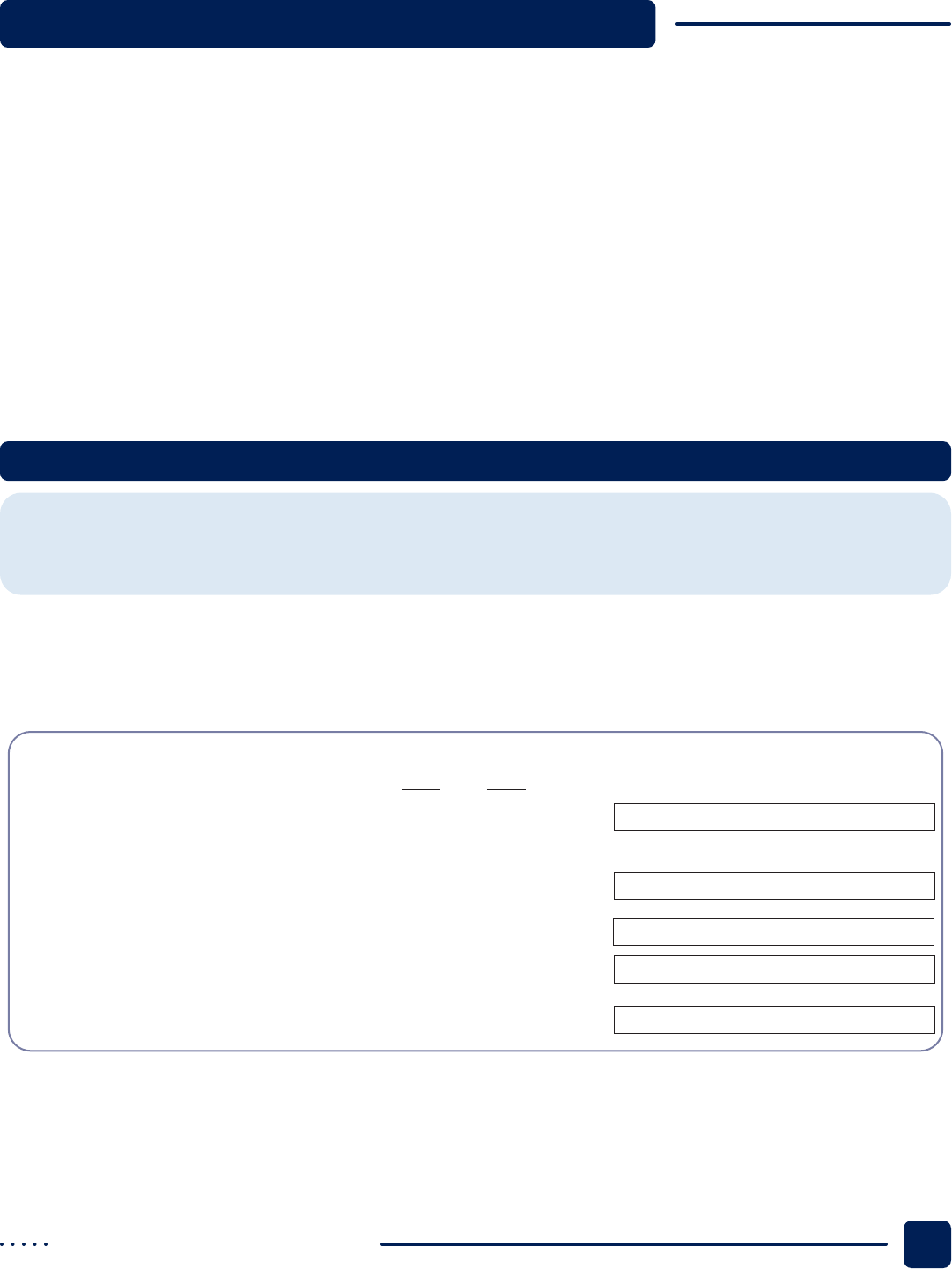

PREPARING THE APPLICATION

WAYS TO FILE

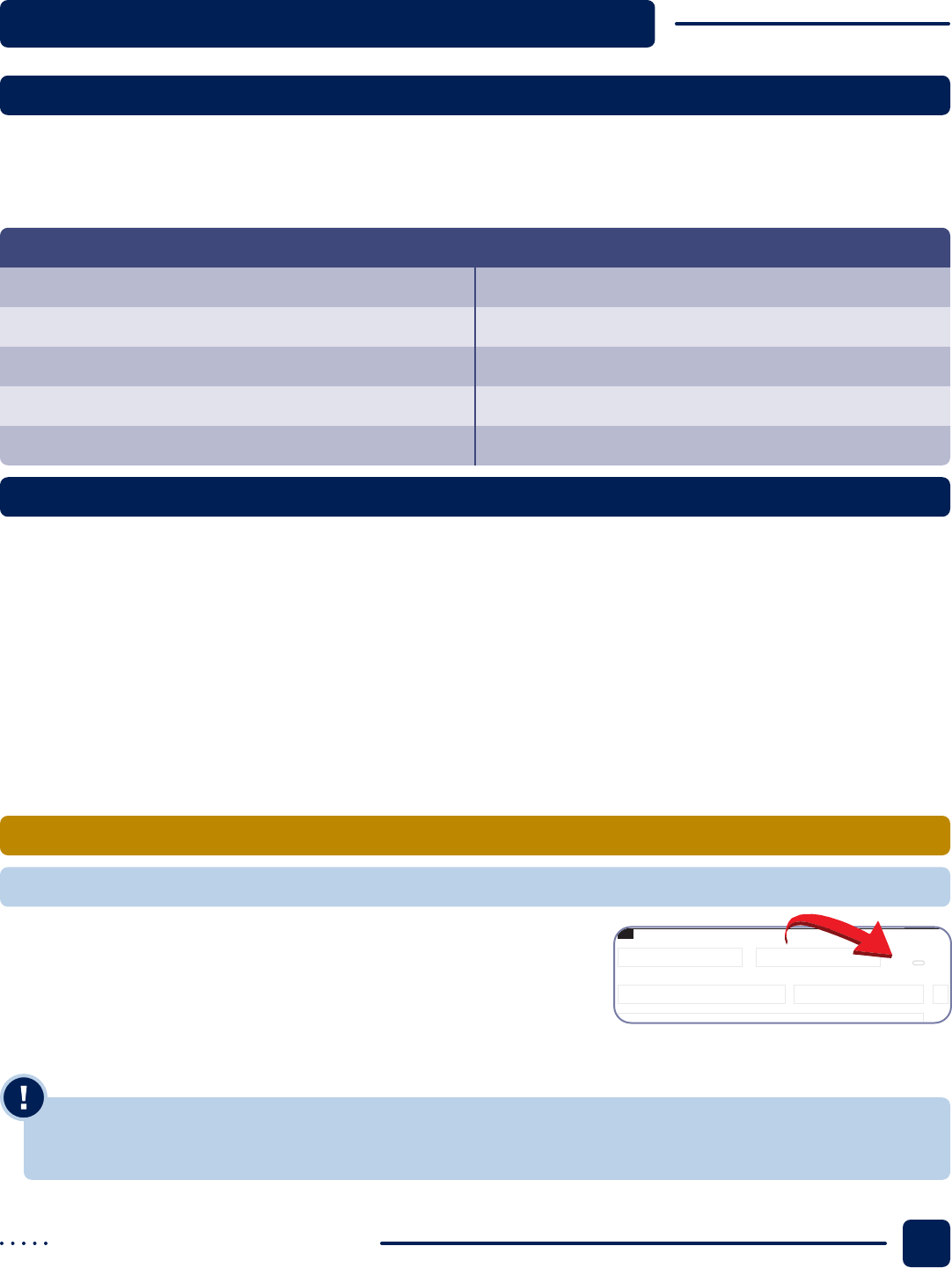

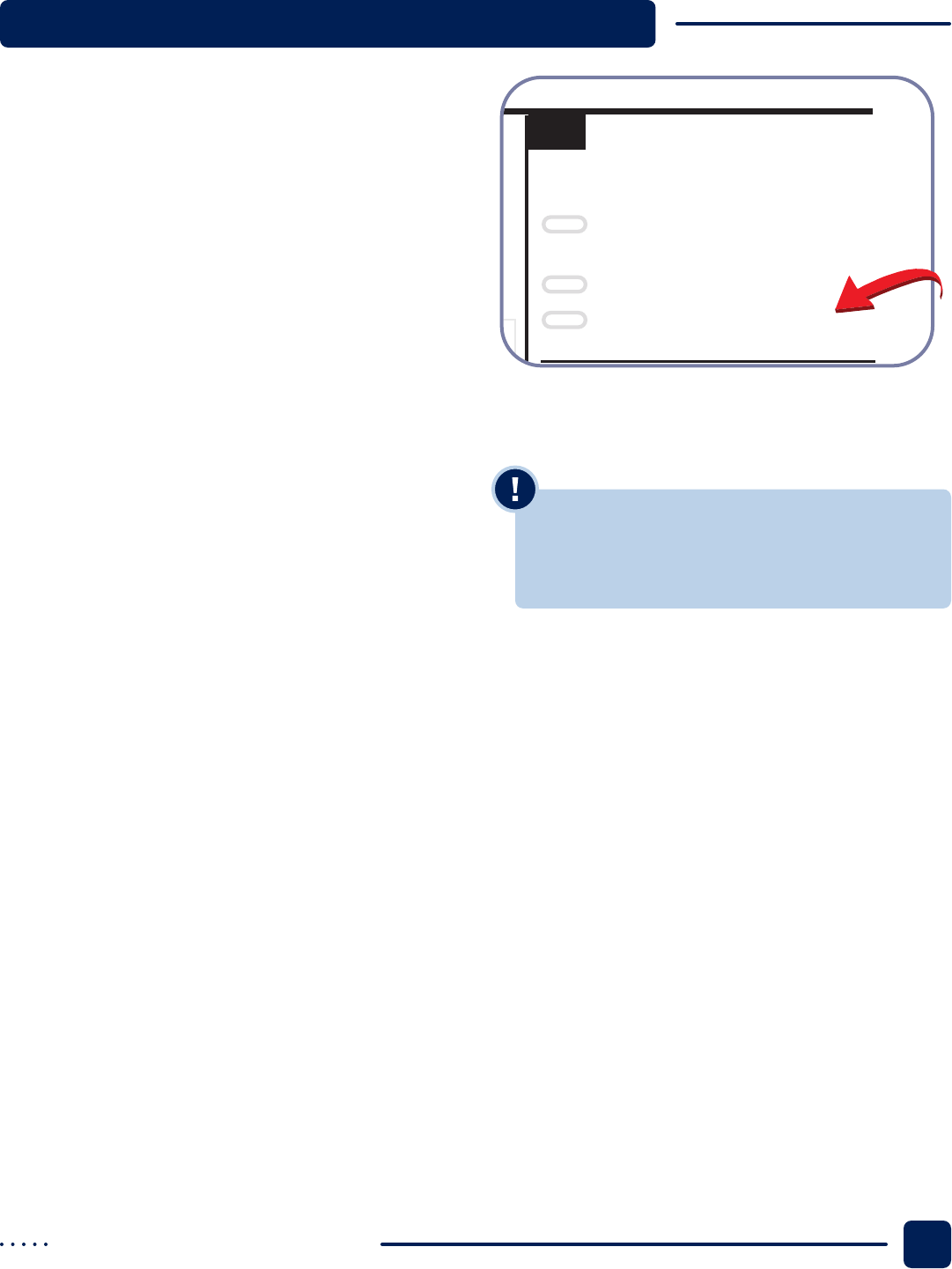

ELECTRONIC FILING

Pennsylvania Department of Revenue oers a free electronic

ling opon for the Property Tax/Rent Rebate Program via

the myPATH portal. This is a non-logged in funcon, meaning

customers do not have to create a myPATH username or

password to apply. You can easily submit the applicaon

on behalf of your customer by vising myPATH.pa.gov and

locang the Rebates panel. From there, click the link to

Apply for a Property Tax/Rent Rebate hyperlink.

Please be prepared to submit any supporng

documentaon along with the applicaon. We suggest

that you save all necessary documents to your computer

before geng started. Addionally, you will need to enter

an email address upon compleon of the applicaon. If

your customer does not have an email, you may enter your

email address as their preparer since this will be used for

sending the conrmaon. Be aware that the system will

me out aer 15 minutes and the PTRR applicaon cannot

be saved for compleon at a later me.

Accepted le types include pdf, jpeg, jpg, png, gif, ,

and r formats. If your aachments are not able to be

electronically uploaded with your applicaon, you will

have to le a paper applicaon.

ELECTRONIC FILING BENEFITS

Using our electronic ling opon oers many benets for

you and your customers, including:

• Faster processing

• Error-reducing automac calculators (Unlike the paper

version of the PA-1000, do not cut Social Security

Income or Railroad Rerement Tier 1 benets in half.

The system will reduce the income for you.)

• Easy direct deposit opons

• Security features to ensure your sensive informaon

is safe

• Immediate conrmaon of receipt (no missing the

deadline)

PAPER FILING

If you are unable to remit the applicaon online via myPATH,

you may complete the paper PA-1000, Property Tax or Rent

Rebate Claim Form. Please keep in mind that any person

who led a paper applicaon in the past will receive a new

PTRR booklet in the mail from the Department of Revenue.

It is important that you use the preprinted label included in

your customer’s PA-1000 booklet if you decide to remit a

paper applicaon. This preprinted label will help to expedite

the processing because it is easy for our equipment to scan

and guarantees that there are no keying errors.

IMPORTANT: When using the address label,

please ensure that all information is 100%

correct. If anything is incorrect, do not use

the label. You will still need to enter the Social

Security number on the application as the

Department of Revenue removed those numbers

from the label due for condentiality purposes.

NOTE: If the applicant has a label that includes a

spouse who passed away during the application

year, do not use the label. The surviving spouse

should print their name, address, and SSN in

Section I and follow the ling instructions. The

surviving spouse should furnish proof required

for a rst time ler. Do not use the label sent by

the department. The surviving spouse should

enter the deceased spouse’s SSN and name in the

spouse information area, and ll in the oval “If

Spouse is Deceased” located in the area next to

the Spouse’s SSN on the application.

To aid in processing the rebate properly, be sure to provide

an applicant’s school district and county codes, which

indicate where they resided as of December 31 of the

applicaon year. School district and county codes are listed

on Pages 68 through 71. The codes are also available online

at revenue.pa.gov/schools.

If your customer does not have a copy of the PTRR Booklet,

please use the forms on our website at revenue.pa.gov.

These forms are in a llable PDF format that are easy for

our equipment to scan, which will help to avoid delays in

processing.

DOCUMENTS

TO INCLUDE

THE PENNSYLVANIA DEPARTMENT OF REVENUE

PTRR Prep Guide Return to Table of Contents22

DOCUMENTS TO INCLUDE

PROOF OF AGE

PROOF OF WIDOW/WIDOWER

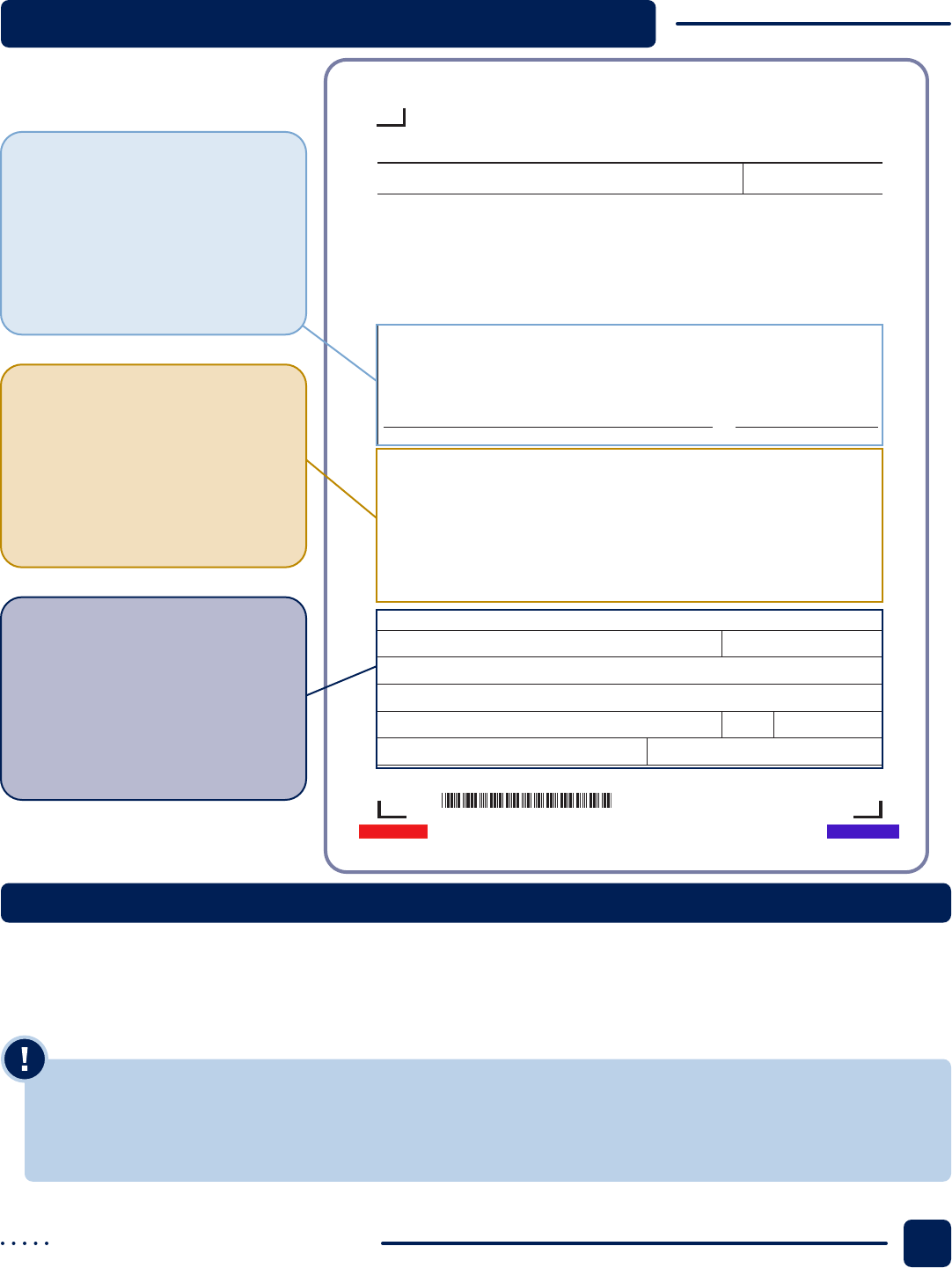

PROOF OF DISABILITY

•

•

•

PA-1000 PS, PHYSICAN’S STATEMENT

OF PERMANENT AND TOTAL DISABILITY

NOTE: If the applicant was denied Social Security

disability, they are not eligible for a rebate.

Return to Table of Contents 23

revenue.pa.gov

OFFICIAL USE ONLY

Name as shown on PA-1000 Social Security Number

Instructions

A claimant not covered under the federal Social Security Act or the federal Railroad Retirement Act who is unable

to submit proof of permanent and total disability may submit this Physician’s Statement. The physician must deter-

mine the claimant’s status using the same standards used for determining permanent and total disability

under the federal Social Security Act or the federal Railroad Retirement Act. CAUTION: If the claimant applied

for Social Security disability benefits and the Social Security Administration did not rule in the claimant’s favor,

the claimant is not eligible for a Property Tax or Rent Rebate.

Confidentiality Statement.

All information on this Physician’s Statement and claim form is confidential. The

department shall only use this information for the purposes of determining the claimant’s eligibility for a Property

Tax or Rent Rebate.

CERTIFICATION

I certify the claimant named above is my patient and is permanently and totally disabled under the standards that

the federal Social Security Act or the federal Railroad Retirement Act requires for determining permanent and total

disability. Upon request from the PA Department of Revenue, I will provide the medical reports or records indicat-

ing diagnosis and prognosis of the claimant’s condition, including signs, symptoms and laboratory findings, if

applicable or appropriate.

Physician Signature Date

Description of Claimant’s Permanent and Total Disability.

Briefly describe the reason(s) the above-named

claimant is totally and permanently disabled.

Physician Identification Information. Please print.

Name National Provider Identifier

Business name, if applicable

Address

City State ZIP Code

Office telephone number Office email address

PHYSICIAN’S STATEMENT

Physician’s Statement of

Permanent and Total Disability

2023

PA-1000 PS 03-23

PA Department of Revenue

2305310050

2305310050

2305310050

(FI)

START

➜

Please sign after printing.

MM/DD/YY

PRINT

TOP OF PAGE

Reset Entire Form

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

PROOF OF INCOME

PTRR Proof Document

Checklist

NOTE: If the customer doesn’t have documentation to verify the income received, they should provide a detailed

explanation regarding the income reported on their claim form. Additionally, if the applicant has no income to report

they should include a detailed explanation regarding how the rent or property taxes were paid. For example, a customer

has no income, but they are paying for rent out of their savings or a customer has no income, but their bills were paid

by a family member.

PTRR Prep Guide Return to Table of Contents24

DOCUMENTS TO INCLUDE

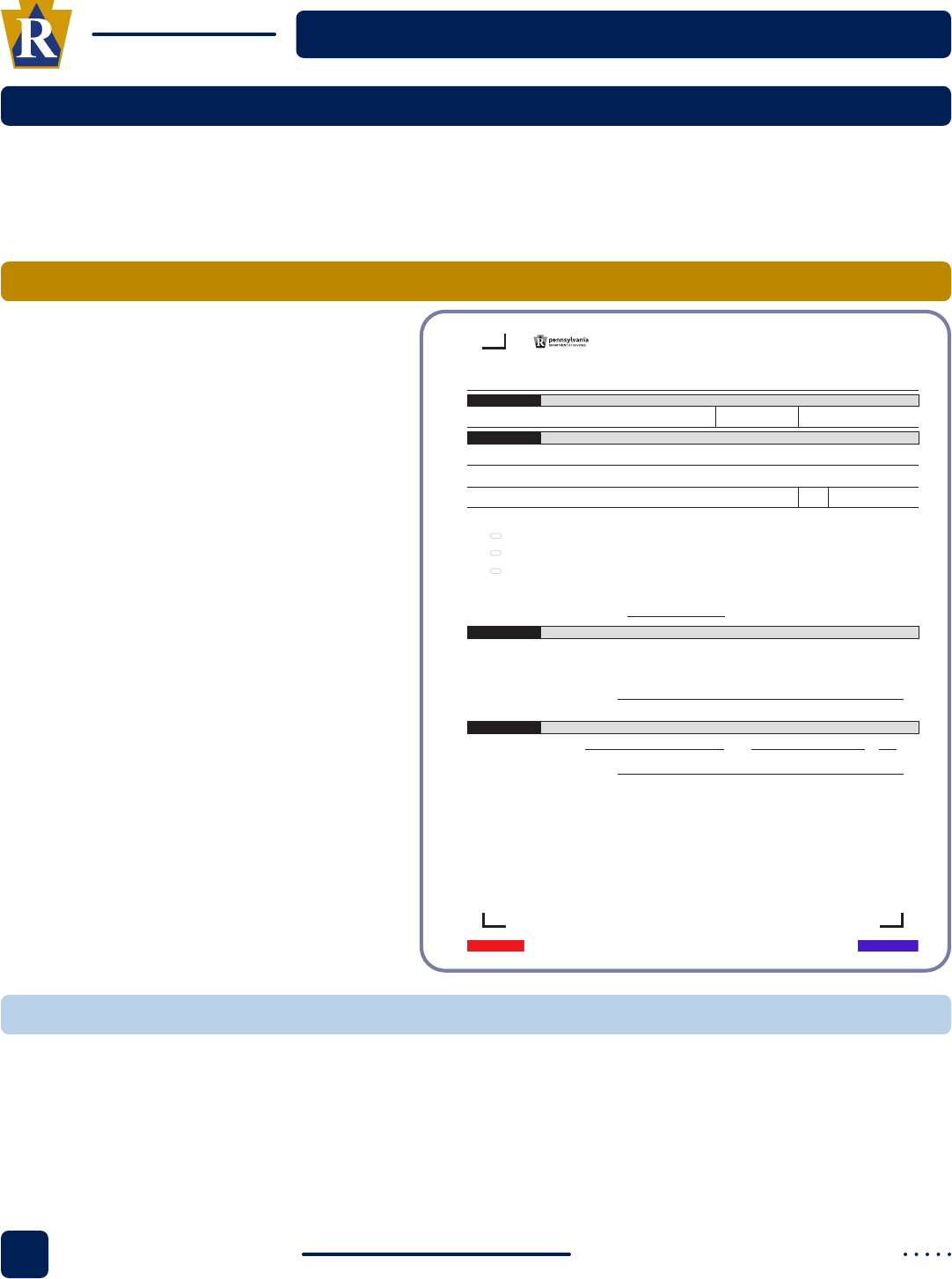

DOCUMENTS REQUIRED FOR A REBATE DUE A DECEDENT

Filing On Behalf of a Deceased Individual

DEX-41, APPLICATION FOR PROPERTY TAX/RENT REBATE DUE THE DECEDENT

GETTING A CHECK REISSUED UNDER THE SPOUSE, ESTATE, OR PERSONAL REPRESENTATIVE NAME

I am filing this application as (select only one oval):

1. The surviving spouse. (Attach a copy of the decedent’s death certificate.)

2. The personal representative of the decedent’s estate. (Attach a copy of a short certificate or court order showing your appointment.)

3. The personal representative of the decedent where a will has NOT been probated or where there is no will. (Attach a copy of the

decedent’s death certificate and a receipted copy of the claimant’s funeral bill and proof that you directly paid for funeral expenses that

are equal to or greater than the amount of the rebate being claimed. Acceptable proof of this payment include the front and back of the

canceled check, a credit card/bank statement, or other document showing you personally paid for the funeral expenses.

State your relationship to the decedent: . Sign the affidavit below and have your signature notarized.)

Subscribed and sworn before me this day of 20 .

(SIGNATURE OF NOTARY PUBLIC)

I am making a request for monies due the decedent and certify that the information provided on this claim has been examined by me and is,

to the best of my knowledge, true and correct. Any monies that I receive as a result of this claim will be disbursed according to the laws of

the Commonwealth of Pennsylvania.

(SIGNATURE OF PERSON FILING THIS CLAIM)

DEX-41

BUREAU OF INDIVIDUAL TAXES

PO BOX 280508

HARRISBURG PA 17128-0508

APPLICATION FOR

PROPERTY TAX/RENT

REBATE DUE THE DECEDENT

DECEDENT INFORMATION

SECTION I

APPLICATION SUBMITTER INFORMATION

SECTION II

AFFIDAVIT

SECTION III

NOTARIZATION

SECTION IV

Name of Decedent Decedent’s Social Security Number Date of Death

Name

State ZIP Code

Street Address

Complete Section III only if Oval 3 is selected in Section II.

City

(EX) 04-22 (FI)

START

➜

PLEASE SIGN AFTER PRINTING

PLEASE SIGN AFTER PRINTING

PRINT

TOP OF PAGE

Reset Entire Form

Return to Table of Contents 25

revenue.pa.gov

APPLYING AS A RENTER (RENT REBATE)

Supporng Schedules

IMPORTANT: If the landlord is a tax-exempt

entity and is not required to pay property taxes

on the rental property, the renter does not

qualify for a rent rebate unless the entity makes

payments in lieu of taxes to a local government

authority (county, municipality, school district,

re/police department, etc.) in order to allow

their residents to claim rent rebates.

LEASE WITH MULTIPLE TENANTS

HOUSING AUTHORITIES

IMPORTANT: Applicants that live in Housing

Authority properties should use the Apartment

Building indicator on the Rent Certicate.

If a rent certicate is not included with the

application, it will delay processing, as the

department will end up sending a request for a

completed form. Additionally, if the letter from

the housing authority isn’t signed, follow the

guidance provided in Landlord’s Oath section.

CARE HOMES/FACILITIES

Monthly Charges Other Than Rent

PTRR Prep Guide Return to Table of Contents26

DOCUMENTS TO INCLUDE

SPOUSE LIVES IN AN ASSISTED LIVING,

PERSONAL CARE OR NURSING HOME

BOARDING HOMES

RENTING A ROOM IN A

PRIVATE HOME OR OTHER DOMOCILE

NOTE: An applicant renting a room in a house

that is not considered a self-contained unit

does not qualify for this program.

APPLYING AS AN OWNER

(PROPERTY TAX REBATE)

Return to Table of Contents 27

revenue.pa.gov

NOTE: The term Et Vir (and husband) and Et Ux

(and wife) indicate joint ownership. However, if

the term Et Al or Et Alia (and others) appear,

the additional owners must be identied and

Schedule F must be completed.

IMPORTANT: If the tax bill or mortgage statement

does not reect the applicant’s address on the

form, an explanation must be submitted. This

may take the form of a letter from either the

tax collector or mortgage company verifying

the applicant’s home address. If the applicant

moved during the claim year, PA-1000 Schedule

A must be completed. If the applicant moved

after December 31st of the claim year, a letter of

explanation must be included.

ELIGIBLE REAL ESTATE TAX BILLS

• County

• School district

• City

• Borough

• Township

TAXES/CHARGES THAT ARE NOT ELIGIBLE

If your tax bills contain any of these charges, you

must deduct them when completing Line 14:

• Flat rate charges

• Footage charges

• Personal property tax

• Per capita tax

• Occupational privilege tax

• Sewer rent

• Garbage collection charges

• Municipal assessments such as, or including,

road, institution, street, library, light, water, re,

debt, and sinking fund taxes

• Interest or penalty payments

TAX BILLS WITH DIFFERENT NAME

PTRR Prep Guide Return to Table of Contents28

DOCUMENTS TO INCLUDE

PHILADELPHIA RESIDENTS

NOTE: You or the person who prepares your

application will need to know the amount of

tax you paid in order to correctly calculate your

rebate. If you do not have a copy of your original

tax bill or a copy of your tax payment, you or

your preparer will need to estimate the amount

of taxes you paid. If the tax amount you provide

is not correct, the department will adjust the

amount of your rebate based upon the paid

taxes reported to the department by the City of

Philadelphia.

REMINDERS

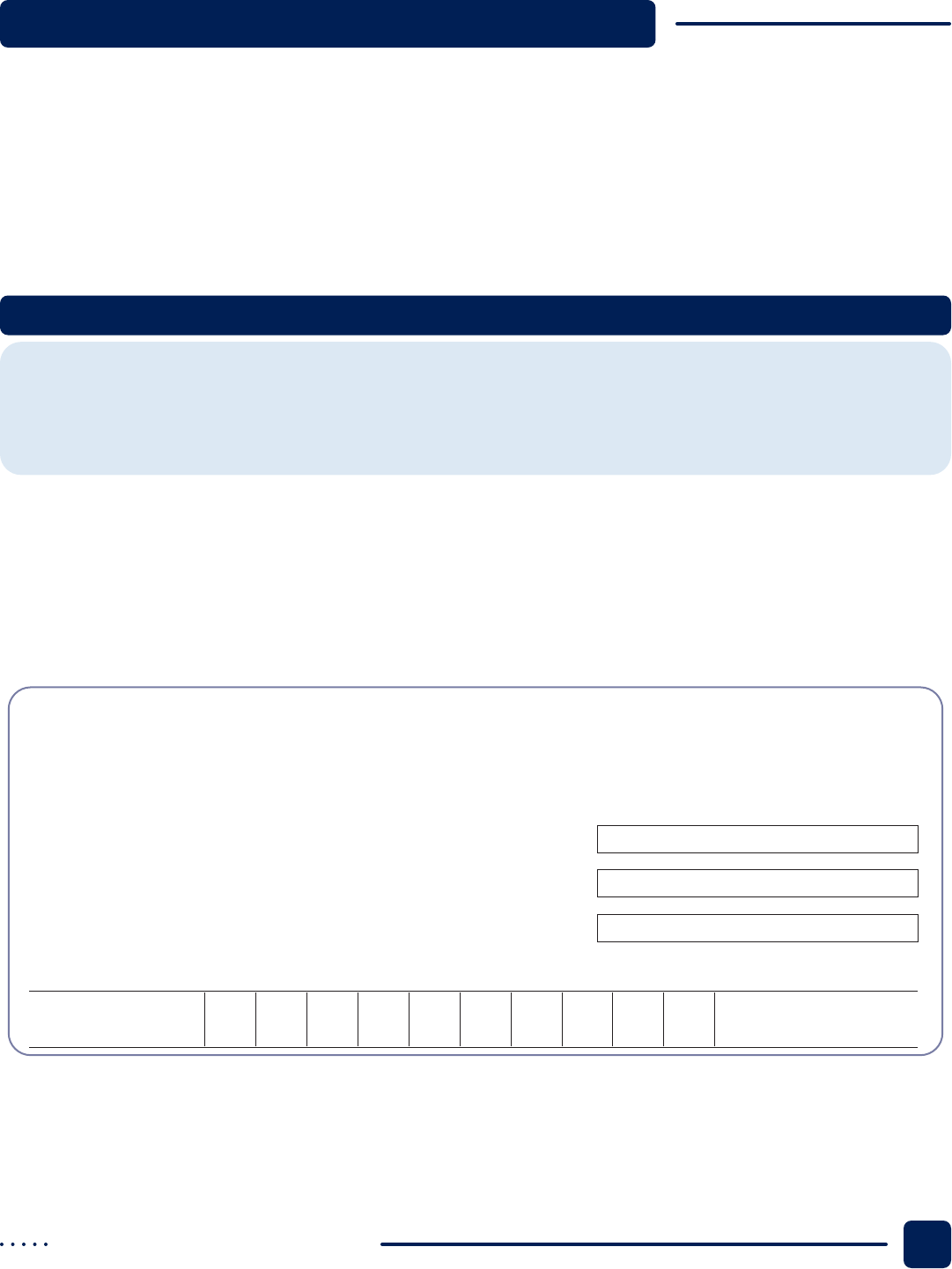

APPLYING AS AN OWNER/RENTER

APPLICANT LIVES IN A MOBILE HOME PARK

Owner and a Renter

APPLICANT SELLS HOME AND STARTS TO RENT

Owner and a

Renter

HOW TO COMPLETE THE APPLICATION

(B) Owner/Renter

Return to Table of Contents 29

revenue.pa.gov

P

or R

Applying as an Owner

(Property Tax Rebate) Determining Rebate Amount

Applying as

an Owner (Property Tax Rebate) Determining Rebate

Amount

NOTE: An Owner/Renter must include proof of

taxes paid and a completed rent certicate in

order to avoid processing delays. See the section

on Documents to Include for more information.

PA-1000

Property Tax or Rent

Rebate Claim 03-23

PA Department of Revenue

P.O. Box 280503

Harrisburg PA 17128-0503

OFFICIAL USE ONLY

Spouse’s Social Security NumberYour Social Security Number

Check your label for accuracy. If incorrect, do not use the label. Complete Section I.

Fill in only one oval in each

section.

I

III

II

If Spouse is

Deceased, fill

in the oval.

1. I am filing for a rebate as a:

P. Property Owner – See

instructions

R. Renter – See instructions

B. Owner/Renter – See

instructions

2. I Certify that as of Dec. 31, 2023,

I am (a):

A. Claimant age 65 or older

B. Claimant under age 65,

with a spouse age 65 or

older who resided in the

same household

C. Widow or widower, age

50 to 64

D. Permanently disabled

and age 18 to 64

3.

Filing on behalf of a

decedent

Dollars Cents

4.

5.

6.

8.

7.

9.

11a.

10.

11b.

13.

IMPORTANT: You must submit proof of the income you reported – See the instructions on Pages 7 to 9.

11c.

11d.

11e.

11f.

11g.

12.

2023

4. Social Security, SSI and SSP Income (Total benefits $ divided by 2) . . . . . . . . . .

5. Railroad Retirement Tier 1 Benefits (Total benefits $ divided by 2) . . . . . . . . . . .

8. Gain or Loss on the Sale or Exchange of Property. . . . . . . . . If a loss, fill in this oval. . . . .

7. Interest and Dividend Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11a. Salaries, wages, bonuses, commissions, and estate and trust income. . . . . . . . . . . . . . . . . . . . .

12. Claimants with Federal Civil Service Retirement System Benefits enter $9,948 or $19,896.

See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

LOSS

9. Net Rental Income or Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . If a loss, fill in this oval. . . . .

10. Net Business Income or Loss . . . . . . . . . . . . . . . . . . . . . . . . . If a loss, fill in this oval. . . . .

LOSS

LOSS

11b. Gambling and Lottery winnings, including PA Lottery winnings, prize winnings and the value

of other prizes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11c. Value of inheritances, alimony and spousal support. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11d. Cash public assistance/relief. Unemployment compensation and workers’ compensation,

except Section 306(c) benefits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11e. Gross amount of loss of time insurance benefits and disability insurance benefits,

and life insurance benefits, except the first $5,000 of total death benefit payments. . . . . . . . . . . .

11f. Gifts of cash or property totaling more than $300, except gifts between

members of a household. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11g. Miscellaneous income and annualized income amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Income.

13. TOTAL INCOME. Add only the positive income amounts from Lines 4 through 11g and subtract

the amount on Line 12. See Page 3 for income limitations. Enter this amount on Line 23. . . . . . . .

6. Total Benefits from Pension, Annuity, IRA Distributions and Railroad Retirement Tier 2 (Do not

include federal veterans’ disability payments or state veterans’ payments.) . . . . . . . . . . . . . . . . . . .

TOTAL INCOME received by you and your spouse during 2023

CODES

REQUIRED

*

**

(FI)

Claimant’s Birthdate Spouse’s Birthdate

Spouse’s First Name MI

PLEASE WRITE IN YOUR SOCIAL SECURITY NUMBER(S) ABOVE

Last Name First Name MI

First Line of Address

Second Line of Address

State ZIP CodeCity or Post Office

Daytime Telephone Number

2305010056

2305010056

School District CodeCounty Code

Country Code

START

➜

MM/DD/YY

MM/DD/YY

PRINT

NEXT PAGE

TOP OF PAGE

Reset Entire Form

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

LINE BY LINE

INSTRUCTIONS

THE PENNSYLVANIA DEPARTMENT OF REVENUE

PTRR Prep Guide Return to Table of Contents32

LINE BY LINE INSTRUCTIONS

GENERAL GUIDELINES

black or blue

IMPORTANT: In certain situations, especially

those involving nursing homes or sibling rivalry

among an applicant’s offspring, multiple people

might submit applications for the same rebate.

In these cases, the Department of Revenue will

issue the rebate payment on the rst application

processed in the applicant’s name.

SECTION I

PA-1000

Property Tax or Rent

Rebate Claim 03-23

PA Department of Revenue

P.O. Box 280503

Harrisburg PA 17128-0503

OFFICIAL USE ONLY

Spouse’s Social Security NumberYour Social Security Number

Check your label for accuracy. If incorrect, do not use the label. Complete Section I.

Fill in only one oval in each

section.

I

III

II

If Spouse is

Deceased, fill

in the oval.

1. I am filing for a rebate as a:

P. Property Owner – See

instructions

R. Renter – See instructions

B. Owner/Renter – See

instructions

2. I Certify that as of Dec. 31, 2023,

I am (a):

A. Claimant age 65 or older

B. Claimant under age 65,

with a spouse age 65 or

older who resided in the

same household

C. Widow or widower, age

50 to 64

D. Permanently disabled

and age 18 to 64

3.

Filing on behalf of a

decedent

Dollars Cents

4.

5.

6.

8.

7.

9.

11a.

10.

11b.

13.

IMPORTANT: You must submit proof of the income you reported – See the instructions on Pages 7 to 9.

11c.

11d.

11e.

11f.

11g.

12.

2023

4. Social Security, SSI and SSP Income (Total benefits $ divided by 2) . . . . . . . . . .

5. Railroad Retirement Tier 1 Benefits (Total benefits $ divided by 2) . . . . . . . . . . .

8. Gain or Loss on the Sale or Exchange of Property. . . . . . . . . If a loss, fill in this oval. . . . .

7. Interest and Dividend Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11a. Salaries, wages, bonuses, commissions, and estate and trust income. . . . . . . . . . . . . . . . . . . . .

12. Claimants with Federal Civil Service Retirement System Benefits enter $9,948 or $19,896.

See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

LOSS

9. Net Rental Income or Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . If a loss, fill in this oval. . . . .

10. Net Business Income or Loss . . . . . . . . . . . . . . . . . . . . . . . . . If a loss, fill in this oval. . . . .

LOSS

LOSS

11b. Gambling and Lottery winnings, including PA Lottery winnings, prize winnings and the value

of other prizes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11c. Value of inheritances, alimony and spousal support. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11d. Cash public assistance/relief. Unemployment compensation and workers’ compensation,

except Section 306(c) benefits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11e. Gross amount of loss of time insurance benefits and disability insurance benefits,

and life insurance benefits, except the first $5,000 of total death benefit payments. . . . . . . . . . . .

11f. Gifts of cash or property totaling more than $300, except gifts between

members of a household. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11g. Miscellaneous income and annualized income amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Income.

13. TOTAL INCOME. Add only the positive income amounts from Lines 4 through 11g and subtract

the amount on Line 12. See Page 3 for income limitations. Enter this amount on Line 23. . . . . . . .

6. Total Benefits from Pension, Annuity, IRA Distributions and Railroad Retirement Tier 2 (Do not

include federal veterans’ disability payments or state veterans’ payments.) . . . . . . . . . . . . . . . . . . .

TOTAL INCOME received by you and your spouse during 2023

CODES

REQUIRED

*

**

(FI)

Claimant’s Birthdate Spouse’s Birthdate

Spouse’s First Name MI

PLEASE WRITE IN YOUR SOCIAL SECURITY NUMBER(S) ABOVE

Last Name First Name MI

First Line of Address

Second Line of Address

State ZIP CodeCity or Post Office

Daytime Telephone Number

2305010056

2305010056

School District CodeCounty Code

Country Code

START

➜

MM/DD/YY

MM/DD/YY

PRINT

NEXT PAGE

TOP OF PAGE

Reset Entire Form

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

1

2

3

4 5 6

7 8

irs.

gov/e-file-providers/foreign-country-code-listing-

.

Return to Table of Contents 33

revenue.pa.gov

SECTION II

Eligibility Re-

quirements

P or R

Eligibility Requirements

SECTION III

IMPORTANT: All income except Social Security,

SSI, and SSP received by an applicant and

their spouse residing together and showing a

Pennsylvania address must be documented. Proof

of Social Security, SSI, and SSP are not required,

as the Social Security Administration provides the

department with a record of these benets.

PA-1000

Property Tax or Rent

Rebate Claim 03-23

PA Department of Revenue

P.O. Box 280503

Harrisburg PA 17128-0503

OFFICIAL USE ONLY

Spouse’s Social Security NumberYour Social Security Number

Check your label for accuracy. If incorrect, do not use the label. Complete Section I.

Fill in only one oval in each

section.

I

III

II

If Spouse is

Deceased, fill

in the oval.

1. I am filing for a rebate as a:

P. Property Owner – See

instructions

R. Renter – See instructions

B. Owner/Renter – See

instructions

2. I Certify that as of Dec. 31, 2023,

I am (a):

A. Claimant age 65 or older

B. Claimant under age 65,

with a spouse age 65 or

older who resided in the

same household

C. Widow or widower, age

50 to 64

D. Permanently disabled

and age 18 to 64

3.

Filing on behalf of a

decedent

Dollars Cents

4.

5.

6.

8.

7.

9.

11a.

10.

11b.

13.

IMPORTANT: You must submit proof of the income you reported – See the instructions on Pages 7 to 9.

11c.

11d.

11e.

11f.

11g.

12.

2023

4. Social Security, SSI and SSP Income (Total benefits $ divided by 2) . . . . . . . . . .

5. Railroad Retirement Tier 1 Benefits (Total benefits $ divided by 2) . . . . . . . . . . .

8. Gain or Loss on the Sale or Exchange of Property. . . . . . . . . If a loss, fill in this oval. . . . .

7. Interest and Dividend Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11a. Salaries, wages, bonuses, commissions, and estate and trust income. . . . . . . . . . . . . . . . . . . . .

12. Claimants with Federal Civil Service Retirement System Benefits enter $9,948 or $19,896.

See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

LOSS

9. Net Rental Income or Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . If a loss, fill in this oval. . . . .

10. Net Business Income or Loss . . . . . . . . . . . . . . . . . . . . . . . . . If a loss, fill in this oval. . . . .

LOSS

LOSS

11b. Gambling and Lottery winnings, including PA Lottery winnings, prize winnings and the value

of other prizes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11c. Value of inheritances, alimony and spousal support. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11d. Cash public assistance/relief. Unemployment compensation and workers’ compensation,

except Section 306(c) benefits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11e. Gross amount of loss of time insurance benefits and disability insurance benefits,

and life insurance benefits, except the first $5,000 of total death benefit payments. . . . . . . . . . . .

11f. Gifts of cash or property totaling more than $300, except gifts between

members of a household. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11g. Miscellaneous income and annualized income amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Income.

13. TOTAL INCOME. Add only the positive income amounts from Lines 4 through 11g and subtract

the amount on Line 12. See Page 3 for income limitations. Enter this amount on Line 23. . . . . . . .

6. Total Benefits from Pension, Annuity, IRA Distributions and Railroad Retirement Tier 2 (Do not

include federal veterans’ disability payments or state veterans’ payments.) . . . . . . . . . . . . . . . . . . .

TOTAL INCOME received by you and your spouse during 2023

CODES

REQUIRED

*

**

(FI)

Claimant’s Birthdate Spouse’s Birthdate

Spouse’s First Name MI

PLEASE WRITE IN YOUR SOCIAL SECURITY NUMBER(S) ABOVE

Last Name First Name MI

First Line of Address

Second Line of Address

State ZIP CodeCity or Post Office

Daytime Telephone Number

2305010056

2305010056

School District CodeCounty Code

Country Code

START

➜

MM/DD/YY

MM/DD/YY

PRINT

NEXT PAGE

TOP OF PAGE

Reset Entire Form

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

PTRR Prep Guide Return to Table of Contents34

LINE BY LINE INSTRUCTIONS

(If using myPATH just enter the full amount received and the

applicaon will calculate the amount to report.)

(If using myPATH just enter the full amount received and the

applicaon will calculate the amount to report.)

IMPORTANT: Do not include rollovers from

Individual Retirement Accounts and employer

pensions. However, proof must be provided.

Proof includes, but is not limited to, a federal

Form 1099-R showing a rollover or other

documentation indicating that the distribution

was rolled into a new account.

Return to Table of Contents 35

revenue.pa.gov

NOTE: The total income from old age benet

programs from other countries, such as Service

Canada Old Age Security, must be converted

into U.S. dollars and reported on Line 6.

IMPORTANT: If the applicant received capital

gains distributions from a mutual fund, include

their PA Schedule B or the front page of their

PA tax return to verify the income. If they have

PA tax-exempt interest income, include federal

Form 1040 Schedule B along with a copy of the

front page of their federal tax return. Copies

of the federal Form 1040 Schedule B, PA-40

Schedule A and/or B, any federal Form 1099,

federal Schedule K-1, PA RK- 1 and/or PA NRK-1,

or any other document to verify the amounts

reported must be submitted. This can include a

copy of their PA or Federal income tax return.

PTRR Prep Guide Return to Table of Contents36

LINE BY LINE INSTRUCTIONS

income.

income.

NOTE: An applicant who is a renter receiving

cash public assistance is not eligible for the

rent rebate for the months the assistance was

received. If the applicant received cash public

assistance for the entire year, no application for

rent rebate may be led.

Return to Table of Contents 37

revenue.pa.gov

NOTE: If an applicant’s total income as shown on

Line 13 is over $45,000, they are not entitled to

a rebate.

DETERMINING REBATE AMOUNT

PROPERTY OWNERS

NOTE: Be sure to include the total amount of

property taxes paid for the year when entering

the tax amount on this line or on the rst schedule

that applies, as the amount from Line 14 is also

used to determine if a supplemental rebate will be

paid. The department will calculate and determine

the amount of any supplemental rebate.

RENTERS

PTRR Prep Guide Return to Table of Contents38

LINE BY LINE INSTRUCTIONS

OWNERS/RENTERS

NOTE: Lines 14 and 15 must be completed to

determine the amount of the property tax rebate

allowed. Lines 16, 17, and 18 must be completed to

determine the amount of rent rebate allowed.

DIRECT DEPOSIT

NOTE: If the direct deposit request is to a represen-

tative payee bank account or bank account for

anyone other than the applicant or the applicant’s

spouse (in the case of a joint claim), each application

led requesting payment to that account must

include a copy of the contract, agree ment, or other

document authorizing the payee as the proper

receiver of the applicant’s rebate.

Return to Table of Contents 39

revenue.pa.gov

SECTION IV

Claimant Oath and Signature(s)

NOTE: The Property Tax or Rent Rebate program

is a benet provided to qualifying homeowners

and renters who apply. The Department of

Revenue will not place a lien or judgment on your

property because of a Property Tax/Rent Rebate

paid to you.

SIGNING AS THE PREPARER

SUPPORTING

SCHEDULES

THE PENNSYLVANIA DEPARTMENT OF REVENUE

PTRR Prep Guide Return to Table of Contents42

SUPPORTING SCHEDULES

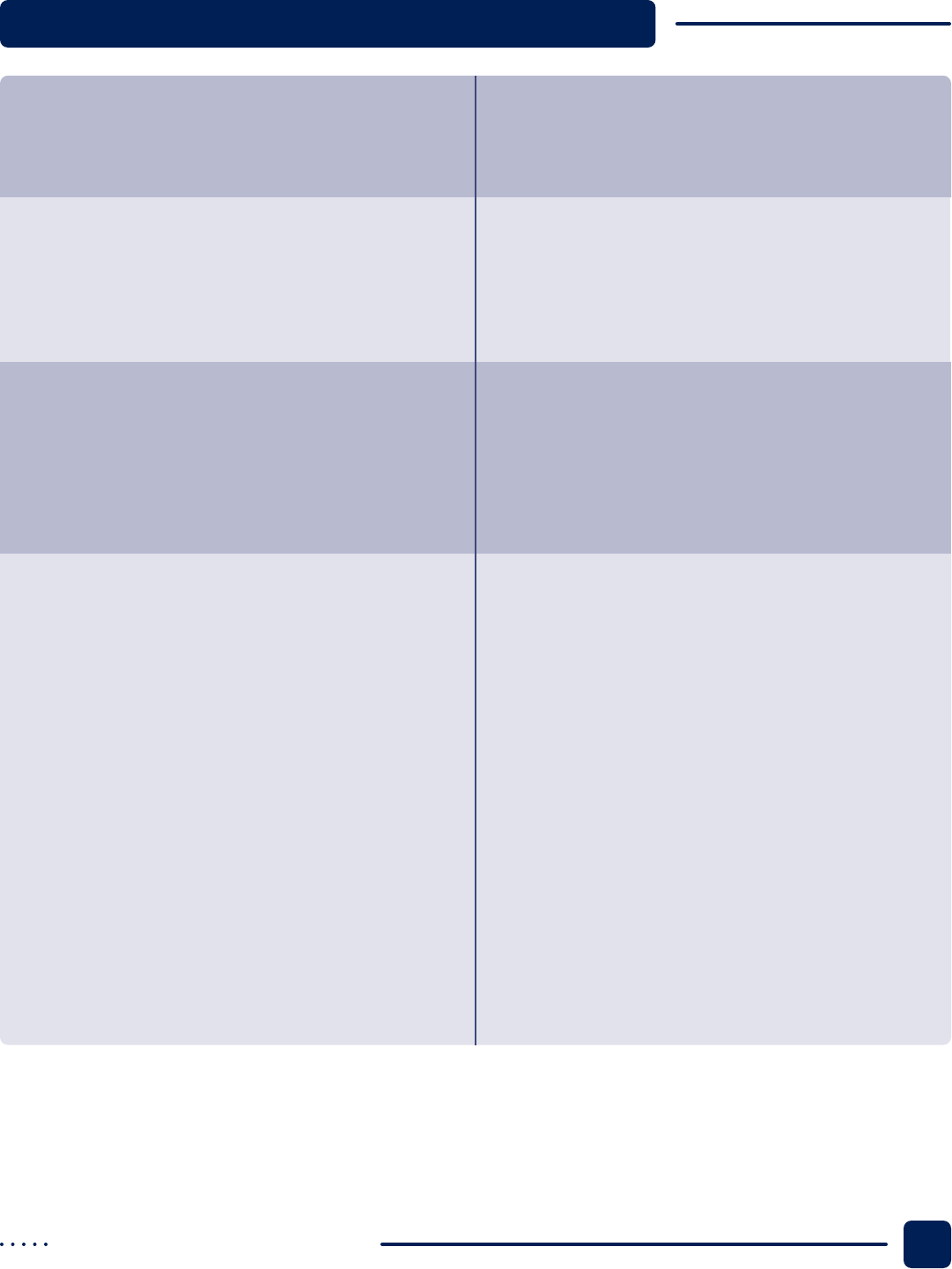

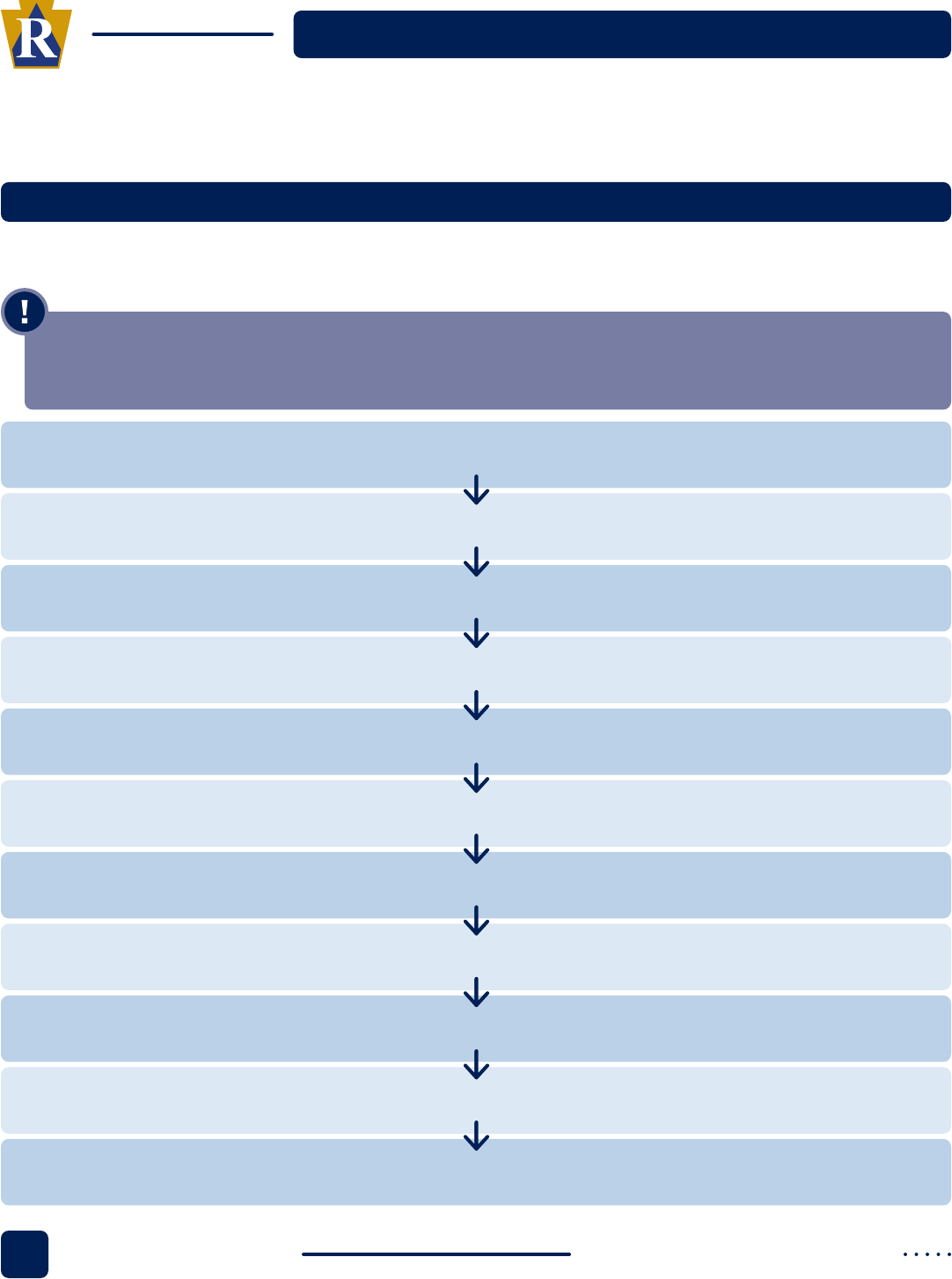

ORDER OF COMPLETION

IMPORTANT: You must carry forward the last amount shown on the previous schedule when you move on to the

next schedule. Then you will report the amount shown on the last schedule that applies to you on either Line 14

or Line 16 of the PA-1000 application. (If you file via the myPATH application this will automatically calculate.)

PA-1000 Lines 1 – 11f

PA-1000 Lines 11g, 12, & 23

Schedule D (Renter Received Cash Public Assistance)

PA-1000 Lines 20 - 22

Schedule A (Deceased Claimant and Multiple Home Prorations)

Schedule F (Additional Names on Deed or Lease)

Schedule G (Annualization of Income for Deceased Claimant)

Schedule B (Widow or Widower Remarried)

PA-1000 Lines 12 - 19

PA-1000 RC (Rent Certificate)

Schedule E (Business or Rental Use of Personal Residence)

Return to Table of Contents 43

revenue.pa.gov

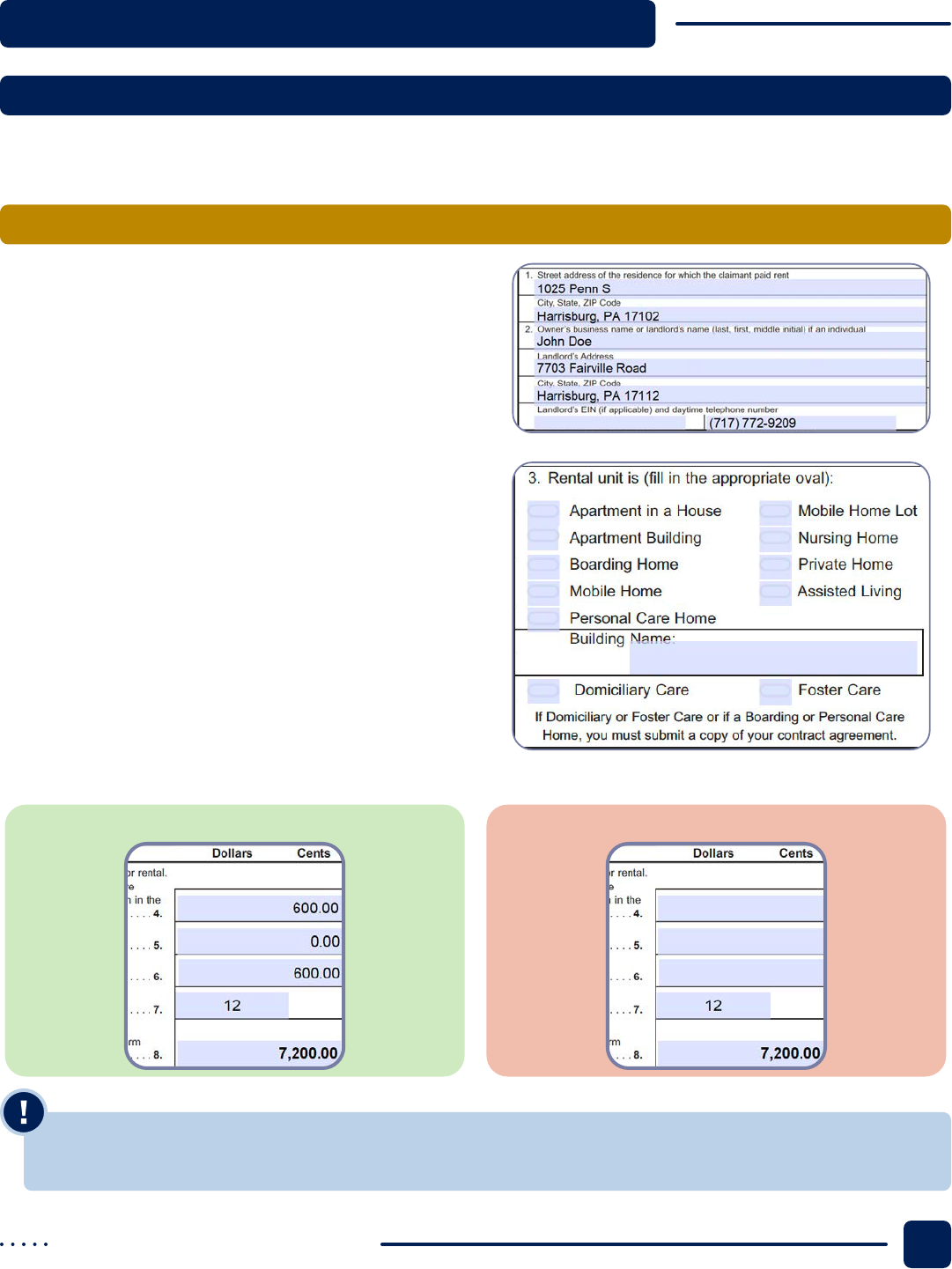

PA-1000 RC, RENT CERTIFICATE

GENERAL REMINDERS

CORRECT

INCORRECT

NOTE: To assist with processing an application in this situation, enter the appropriate amounts on lines that

don’t have values entered.

contract agreement.

PTRR Prep Guide Return to Table of Contents44

SUPPORTING SCHEDULES

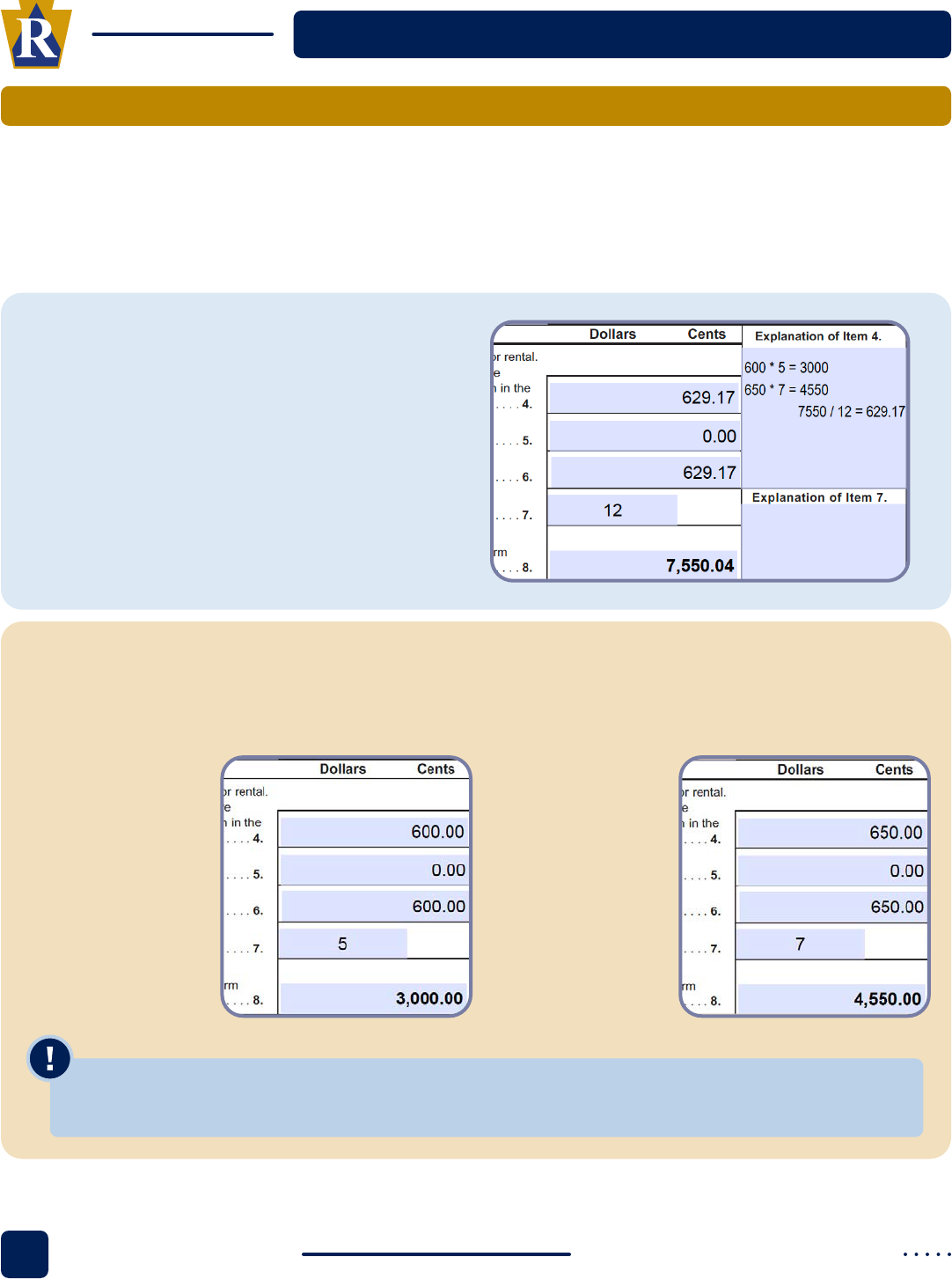

CHANGES IN RENT PAID THROUGHOUT THE YEAR

year.

NOTE: In this situation we don’t need both schedules to be signed by the landlord. Just notate on the

second schedule to see the rst schedule.

Return to Table of Contents 45

revenue.pa.gov

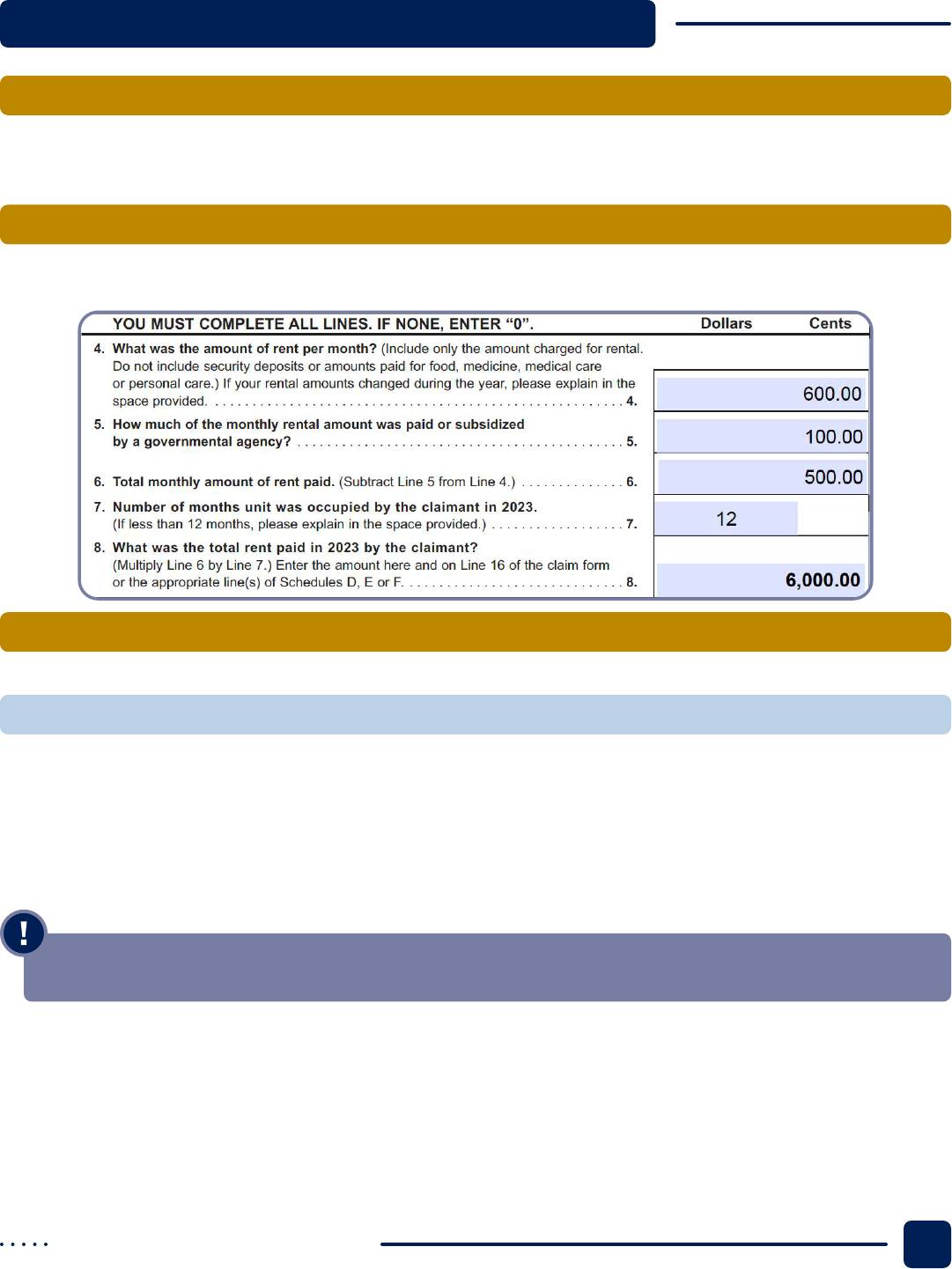

MONTHLY CHARGES OTHER THAN RENT

SUBSIDIES

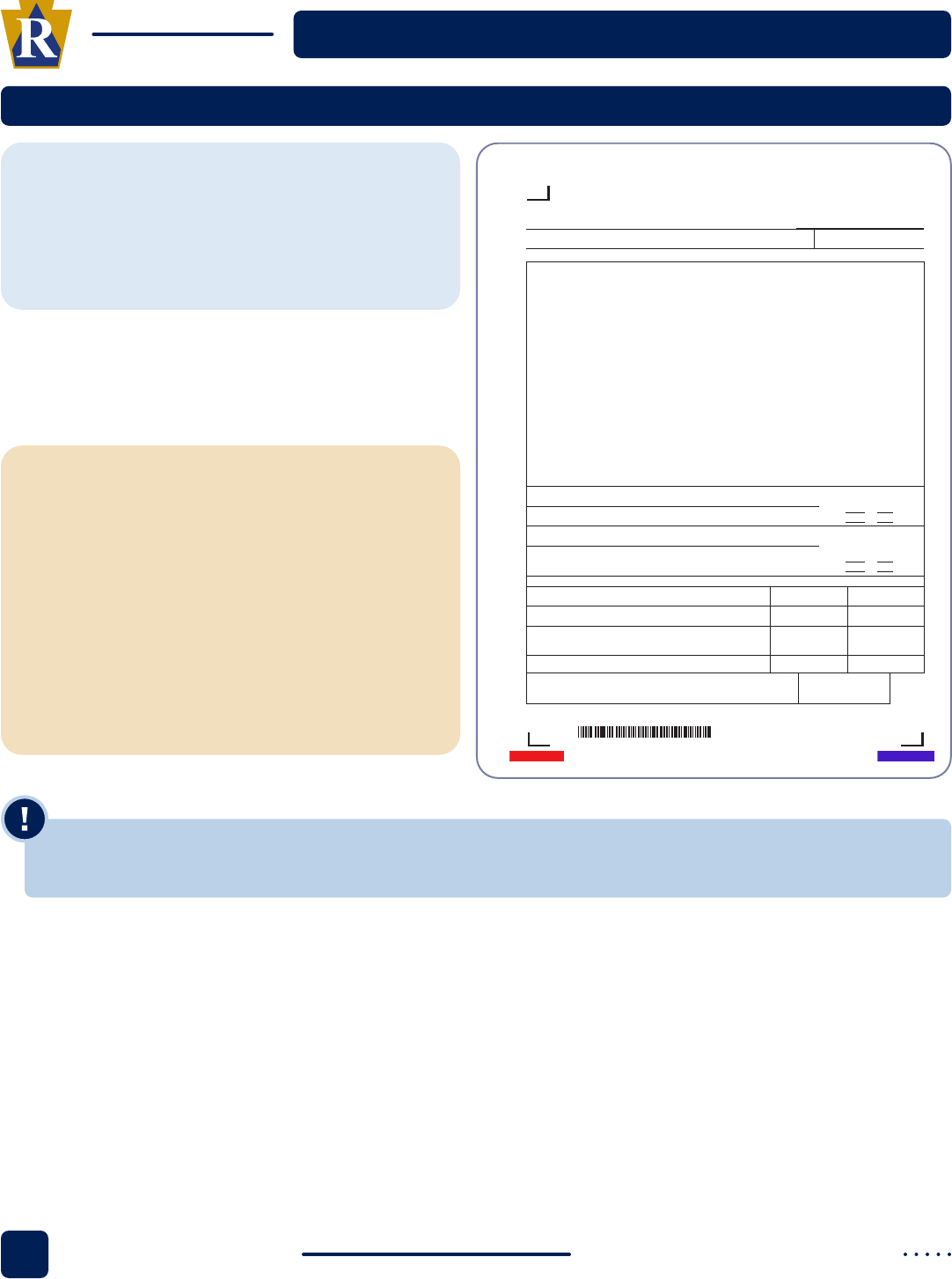

LANDLORD’S SIGNATURE

UNABLE TO OBTAIN A LANDLORD’S SIGNATURE

IMPORTANT: All gures should be lled in on Lines 1 through 8 of the schedule as well as the rental unit type.

PTRR Prep Guide Return to Table of Contents46

SUPPORTING SCHEDULES

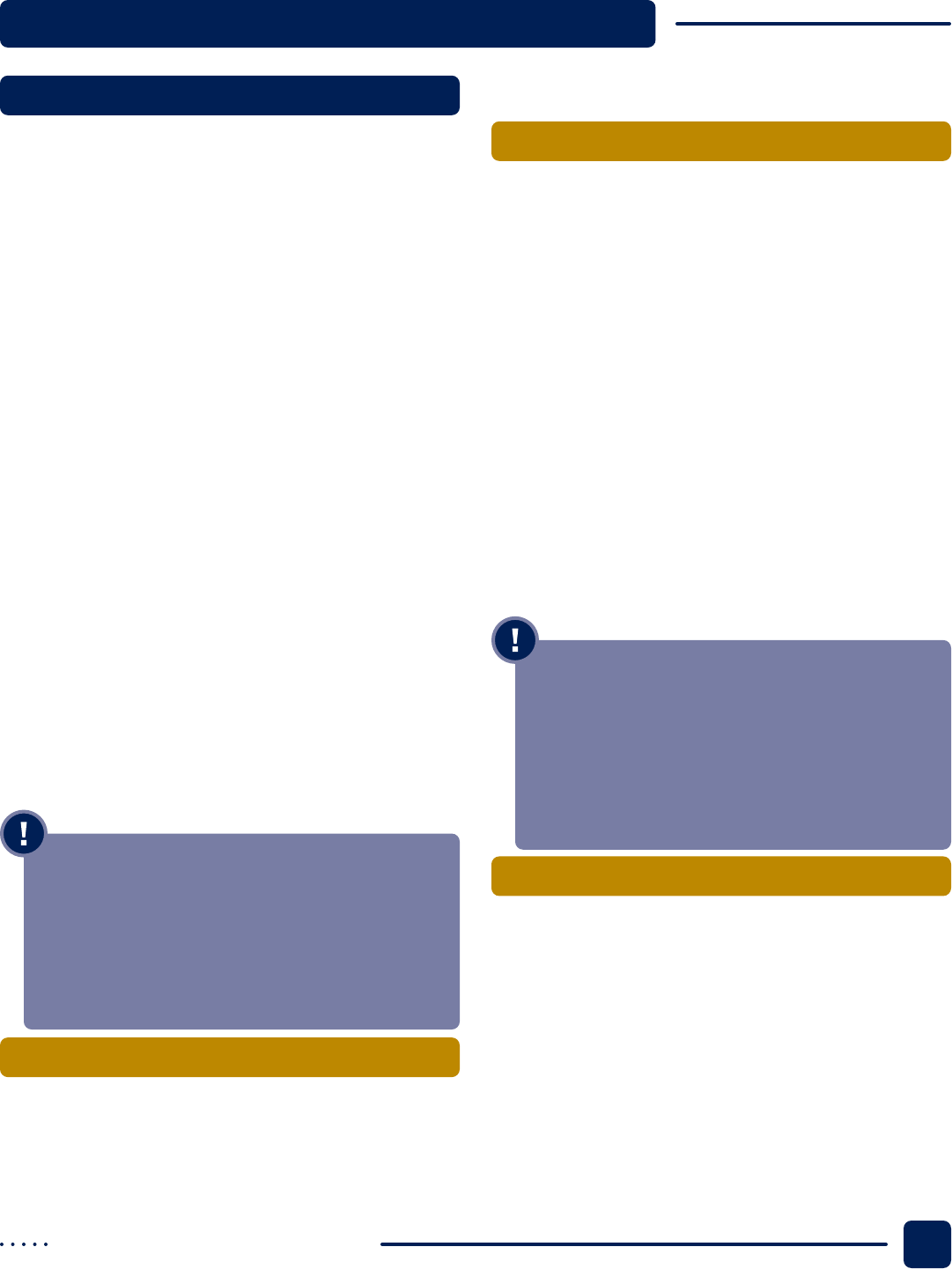

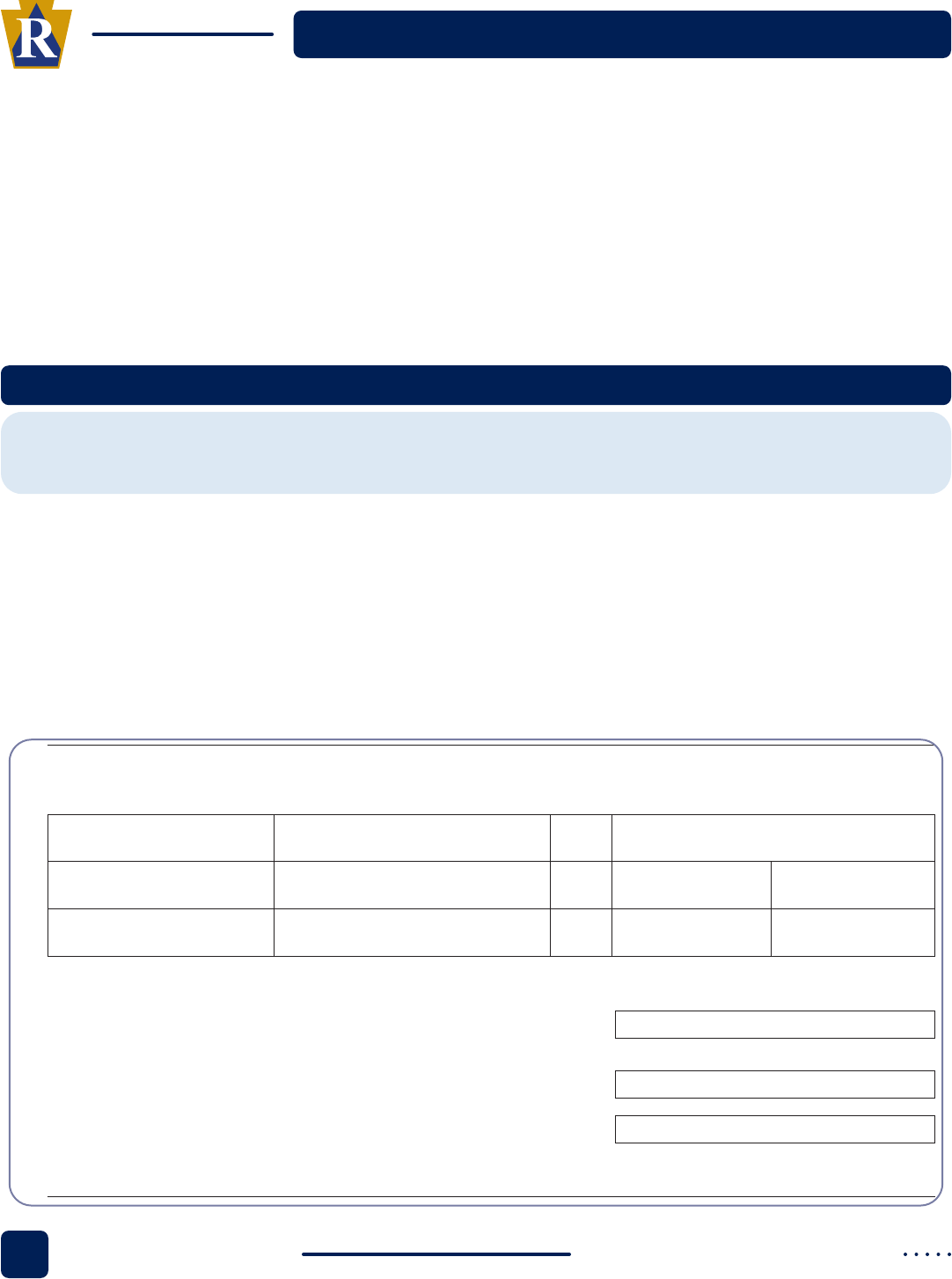

SCHEDULE A, DECEASED CLAIMANT AND/OR MULTIPLE HOME PRORATIONS

OFFICIAL USE ONLY

PA SCHEDULE A

Deceased Claimant and/or

Multiple Home Prorations

2023

PA-1000 A 03-23

PA Department of Revenue

You may make photocopies of this form as needed.

Street address (First Home)

City or Post Office

State ZIP Code

State ZIP Code

Street address (Second Home)

City or Post Office

If you owned, paid the property taxes on and resided in a Pennsylvania located home during 2023, then sold that residence and bought

another Pennsylvania located home, paid the property taxes on and resided in that home for the remainder of the year, fill in the appropriate

dates for each residence. Complete the address and occupancy dates along with Lines 1 through 5 for each home in the applicable columns.

If you owned, paid the property taxes on and resided in a Pennsylvania located home during 2023, then sold the property and moved into a

rental property and paid rent or if you lived in a rental property and paid rent, then bought a Pennsylvania located home, paid the property

taxes and resided in that home for the remainder of the year, complete the address and occupancy dates and complete the information for

the First Home column on Lines 1 through 5 for the portion of the year that you owned your home. You should also complete a PA Rent

Certificate for the portion of the year that you rented a Pennsylvania located rental property. NOTE: If you resided part of the year in a home

located outside PA, do not claim the property tax paid for that period. Enter zero in the appropriate column on Line 1.

Additionally, if a deceased individual owned, paid property taxes on and resided in a Pennsylvania located home during 2023 and died during

the claim year, complete the address and occupancy dates and complete the information for the First Home column for Lines 1 through 5. If

the deceased previously owned another Pennsylvania located home before owning the Pennsylvania located home he or she was living in

preceding death, complete the address and occupancy dates along with Lines 1 through 5 for both columns of the form. If the deceased

resided part of a year outside PA, do not claim the property tax paid for that period. Enter zero in the appropriate column on Line 1. If the

deceased paid property taxes and resided in a Pennsylvania located home during 2023, then sold the property, moved into a rental property

and paid rent; or if the deceased lived in a rental property and paid rent, then bought a Pennsylvania located home, paid the property taxes

and resided in that home for the remainder of his or her life, complete the address and occupancy dates and complete the information for the

First Home column for Lines 1 through 5 for the portion of the year that the deceased owned the home. The surviving spouse, estate or

personal representative claiming the rebate on behalf of the deceased should also complete a PA Rent Certificate for the portion of the year

the deceased rented a Pennsylvania located rental property.

Total taxes paid on Line 1 for the First Home Column includes the amount of property taxes paid by the claimant directly or on the claimant’s

behalf from an escrow account for a claimant that owned the first home as of Jan. 1 of the claim year. For first homes purchased during the

claim year, include the amount of property taxes paid by the claimant directly or on the claimant’s behalf from an escrow account and the total

property taxes, before any pro-rata allocation of the property taxes, from a HUD-1 Closing Statement from the purchase of the property. Total

taxes paid on Line 1 for the Second Home Column includes the amount of property taxes paid by the claimant directly or on the claimant’s

behalf from an escrow account and the total property taxes, before any pro-rata allocation of the property taxes, from a HUD-1 Closing

Statement from the purchase of the property.

Social Security Number

Name as shown on PA-1000

Month Day 2023 until

Month Day 2023

Month Day 2023 until

Month Day 2023

First Home

1. Total property taxes paid on each home. See above instructions. $ $

$

$

$

2. Number of days you or the deceased owned and occupied each home.

3. Percentage of the year that you or the deceased owned and occupied

each home. Divide Line 2 by the number of days in the claim year

(365 or 366). Round to two decimal places.

4. Multiply Line 1 by Line 3.

5. Total property taxes paid. Add Line 4 for both homes. Enter the amount on

Line 14 of your or the deceased’s claim form or the next schedule you or the

deceased must complete.

Second Home

I/The deceased owned and

occupied this home from

I/The deceased owned and

occupied this home from

(Date moved into this home):

2305410058

2305410058

2305410058

(FI)

START

➜

PRINT

TOP OF PAGE

Reset Entire Form

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

NOTE: If the applicant owned and occupied more than one home as their principal residence, proof of the taxes

paid on each home must be submitted.

Return to Table of Contents 47

revenue.pa.gov

SCHEDULE B, WIDOW OR WIDOWER PRORATIONS

OFFICIAL USE ONLY

You may make photocopies of this form as needed.

Renter SCHEDULE D. Renters who received cash public assistance are not eligible for rebates for those months when they

received that assistance. If you received cash public assistance during any part of

2023

, use this schedule to determine the

amount of rent for which you qualify for a rebate. IMPORTANT: If you received cash public assistance for all of

2023

, you

may not claim a rebate.

1. Total number of months during which you received cash public assistance: 1.

NOTE: If you received cash public assistance for a full year, you may not claim a rebate.

2. Total rent that you paid in 2023 from Line 8 of Schedule RC, or if you

completed Schedule B, enter the result from Line 4 of Schedule B. . . . . . . 2. $

3. Total rent you paid during the months that you received

cash public assistance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $

4. Eligible rent paid. Subtract Line 3 from Line 2. Enter this amount on the

next schedule you must complete, or on Line 16 of your claim form. . . . 4. $

Owner/Renter SCHEDULE E. You must complete this schedule if you also used part of your homestead for a purpose other

than your personal residence.

• If you operated a business in part of your home, you must submit a 1040 Schedule C or PA-40 Schedule C.

• If you rented part of your home to others, you must submit a 1040 Schedule E or PA-40 Schedule E.

1. Total property taxes or rent paid on your residence in 2023. Enter the

amount of your total property taxes paid or total rent paid from Line 8 of

Schedule RC, or, if you completed Schedule A, B or D, enter the result

from that schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $

2. Enter the percentage of your home that you used as your residence

from the chart below. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . or %

3. Eligible property taxes or rent paid. Multiply Line 1 by Line 2.

Enter this amount on the next schedule you must complete or. . . . . . . . . . . 3. $

a) If an owner, enter the amount on Line 14 of your claim form

b) If a renter, enter the amount on Line 16 of your claim form

____% Other percentage

. ____

20%

0.20

25%

0.25

30%

0.30

33%

0.33

40%

0.40

50%

0.50

67%

0.67

75%

0.75

80%

0.80

90%

0.90

CHART OF PERSONAL

USE PERCENTAGE

Name as shown on PA-1000 Social Security Number

Widow/Widower SCHEDULE B. If you were a widow or widower age 50 to 64 during 2023, and you remarried, use this

schedule to determine the percentage of the year for which you qualify for a Property Tax or Rent Rebate.

Date you remarried: Month / Day / 2023

1. Total property tax or rent that you paid in 2023. If you were an owner and

completed Schedule A, enter the amount from Line 5. If you were a renter,

enter the amount from Line 8 of Schedule RC. . . . . . . . . . . . . . . . . . . . . . . . 1. $

2. Number of days you were a widow or widower during 2023 . . . . . . . . . . . . 2.

3. Percentage of the year you were a widow or widower. Divide Line 2 by

the number of days in the claim year (365 or 366).

Round to two decimal places. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Eligible property taxes or rent paid. Multiply Line 1 by Line 3. Enter this amount

on the next schedule you must complete or . . . . . . . . . . . . . . . . . . . . . . . . . 4. $

a) If an owner, enter the amount on Line 14 of your claim form.

b) If a renter, enter the amount on Line 16 of your claim form.

PA SCHEDULE B/D/E

Widow or Widower/Public

Assistance/ Business Use Prorations

2023

PA-1000 B/D/E 03-23

PA Department of Revenue

2305510055

2305510055

2305510055

(FI)

START

➜

PRINT

TOP OF PAGE

Reset Entire Form

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

PTRR Prep Guide Return to Table of Contents48

SUPPORTING SCHEDULES

SCHEDULE D, PUBLIC ASSISTANCE PRORATIONS

NOTE: If a customer received cash public assistance during the application year, they should also include the

Compass Letter issued by DHS.

OFFICIAL USE ONLY

You may make photocopies of this form as needed.

Renter SCHEDULE D. Renters who received cash public assistance are not eligible for rebates for those months when they

received that assistance. If you received cash public assistance during any part of

2023

, use this schedule to determine the

amount of rent for which you qualify for a rebate. IMPORTANT: If you received cash public assistance for all of

2023

, you

may not claim a rebate.

1. Total number of months during which you received cash public assistance: 1.

NOTE: If you received cash public assistance for a full year, you may not claim a rebate.

2. Total rent that you paid in 2023 from Line 8 of Schedule RC, or if you

completed Schedule B, enter the result from Line 4 of Schedule B. . . . . . . 2. $

3. Total rent you paid during the months that you received

cash public assistance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $

4. Eligible rent paid. Subtract Line 3 from Line 2. Enter this amount on the

next schedule you must complete, or on Line 16 of your claim form. . . . 4. $

Owner/Renter SCHEDULE E. You must complete this schedule if you also used part of your homestead for a purpose other

than your personal residence.

• If you operated a business in part of your home, you must submit a 1040 Schedule C or PA-40 Schedule C.

• If you rented part of your home to others, you must submit a 1040 Schedule E or PA-40 Schedule E.

1. Total property taxes or rent paid on your residence in 2023. Enter the

amount of your total property taxes paid or total rent paid from Line 8 of

Schedule RC, or, if you completed Schedule A, B or D, enter the result

from that schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $

2. Enter the percentage of your home that you used as your residence

from the chart below. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . or %

3. Eligible property taxes or rent paid. Multiply Line 1 by Line 2.

Enter this amount on the next schedule you must complete or. . . . . . . . . . . 3. $

a) If an owner, enter the amount on Line 14 of your claim form

b) If a renter, enter the amount on Line 16 of your claim form

____% Other percentage

. ____

20%

0.20

25%

0.25

30%

0.30

33%

0.33

40%

0.40

50%

0.50

67%

0.67

75%

0.75

80%

0.80

90%

0.90

CHART OF PERSONAL

USE PERCENTAGE

Name as shown on PA-1000 Social Security Number

Widow/Widower SCHEDULE B. If you were a widow or widower age 50 to 64 during 2023, and you remarried, use this

schedule to determine the percentage of the year for which you qualify for a Property Tax or Rent Rebate.

Date you remarried: Month / Day / 2023

1. Total property tax or rent that you paid in 2023. If you were an owner and

completed Schedule A, enter the amount from Line 5. If you were a renter,

enter the amount from Line 8 of Schedule RC. . . . . . . . . . . . . . . . . . . . . . . . 1. $

2. Number of days you were a widow or widower during 2023 . . . . . . . . . . . . 2.

3. Percentage of the year you were a widow or widower. Divide Line 2 by

the number of days in the claim year (365 or 366).

Round to two decimal places. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Eligible property taxes or rent paid. Multiply Line 1 by Line 3. Enter this amount

on the next schedule you must complete or . . . . . . . . . . . . . . . . . . . . . . . . . 4. $

a) If an owner, enter the amount on Line 14 of your claim form.

b) If a renter, enter the amount on Line 16 of your claim form.

PA SCHEDULE B/D/E

Widow or Widower/Public

Assistance/ Business Use Prorations

2023

PA-1000 B/D/E 03-23

PA Department of Revenue

2305510055

2305510055

2305510055

(FI)

START

➜

PRINT

TOP OF PAGE

Reset Entire Form

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

Return to Table of Contents 49

revenue.pa.gov

SCHEDULE E, BUSINESS USE PRORATIONS

OFFICIAL USE ONLY

You may make photocopies of this form as needed.

Renter SCHEDULE D. Renters who received cash public assistance are not eligible for rebates for those months when they

received that assistance. If you received cash public assistance during any part of

2023

, use this schedule to determine the

amount of rent for which you qualify for a rebate. IMPORTANT: If you received cash public assistance for all of

2023

, you

may not claim a rebate.

1. Total number of months during which you received cash public assistance: 1.

NOTE: If you received cash public assistance for a full year, you may not claim a rebate.

2. Total rent that you paid in 2023 from Line 8 of Schedule RC, or if you

completed Schedule B, enter the result from Line 4 of Schedule B. . . . . . . 2. $

3. Total rent you paid during the months that you received

cash public assistance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $

4. Eligible rent paid. Subtract Line 3 from Line 2. Enter this amount on the

next schedule you must complete, or on Line 16 of your claim form. . . . 4. $

Owner/Renter SCHEDULE E. You must complete this schedule if you also used part of your homestead for a purpose other

than your personal residence.

• If you operated a business in part of your home, you must submit a 1040 Schedule C or PA-40 Schedule C.

• If you rented part of your home to others, you must submit a 1040 Schedule E or PA-40 Schedule E.

1. Total property taxes or rent paid on your residence in 2023. Enter the

amount of your total property taxes paid or total rent paid from Line 8 of

Schedule RC, or, if you completed Schedule A, B or D, enter the result

from that schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $

2. Enter the percentage of your home that you used as your residence

from the chart below. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . or %

3. Eligible property taxes or rent paid. Multiply Line 1 by Line 2.

Enter this amount on the next schedule you must complete or. . . . . . . . . . . 3. $

a) If an owner, enter the amount on Line 14 of your claim form

b) If a renter, enter the amount on Line 16 of your claim form

____% Other percentage

. ____

20%

0.20

25%

0.25

30%

0.30

33%

0.33

40%

0.40

50%

0.50

67%

0.67

75%

0.75

80%

0.80

90%

0.90

CHART OF PERSONAL

USE PERCENTAGE

Name as shown on PA-1000 Social Security Number