Farm Service Agency Programs and Business Entities

Robert Moore Zachary Ishee

Attorney and Research Specialist Law Fellow

OSU Agricultural & Resource Law Program National Agricultural Law Center

The Farm Service Agency (FSA) is an agency within the United States Department of Agriculture

(USDA) that supports farms and farming communities with disaster relief, conservation, commodity

price guarantees, and loan programs through state and county offices. Each FSA program has its

own rules and requirements for eligibility, but the business entity a producer chooses can have

significant impacts on program eligibility and payments. This bulletin informs producers of the

impacts different business entities can have when utilizing FSA programs.

FSA definition of business entities

The FSA has a unique manner of defining business entities for FSA program purposes. Two

categories of business entities exist in FSA: “joint operation” and “legal entity” A “joint operation” is a

general partnership or joint venture whose members are jointly and severally liable for the obligations

of the business--a general partnership is an entity comprised of two or more persons formed under

state law subject to a formalized agreement, and a joint venture is a general partnership without a

formalized agreement. A “legal entity” for FSA purposes is any entity organized under state law with

liability protection for its owners, and includes corporations, limited liability companies(LLC), and

limited partnerships. A legal entity can have any number of owners.

farmoffice.osu.edu 2

FSA program rules

There are two categories of FSA program rules. “Payment limitation rules” cap the amount of money

a person or entity can receive from a particular program. “Payment eligibility rules” determine

whether an individual or business entity can receive payment at all. Some programs have payment

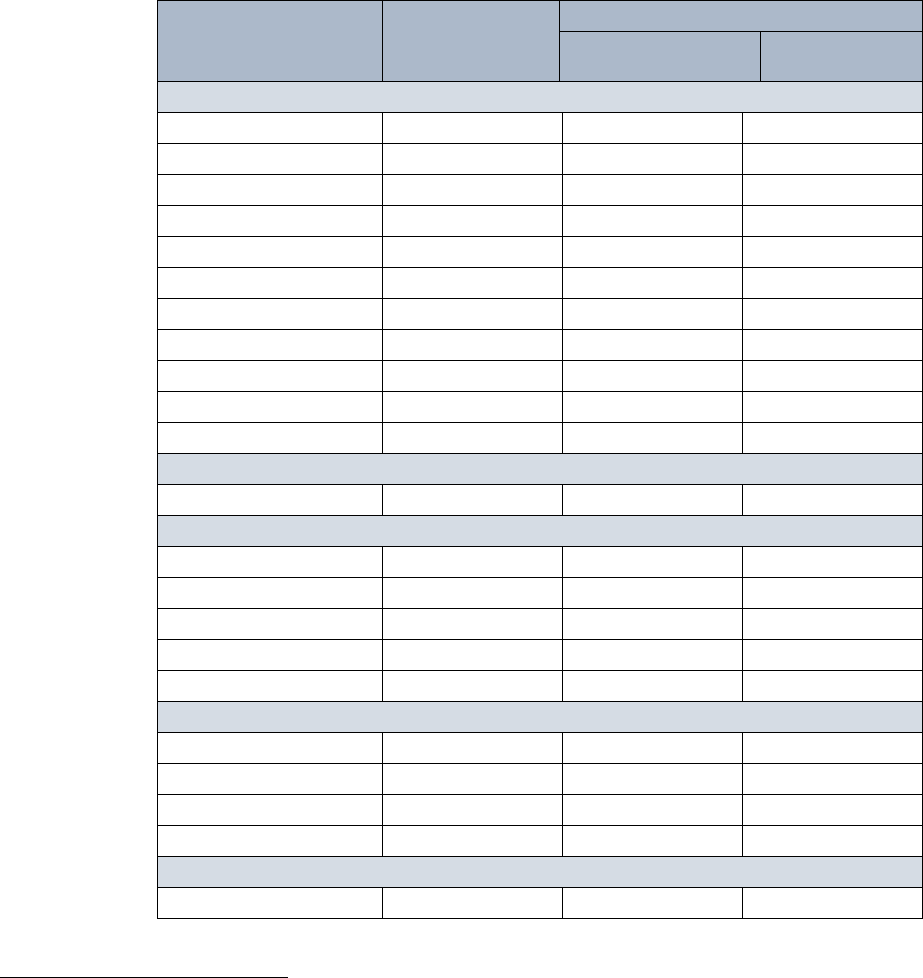

limitation rules, some have payment eligibility rules, and some programs have both. Table 1 shows

FSA programs that have payment limitation and payment eligibility rules, further explained in this

bulletin.

Table 1. Payment Limitation and Payment Eligibility Rules for FSA Programs

FSA Program

Payment

Limitation

Payment Eligibility

Actively engaged in

farming requirement

AGI limit

Conservation programs

CRP

1

Yes

Yes

Yes

CRP

2

Yes

No

Yes

ECP

No

No

Yes

EFRP

No

No

Yes

ACEP (NRCS)

Yes

No

Yes

AWEP (NRCS)

Yes

No

Yes

CBWI (NRCS)

Yes

No

Yes

EQIP (NRCS)

Yes

No

Yes

CSP (NRCS)

Yes

No

Yes

RCPP (NRCS)

Yes

No

Yes

WHIP (NRCS)

Yes

No

Yes

Commodity programs

ARC and PLC

Yes

Yes

Yes

Disaster assistance programs

ELAP

No

No

Yes

LFP

No

No

Yes

LIP

No

No

Yes

NAP

No

No

Yes

TAP

No

No

Yes

Price support programs

MAL

No

No

No

LDP

No

No

Yes

MLG

No

No

Yes

DMC

No

No

No

Other programs

AMA

Yes

No

Yes

1

CRP contracts approved before October 1, 2008, are subject to 1-PL provisions, including permitted entity provisions.

2

4-PL, 5-PL and 6-PL.

farmoffice.osu.edu 3

Payment limitation rules

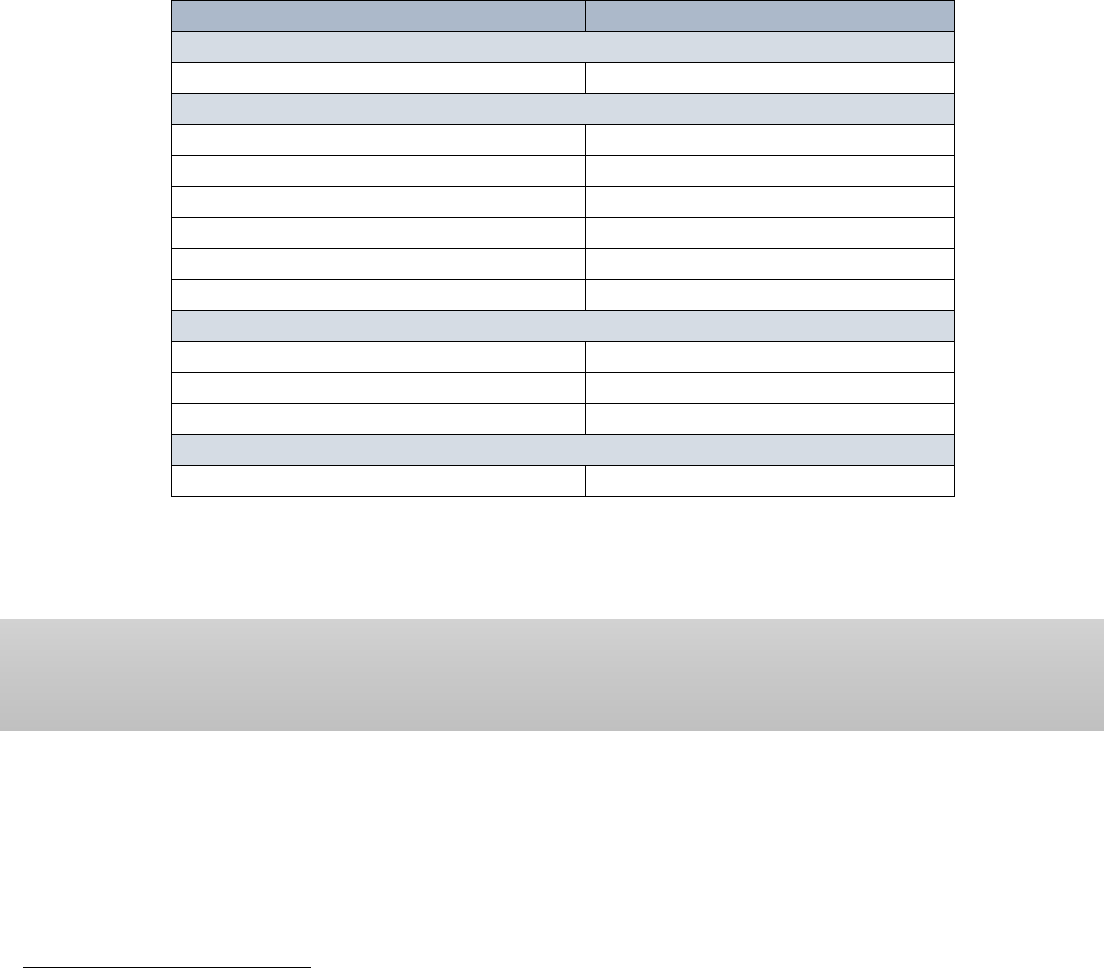

Payment limitation rules restrict the amount an individual or legal entity can receive from an FSA

program. Table 2 shows the payment limitations for various FSA programs.

Table 2. Program Payment Limitation Amounts

Program and Payment Type

Annual $ Limitation through 2023

Commodity and price support programs

ARC and PLC Payments

125,000

Conservation programs

AMA

50,000

3

CRP Annual Rent and Incentive

50,000

4

CSP

200,000

5

ECP (Per Disaster)

500,000

EFRP (Per Disaster)

500,000

EQIP

450,000

6

Disaster assistance programs

LFP

125,000

NAP (Catastrophic Coverage)

125,000

NAP (Buy-up Coverage)

125,000/300,000

7

Other programs

TAAF

10,000

Payment limitations apply to each program separately. That is, reaching the payment limitation on

one program does not affect the payment limitation of another program, as Example 1 illustrates.

Example 1. John is the sole proprietor of a grain farm. He is eligible for ARC payments of $200,000.

However, due to payment limitation rules, he can only receive $125,000 of ARC payments. John can

also receive up to $50,000 of CRP payments without affecting his ARC payment amount.

FSA payment limitations and different business entities

FSA considers a legal entity to be a single person for payment limitation analysis. The legal entity is

limited to one payment limitation per program, regardless of the number of owners in the entity. A

joint operation, on the other hand, is eligible to receive as many payment limitations per program as

3

The $50,000 limitation is the total limit that a participant may receive under the AMA program in any FY.

4

CRP contracts approved before October 1, 2008, may exceed the limitation, subject to payment limitation rules in effect on the date

of contract approval.

5

The $200,000 limitation is the total limit under all CSP contracts entered into subsequent to the enactment of the 2014 Farm Bill

during FY’s 2014 through 2018 and of the 2018 Farm Bill during FY’s 2019 through 2023.

6

The $450,000 limitation is the total limit under all EQIP contracts entered into subsequent to the enactment of the 2014 Farm Bill

during FY’s 2014 through 2018 and of the 2018 Farm Bill during FY’s 2019 through 2023.

7

The 2018 Farm Bill provides a separate maximum limitation of $125,000 on NAP payments for losses to crops with catastrophic

coverage and a $300,000 maximum limitation on NAP payments for losses to crops with buy-up coverage.

farmoffice.osu.edu 4

there are owners in the operation.

8

The result of this rule is that a large, multiple-owner farm

operation may want to consider organizing as a general partnership to increase the number of

payment limitations the operation can use under the ARC and PLC programs. Consider the following:

Example 2. John and Jane are equal owners of an LLC that operates as a large grain farm. They

could receive $250,000 of ARC payments based on the number of acres they farm. However,

because the LLC is a legal entity, it is only eligible for one ARC payment limitation of $125,000. John

and Jane will receive a total of $125,000 in ARC payments.

Example 3. Same scenario as Example 2, except John and Jane operate as a general partnership.

The partnership is eligible for two payment limitations, one for each partner. John and Jane can

receive a total of $250,000 in ARC payments.

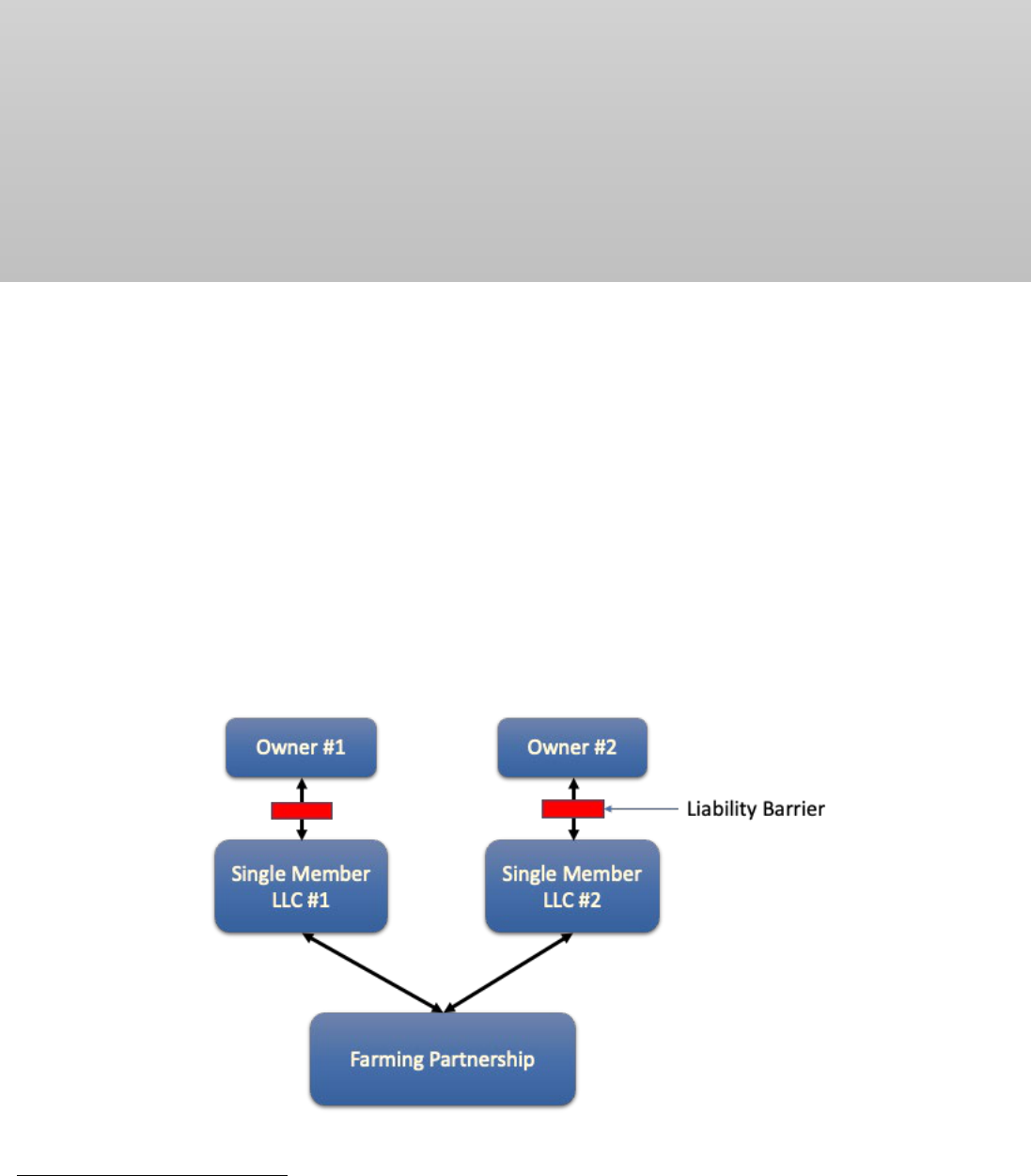

Reducing liability risk while increasing payment limitations

While using a general partnership can increase FSA payment limitations, it can also bring additional

liability exposure for its partners. For further explanation of liability characteristics of different

entities, see our law bulletin in this series on Using Business Entities to Manage Farm Liability Risk.

There is a strategy, however, that can limit the increased liability risk of a general partnership. If each

partner in the general partnership is organized as a single member LLC, the LLC would limit the

partnership liability of its owner to the extent of the LLC’s assets. The LLC provides a liability barrier

for the owner’s personal assets. If the single member LLC owns only a bank account, for example,

its liability exposure within the general partnership would be limited to the assets in the bank

account. Diagram 1 and Example 4 illustrate this liability protection strategy.

Diagram 1. Using Single Member LLCs to Limit Liability to Partners

8

Owners may be partners, shareholders or members depending upon the type of entity.

farmoffice.osu.edu 5

Example 4. Using the business structure in Diagram 1 and assuming each LLC is a 50/50 partner in

a farm partnership, each owner is protected from liability through its LLC. Additionally, because they

are partners, they can take advantage of receiving two payment limitations. This means that if the

farm partnership is large enough to be eligible for $250,000 in ARC payments, both LLCs, and

ultimately the two owners of the LLCs, can receive $125,000 each.

FSA payment attribution

FSA uses a process of payment attribution to ensure that no one person receives more payments

than the FSA payment limitation rules allow. Attribution prevents a producer from using multiple

entities to exceed a payment limitation. All FSA payments are associated with the Social Security

number for individuals and Employer Identification Number (EIN) for legal entities. Once the Social

Security number or EIN receives its maximum allowed payment limitation funds, the individual or

legal entity is ineligible for further payments from that program.

Producers are permitted to be owners in multiple legal entities and receive payments from each

entity. However, all payments are tracked and attributed to the individual through the entities, to the

fourth level of ownership. When a producer or legal entity has reached its payment limitation, it is

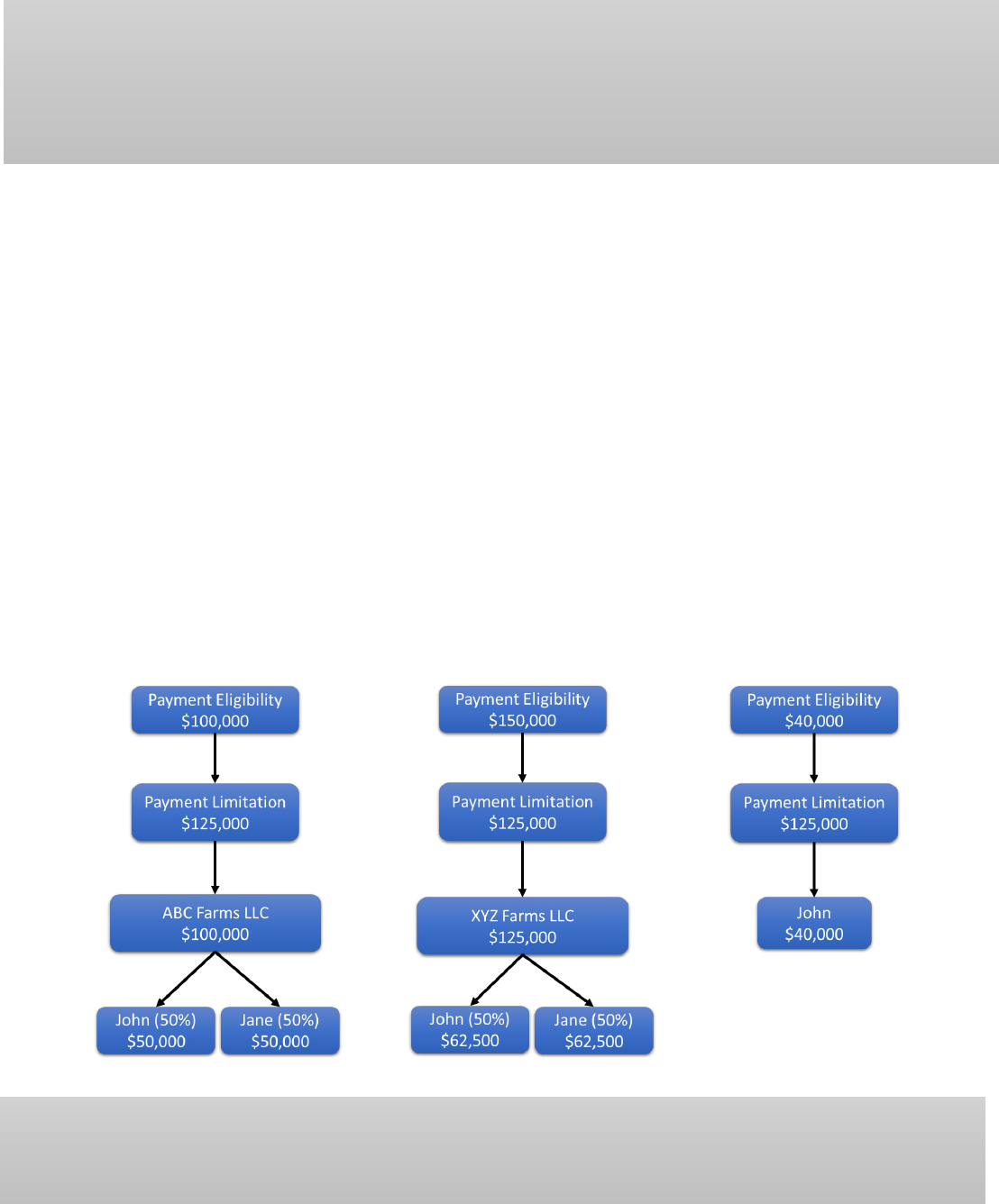

ineligible for further payments. Diagram 2 and Examples 5 and 6 illustrate payment attribution.

Diagram 2: FSA Payment Attribution

Example 5. In Diagram 2, ABC Farms LLC is eligible for $100,000 in ARC payments. The payment

limitation is $125,000 so ABC Farms LLC can receive all $100,000 of eligible payments. John and

Jane, as equal owners, can each receive $50,000.

farmoffice.osu.edu 6

Example 6. In Diagram 2, XYZ Farms is eligible for $150,000 in ARC payments. However, as a legal

entity it may receive no more than $125,000 in payments. Therefore, only $125,000 is received by

XYZ Farms LLC. John and Jane, as equal owners, can each receive half of that, or $62,500,000.

Additionally, John operates his own farming operation as a sole proprietor. He is eligible for $40,000

in ARC payments but individually has a $125,000 payment limitation. John has already received

$112,500 from the two LLCs he is engaged with. Therefore, instead of receiving all $40,000, he may

only receive another $12,500 to reach his personal payment limitation. Jane receives all her eligible

payments as she has not reached her payment limitation of $125,000. Of note, John’s FSA payments

could be paid in any order. John cannot control which of his operations is paid first or paid fully. For

example, John could have received $40,000 for the sole proprietorship and $62,500 for XYZ Farms

LLC, and then would only receive $22,500 for ABC Farms LLC.

Attribution prevents producers from establishing multiple entities to become eligible for multiple

payment limitations. While there is nothing wrong with producers operating multiple entities and it is

often a good business practice, multiple entities cannot circumvent FSA payment limitation rules.

FSA payment eligibility: the “actively engaged in farming” requirement

ARC and PLC programs require a producer to be “actively engaged in farming,” which means the

producer must make significant contributions of certain farming inputs that are commensurate and at

risk. The 6-PL FSA Handbook requires a “left-hand” and “right-hand” contribution to comply with the

actively engaged requirements. The “left-hand contribution” is land, machinery and capital and the

“right-hand contribution” is labor and management. Without both contributions, the producer will not

be eligible for ARC and PLC program payments. The actively engaged requirement seeks to ensure

that ARC and PLC payments go to persons and entities who are truly engaged in farming activities

and not merely silent partners or investors.

Exceptions. One notable exception to the actively engaged rule is the “landowner exception.” A

landowner who contributes owned land to a farming operation for which they receive rent or income

based on the land’s production is considered actively engaged. This usually is in the form of a

landowner in a share-rent arrangement. For example, if the landowner provides the land in

exchange for one-third of the crop, the landowner will likely be actively engaged and eligible for ARC

and PLC payments.

Another exception to the actively engaged rules applies to spouses. If one spouse is determined to

be actively engaged, the other spouse is credited with significant contributions of active labor and

management to the same farming operation. Requirements of land, machinery or capital remain

applicable to the spouse. Essentially, the right-hand contributions are automatically satisfied, while

the left-hand contributions must still be met. Example 7 provides an illustration.

Example 7. Jane and Joe are married. They each own 50% of the land, machinery and capital needed

for the farming operation. Jane provides all management and labor as Joe works off the farm and

provides no management or labor to the farm. Joe will receive credit for Jane’s labor and

farmoffice.osu.edu 7

management under the spousal exception, and he owns 50% of the land, machinery, and capital.

Thus, both Jane and Joe are considered to be actively engaged.

The actively engaged requirement and legal entities. A legal entity must provide the left-hand

contribution. That is, the entity must provide the land, machinery, or capital. Land and machinery can

be owned or leased. The capital can be cash or borrowed money to purchase inputs or other

production needs.

The owners of the legal entity must provide at least some of the labor or management. There are two

different scenarios for legal entities and labor and management. One potential scenario is when all

the owners’ combined annual payments exceed one payment limitation, then each owner must

provide labor or management to the entity. If an owner does not provide labor or management, the

entity’s payment is reduced by that owner’s proportionate share. The other scenario is when all the

owners’ combined annual payments are less than one payment limitation. In this situation, the

entity’s payment is not reduced provided that owners who collectively hold at least a 50% ownership

interest provide labor or management.

9

Example 8. John, Jane and Joe are equal owners in XYZ Farms LLC. John and Jane provide labor and

management to the LLC. Joe provides no labor or management. For 2022, John, Jane and Joe receive

a combined total of $150,000 of PLC payments from operations outside of XYZ Farms LLC (the

Payment Limitation is $125,000). XYZ Farms LLC is eligible for $90,000 in payments. How much in

2022 PLC payments may XYZ Farms LLC receive?

Because the owners cumulatively received more than one payment limitation, all owners must

provide labor or management. Joe provides neither labor nor management. Therefore, XYZ Farms

LLC’s payment is reduced in proportion to Joe’s ownership, which is one-third. The farming operation

will receive $60,000 in payments, the full $90,000 payment reduced by one-third to reflect Joe’s

ineligible share.

Conversely, if the three owners had received only $100,000 of combined payments, XYZ Farms LLC

would receive all $90,000 in payments. Here, John and Jane provide labor and management and hold

more than 50% ownership. Because the owners receive less than one combined payment limitation,

John and Jane’s labor and management allow the farming operation to receive all eligible payments.

The actively engaged requirement and joint operations. Actively engaged determinations for joint

operations are different than for legal entities. For joint operations, each owner rather than the entity

is scrutinized regarding their right-hand and left-hand contributions. Any owner that does not meet

eligibility requirements will be ineligible for payments and thus the joint operation will not receive

that share of payments.

9

6-PL Handbook, Paragraph 258.

farmoffice.osu.edu 8

Joint operations are classified as either family-owned or non-family-owned. A family-owned Joint

operation requires all owners to be family members.

10

Any or all of the owners of a family-owned

joint operation can satisfy their right-hand contribution with management alone. A non-family-

owned joint operation is limited to only one owner satisfying their right-hand contribution through

management. The joint operation may request up to two additional owners be permitted to satisfy

their right-hand contributions with management alone. This rule is intended to prevent silent

partners being classified as actively engaged through the appearance of management.

Example 9. Bill, Betty and Bob are siblings who operate a general partnership. Bill and Betty’s only

right-hand contribution is management. Bob provides both labor and management. Provided they all

meet the left-hand requirements, all three will be deemed actively engaged. Because they are a

family-owned joint operation, there is no limit to the number of owners who may receive their right-

hand contributions through management alone.

Example 10. Use the same example above except that Bill, Betty and Bob are unrelated. Now, only

Bill or Betty will be deemed actively engaged by only providing management as their left-hand

contribution. Because the operation is a non-family joint operation, only one owner is automatically

permitted to be actively engaged by providing only management. The entity can request the other

management-only owner be deemed actively engaged but must provide justification to FSA.

FSA payment eligibility: income limitations

As shown in Table 1 above, most FSA programs include an Adjusted Gross Income (AGI) limitation,

which is currently set at $900,000. Producers and legal entities whose AGI exceeds the limitation

will be ineligible for certain programs. For purposes of income limitations, the AGI is calculated using

the average AGI or comparable measure of the person or legal entity over the three taxable years

preceding the most immediately preceding complete taxable year for which payment or benefits are

requested. For example, the AGI determination for 2020 would use the average AGI from the 2016,

2017 and 2018 tax years. General partnerships and joint ventures are not subject to the AGI

limitation although the individual partners remain subject to the AGI limitation.

FSA and the IRS share data to determine the AGI of producers. The IRS notifies FSA of producers

who may exceed the AGI limit. Upon receiving such notice, FSA will send a letter of notification to a

producer who may be ineligible for the applicable program due to the AGI limitation.

Occasionally, the IRS may misidentify a producer who does not actually exceed the AGI limit. In such

situations, the producer’s attorney or accountant can provide a detailed statement showing that the

producer does not exceed the AGI limit.

11

This situation often occurs in the case of a married couple

whose joint return reports AGI in excess of $900,000, but each spouse’s individual AGI is less than

10

Family member includes great grandparent, grandparent, parent, child, grandchild, great grandchild, sibling, spouse, niece, nephew,

first cousin. 7 CFR § 1400.3.

11

Specific information must be included in the letter provided by the attorney or CPA. See 6-PL, paragraph 468 for requirements.

farmoffice.osu.edu 9

the $900,000 threshold. A statement from the attorney or CPA can show why the individual spouses

do not exceed the AGI limit.

Example 11. Larry and Linda are married and operate a farming operation. They report their income

on a joint tax return. Their joint AGI is $1,200,000. They are flagged by the IRS as exceeding the

$900,000 income threshold for FSA programs. FSA notifies Linda and Larry that they may be

ineligible for certain programs because they exceed the $900,000 AGI threshold. Linda and Larry’s

attorney sends a letter to FSA informing the IRS that while Larry and Linda’s combined AGI exceeds

$900,000, their individual AGI’s are only $600,000. Linda and Larry remain eligible and AGI

compliant.

Legal entities are subject to the AGI limit. Entities do not have AGI on their tax returns so FSA uses

a comparable measure. For entities taxed as a partnership (LLC, LLP, LP), the AGI is the income from

trade or business activities plus the amount of guaranteed payments to the members. For entities

taxed as corporations, the AGI is the total taxable income plus the amount of charitable contributions

reported on the tax return.

General partnerships and joint ventures are not subject to the AGI limit. A general partnership’s

AGI may exceed the $900,000 limit and still be eligible for programs. However, the individual

partners remain subject to the AGI limit. If a partner exceeds the AGI limit then that partner is

individually ineligible for program payments, and the partnership would not receive that partner’s

share of payments.

Farming operations that will potentially exceed the $900,000 AGI limit may want to consider

organizing as a general partnership to remain eligible for FSA programs. Any legal entity such as an

LLC or corporation will not be eligible for many FSA programs if its AGI exceeds $900,000, even if

every owner’s AGI is less than the AGI limit.

Adding payment limitations: the “substantive change” requirement

Producers may find themselves in a situation where they are consistently maxed out on payment

limitations. The obvious course of action is to increase the number of payment limitations available.

But additional payment limitations for an existing farming operation are only allowed if there is bona-

fide “substantive change.” FSA rules require an operation to document that one of the following

bona-fide and substantive changes has occurred:

• Adding one or more adult family members to a farming operation.

• For a landowner only, a change from cash-rent to share-rent.

• A 20% increase in land not previously involved in the farming operation (one additional person

only).

• In some situations, a change in ownership by sale or gift of equipment, land or livestock from a

person or legal entity previously engaged in the farming operation to a person or legal entity

who has not been engaged in this operation if the sale or gift is commensurate and based on

fair market value.

farmoffice.osu.edu 10

• The addition of equipment not previously involved in the farming operation if the rental value

is commensurate with the new person’s share of the rent value of all equipment used in the

farming operation.

12

Other than adding an adult family member to the farming operation, it is not easy to increase

payment limitations. In all other situations, there must be a significant change in the size and scale of

the farming operation to justify adding an additional individual to capture an additional payment

limitation. Therefore, establishing the correct type of business entity initially is very important.

The importance of legal assistance

The type of business structure a farming operation uses can have a significant impact on FSA

payments for its owners. Especially for larger farm operations that may be eligible for substantial

FSA payments, operating as a general partnership to increase payment limitations may justify the

additional liability exposure a partnership brings. But once a farming operation has established its

business structure, it may be difficult, if not impossible, to adjust payment eligibility. Therefore,

before deciding upon a business structure, farmers should consult with an attorney who is familiar

with FSA programs and business entities to ensure they establish a business structure best suited to

their specific requirements and needs.

12

7 CFR § 1400.104.