Payment Eligibility and

Payment Limitations

Farm Service Agency

Overview

Congress and the USDA have established requirements

to ensure that farm program payments only go to

farmers who are “actively engaged in farming”. The

2018 Farm Bill extends the payment eligibility and

payment limitation requirements for the 2019 through

the 2023 program years.

Actively Engaged in Farming

To be considered as “actively engaged in farming,” a

person or legal entity (partnerships, corporations, and

so forth), must provide significant contributions to the

farming operation. Contributions include capital, land,

and/or equipment, and active personal labor and/or

active personal management. The active personal

management contribution must be critical to the

profitability of the farming operation. All contributions

to the farming operation must be at risk of loss.

Who is Eligible

Each partner, stockholder or member with an

ownership interest must on a regular basis contribute

active personal labor and/or active personal

management to the farming operation. The

contribution must be identifiable and documentable,

and separate and distinct from the contributions made

by any other partner, stockholder or member. If any

partner, stockholder or member with an ownership

interest fails to meet this requirement, program

payments will be reduced by the corresponding share

held by that partner, stockholder or member.

1

FACT SHEET

May 2019

Additional Payment Eligibility

Provisions for Joint Operations and

Legal Entities Comprised of

Non-Family Members or Partners,

Stockholders or Persons with an

Ownership Interest in the Farming

Operation

General partnerships and joint ventures comprised of

non-family members must document the actions of the

members who make significant contributions of

management to the farming operation; defined as 500

hours of specific management activities per year, or 25

percent of the total management time necessary for the

success of the farming operation. Most farming

operations conducted by general partnerships and joint

ventures with non-family members will be limited to

only one member who can meet “actively engaged in

farming” requirements and qualify for payments based

solely on the documented contribution of active

personal management. Operations that can

demonstrate that they are large or complex farming

operations, according to newly established standards,

may be allowed an additional manager. Similarly, an

operation that can demonstrate that it is a large and

complex farming operation may qualify a third

manager for payment, but only if all three managers

can document substantial management contributions to

the operation.

The 2018 Farm Bill expands the definition of family

member to include a first cousin, niece and nephew.

The addition of first cousin, niece and nephew to the

definition applies to all payment eligibility

determinations, where applicable, effective beginning

with the 2019 program year.

How it Works

Exceptions to the General Requirements

A person or legal entity that is also a landowner is

considered “actively engaged in farming” if the person

or legal entity landowner contributes the land to a

farming operation and in return, receives rent or

income for the use of the land. The landowner’s share

of the profits or losses from the farming operation

must also be commensurate with the landowner’s

contributions to the farming operation; the

contributions must be at risk of loss.

If one spouse has been determined to be “actively

engaged in farming,” the other spouse will also be

viewed as having met the significant contribution of

active personal labor or active personal management in

that same farming operation and toward meeting the

requirements of “actively engaged in farming.”

Sharecroppers may be considered “actively engaged in

farming” if the sharecropper makes a significant

contribution of active personal labor to the farming

operation and in return receives a specified share of

the crop or crops produced on the farm. The

sharecropper’s share of the profits or losses from the

farming operation must be commensurate with the

sharecropper’s contributions; the contributions must be

at risk of loss.

A cash-rent tenant is ineligible to receive payments on

cash-rented land unless the tenant makes a significant

contribution of active personal labor. If the cash-rent

tenant does not provide labor, he or she must make a

significant contribution of both active personal

management and equipment to the farming operation.

All other “actively engaged in farming” requirements

apply as well.

Foreign Persons

Foreign persons, other than registered aliens, are not

eligible to receive certain program benefits under some

programs such as the Agriculture Risk Coverage and

Price Loss Coverage programs and other specific

programs, unless the person provides a significant

contribution of capital, land and active personal labor

to the farming operation. Under some other programs

(such as the Supplemental Disaster Assistance

Programs, the Market Facilitation Program, or others)

foreign persons are excluded from program eligibility

altogether regardless of contributions to a farming

operation.

Notification Requirements

Every legal entity earning payment must report to their

local FSA committee the name and social security

number of each person who owns, either directly or

indirectly, any interest in that legal entity. The legal

entity is also required to inform all members of the

rules regarding payment eligibility and payment

limitation.

Direct Attribution

The 2018 Farm Bill establishes a maximum dollar

amount for each program that can be received

annually, directly or indirectly, by each person or legal

entity. Such limitations on payments are controlled by

direct attribution. Program payments made directly or

indirectly to a person are combined with the pro rata

interest held in any legal entity that received payment,

unless the payments to the legal entity have been

reduced by the pro rata share of the person.

Program payments made directly to a legal entity are

attributed to those persons that have a direct and

indirect interest in the legal entity, unless the payments

to the legal entity have been reduced by the pro rata

share of the person. Payment attribution to a legal

entity is tracked through four levels of ownership. If

any part to the ownership interest at the fourth level is

owned by another legal entity, a reduction in payment

will be applied to the payment entity in the amount

that represents the indirect interest of the fourth level

entity in the payment entity.

Common Attribution

Common attribution means crediting payments made

to a person or legal entity collectively to one limitation

due to a unique or specific relationship between the

persons or legal entities. Common attribution applies

to a minor child and a parent or legal guardian; and a

parent organization over a secondary organization

when the parent organization exercises control over the

secondary organization.

Ownership Interest for Direct Attribution

For the purposes of the direct attribution of payments,

ownership interest that a person or legal entity holds in

a legal entity on June 1 of the current year is used.

Direct attribution of payments is not applicable to

cooperative associations of producers. The payments

will instead be attributed to the members of the

association that produced the commodities marketed

by the association on behalf of the members.

Minor Child Rules

June 1 of the current year is the date a child is

considered to be a minor for payment attribution

purposes. Payments received both directly and

indirectly by a minor child are attributed to the parent

or legal guardian.

Payment Limits

Person - Payments made directly or indirectly to a

person cannot exceed the annual amounts specified in

the table on page 4.

Joint Operations and General Partnerships - Payments

made directly or indirectly to a joint operation such as

a general partnership, cannot exceed, for each payment

specified in the table on page 4, the amount

determined by multiplying the maximum payment

amount specified for a program by the number of

persons and legal entities that comprise the ownership

of the joint operation. Payments to the joint operation

will be reduced by an amount that represents the direct

or indirect ownership in the joint operation by any

person or legal entity that has reached the maximum

limitation.

Legal Entities - Payments made directly or indirectly

to a legal entity cannot exceed the annual amounts

specified in the table on page 4. Payments made to a

legal entity will be reduced by an amount that

represents the direct or indirect ownership in the legal

entity by any person or legal entity that has reached the

maximum limitation.

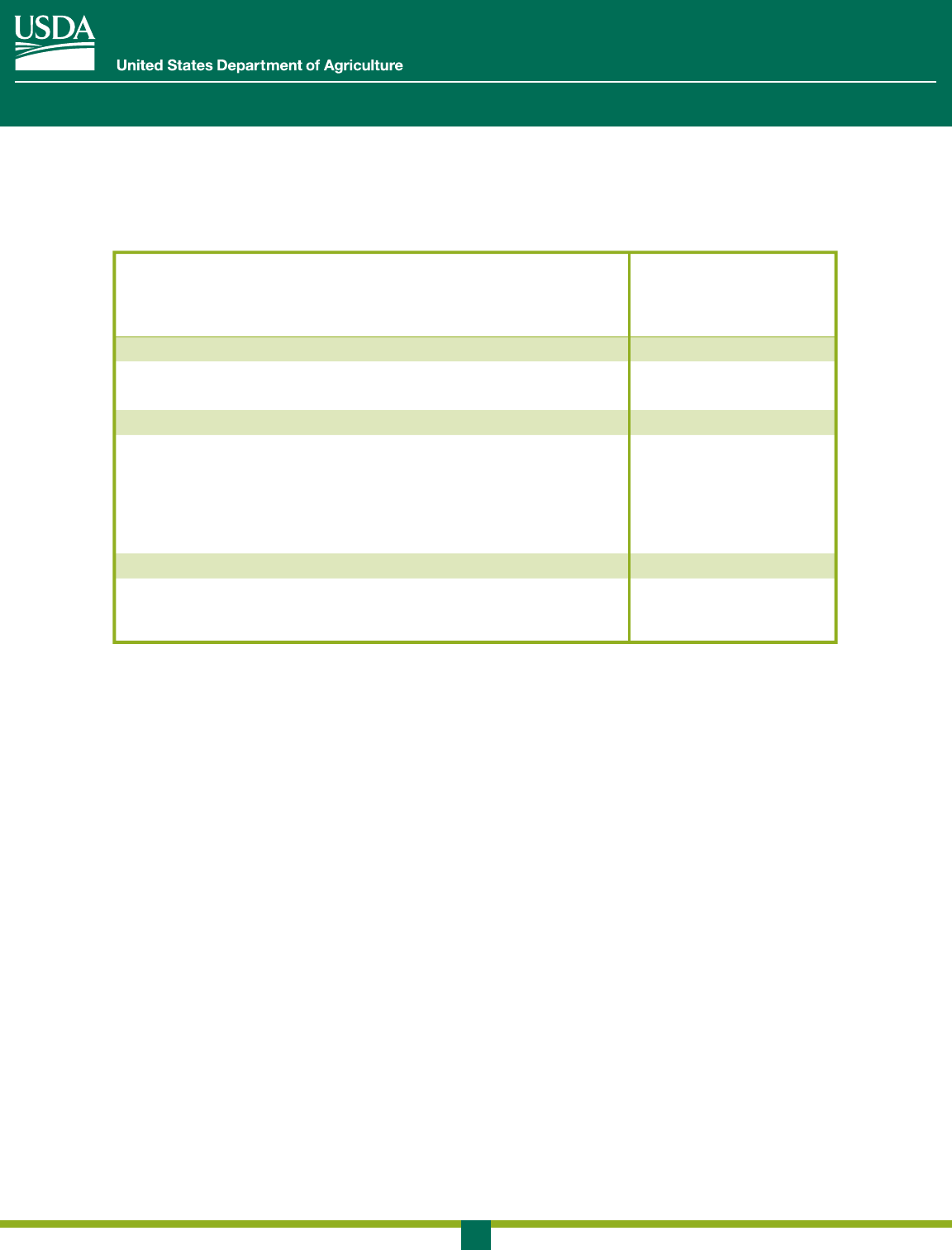

Payment Limitations

This table contains the annual payment limitations for a person or legal entity for programs that are subject to the

provisions of the 2018 Farm Bill.

Overview

Congress and the USDA have established requirements

to ensure that farm program payments only go to

farmers who are “actively engaged in farming”. The

2018 Farm Bill extends the payment eligibility and

payment limitation requirements for the 2019 through

the 2023 program years.

Actively Engaged in Farming

To be considered as “actively engaged in farming,” a

person or legal entity (partnerships, corporations, and

so forth), must provide significant contributions to the

farming operation. Contributions include capital, land,

and/or equipment, and active personal labor and/or

active personal management. The active personal

management contribution must be critical to the

profitability of the farming operation. All contributions

to the farming operation must be at risk of loss.

Who is Eligible

Each partner, stockholder or member with an

ownership interest must on a regular basis contribute

active personal labor and/or active personal

management to the farming operation. The

contribution must be identifiable and documentable,

and separate and distinct from the contributions made

by any other partner, stockholder or member. If any

partner, stockholder or member with an ownership

interest fails to meet this requirement, program

payments will be reduced by the corresponding share

held by that partner, stockholder or member.

2

PAYMENT ELIGIBILITY AND PAYMENT LIMITATIONS - MAY 2019

Additional Payment Eligibility

Provisions for Joint Operations and

Legal Entities Comprised of

Non-Family Members or Partners,

Stockholders or Persons with an

Ownership Interest in the Farming

Operation

General partnerships and joint ventures comprised of

non-family members must document the actions of the

members who make significant contributions of

management to the farming operation; defined as 500

hours of specific management activities per year, or 25

percent of the total management time necessary for the

success of the farming operation. Most farming

operations conducted by general partnerships and joint

ventures with non-family members will be limited to

only one member who can meet “actively engaged in

farming” requirements and qualify for payments based

solely on the documented contribution of active

personal management. Operations that can

demonstrate that they are large or complex farming

operations, according to newly established standards,

may be allowed an additional manager. Similarly, an

operation that can demonstrate that it is a large and

complex farming operation may qualify a third

manager for payment, but only if all three managers

can document substantial management contributions to

the operation.

The 2018 Farm Bill expands the definition of family

member to include a first cousin, niece and nephew.

The addition of first cousin, niece and nephew to the

definition applies to all payment eligibility

determinations, where applicable, effective beginning

with the 2019 program year.

How it Works

Exceptions to the General Requirements

A person or legal entity that is also a landowner is

considered “actively engaged in farming” if the person

or legal entity landowner contributes the land to a

farming operation and in return, receives rent or

income for the use of the land. The landowner’s share

of the profits or losses from the farming operation

must also be commensurate with the landowner’s

contributions to the farming operation; the

contributions must be at risk of loss.

If one spouse has been determined to be “actively

engaged in farming,” the other spouse will also be

viewed as having met the significant contribution of

active personal labor or active personal management in

that same farming operation and toward meeting the

requirements of “actively engaged in farming.”

Sharecroppers may be considered “actively engaged in

farming” if the sharecropper makes a significant

contribution of active personal labor to the farming

operation and in return receives a specified share of

the crop or crops produced on the farm. The

sharecropper’s share of the profits or losses from the

farming operation must be commensurate with the

sharecropper’s contributions; the contributions must be

at risk of loss.

A cash-rent tenant is ineligible to receive payments on

cash-rented land unless the tenant makes a significant

contribution of active personal labor. If the cash-rent

tenant does not provide labor, he or she must make a

significant contribution of both active personal

management and equipment to the farming operation.

All other “actively engaged in farming” requirements

apply as well.

Foreign Persons

Foreign persons, other than registered aliens, are not

eligible to receive certain program benefits under some

programs such as the Agriculture Risk Coverage and

Price Loss Coverage programs and other specific

programs, unless the person provides a significant

contribution of capital, land and active personal labor

to the farming operation. Under some other programs

(such as the Supplemental Disaster Assistance

Programs, the Market Facilitation Program, or others)

foreign persons are excluded from program eligibility

altogether regardless of contributions to a farming

operation.

Notification Requirements

Every legal entity earning payment must report to their

local FSA committee the name and social security

number of each person who owns, either directly or

indirectly, any interest in that legal entity. The legal

entity is also required to inform all members of the

rules regarding payment eligibility and payment

limitation.

Direct Attribution

The 2018 Farm Bill establishes a maximum dollar

amount for each program that can be received

annually, directly or indirectly, by each person or legal

entity. Such limitations on payments are controlled by

direct attribution. Program payments made directly or

indirectly to a person are combined with the pro rata

interest held in any legal entity that received payment,

unless the payments to the legal entity have been

reduced by the pro rata share of the person.

Program payments made directly to a legal entity are

attributed to those persons that have a direct and

indirect interest in the legal entity, unless the payments

to the legal entity have been reduced by the pro rata

share of the person. Payment attribution to a legal

entity is tracked through four levels of ownership. If

any part to the ownership interest at the fourth level is

owned by another legal entity, a reduction in payment

will be applied to the payment entity in the amount

that represents the indirect interest of the fourth level

entity in the payment entity.

Common Attribution

Common attribution means crediting payments made

to a person or legal entity collectively to one limitation

due to a unique or specific relationship between the

persons or legal entities. Common attribution applies

to a minor child and a parent or legal guardian; and a

parent organization over a secondary organization

when the parent organization exercises control over the

secondary organization.

Ownership Interest for Direct Attribution

For the purposes of the direct attribution of payments,

ownership interest that a person or legal entity holds in

a legal entity on June 1 of the current year is used.

Direct attribution of payments is not applicable to

cooperative associations of producers. The payments

will instead be attributed to the members of the

association that produced the commodities marketed

by the association on behalf of the members.

Minor Child Rules

June 1 of the current year is the date a child is

considered to be a minor for payment attribution

purposes. Payments received both directly and

indirectly by a minor child are attributed to the parent

or legal guardian.

Payment Limits

Person - Payments made directly or indirectly to a

person cannot exceed the annual amounts specified in

the table on page 4.

Joint Operations and General Partnerships - Payments

made directly or indirectly to a joint operation such as

a general partnership, cannot exceed, for each payment

specified in the table on page 4, the amount

determined by multiplying the maximum payment

amount specified for a program by the number of

persons and legal entities that comprise the ownership

of the joint operation. Payments to the joint operation

will be reduced by an amount that represents the direct

or indirect ownership in the joint operation by any

person or legal entity that has reached the maximum

limitation.

Legal Entities - Payments made directly or indirectly

to a legal entity cannot exceed the annual amounts

specified in the table on page 4. Payments made to a

legal entity will be reduced by an amount that

represents the direct or indirect ownership in the legal

entity by any person or legal entity that has reached the

maximum limitation.

Payment Limitations

This table contains the annual payment limitations for a person or legal entity for programs that are subject to the

provisions of the 2018 Farm Bill.

Overview

Congress and the USDA have established requirements

to ensure that farm program payments only go to

farmers who are “actively engaged in farming”. The

2018 Farm Bill extends the payment eligibility and

payment limitation requirements for the 2019 through

the 2023 program years.

Actively Engaged in Farming

To be considered as “actively engaged in farming,” a

person or legal entity (partnerships, corporations, and

so forth), must provide significant contributions to the

farming operation. Contributions include capital, land,

and/or equipment, and active personal labor and/or

active personal management. The active personal

management contribution must be critical to the

profitability of the farming operation. All contributions

to the farming operation must be at risk of loss.

Who is Eligible

Each partner, stockholder or member with an

ownership interest must on a regular basis contribute

active personal labor and/or active personal

management to the farming operation. The

contribution must be identifiable and documentable,

and separate and distinct from the contributions made

by any other partner, stockholder or member. If any

partner, stockholder or member with an ownership

interest fails to meet this requirement, program

payments will be reduced by the corresponding share

held by that partner, stockholder or member.

Additional Payment Eligibility

Provisions for Joint Operations and

Legal Entities Comprised of

Non-Family Members or Partners,

Stockholders or Persons with an

Ownership Interest in the Farming

Operation

General partnerships and joint ventures comprised of

non-family members must document the actions of the

members who make significant contributions of

management to the farming operation; defined as 500

hours of specific management activities per year, or 25

percent of the total management time necessary for the

success of the farming operation. Most farming

operations conducted by general partnerships and joint

ventures with non-family members will be limited to

only one member who can meet “actively engaged in

farming” requirements and qualify for payments based

solely on the documented contribution of active

personal management. Operations that can

demonstrate that they are large or complex farming

operations, according to newly established standards,

may be allowed an additional manager. Similarly, an

operation that can demonstrate that it is a large and

complex farming operation may qualify a third

manager for payment, but only if all three managers

can document substantial management contributions to

the operation.

The 2018 Farm Bill expands the definition of family

member to include a first cousin, niece and nephew.

The addition of first cousin, niece and nephew to the

definition applies to all payment eligibility

determinations, where applicable, effective beginning

with the 2019 program year.

3

PAYMENT ELIGIBILITY AND PAYMENT LIMITATIONS - MAY 2019

How it Works

Exceptions to the General Requirements

A person or legal entity that is also a landowner is

considered “actively engaged in farming” if the person

or legal entity landowner contributes the land to a

farming operation and in return, receives rent or

income for the use of the land. The landowner’s share

of the profits or losses from the farming operation

must also be commensurate with the landowner’s

contributions to the farming operation; the

contributions must be at risk of loss.

If one spouse has been determined to be “actively

engaged in farming,” the other spouse will also be

viewed as having met the significant contribution of

active personal labor or active personal management in

that same farming operation and toward meeting the

requirements of “actively engaged in farming.”

Sharecroppers may be considered “actively engaged in

farming” if the sharecropper makes a significant

contribution of active personal labor to the farming

operation and in return receives a specified share of

the crop or crops produced on the farm. The

sharecropper’s share of the profits or losses from the

farming operation must be commensurate with the

sharecropper’s contributions; the contributions must be

at risk of loss.

A cash-rent tenant is ineligible to receive payments on

cash-rented land unless the tenant makes a significant

contribution of active personal labor. If the cash-rent

tenant does not provide labor, he or she must make a

significant contribution of both active personal

management and equipment to the farming operation.

All other “actively engaged in farming” requirements

apply as well.

Foreign Persons

Foreign persons, other than registered aliens, are not

eligible to receive certain program benefits under some

programs such as the Agriculture Risk Coverage and

Price Loss Coverage programs and other specific

programs, unless the person provides a significant

contribution of capital, land and active personal labor

to the farming operation. Under some other programs

(such as the Supplemental Disaster Assistance

Programs, the Market Facilitation Program, or others)

foreign persons are excluded from program eligibility

altogether regardless of contributions to a farming

operation.

Notification Requirements

Every legal entity earning payment must report to their

local FSA committee the name and social security

number of each person who owns, either directly or

indirectly, any interest in that legal entity. The legal

entity is also required to inform all members of the

rules regarding payment eligibility and payment

limitation.

Direct Attribution

The 2018 Farm Bill establishes a maximum dollar

amount for each program that can be received

annually, directly or indirectly, by each person or legal

entity. Such limitations on payments are controlled by

direct attribution. Program payments made directly or

indirectly to a person are combined with the pro rata

interest held in any legal entity that received payment,

unless the payments to the legal entity have been

reduced by the pro rata share of the person.

Program payments made directly to a legal entity are

attributed to those persons that have a direct and

indirect interest in the legal entity, unless the payments

to the legal entity have been reduced by the pro rata

share of the person. Payment attribution to a legal

entity is tracked through four levels of ownership. If

any part to the ownership interest at the fourth level is

owned by another legal entity, a reduction in payment

will be applied to the payment entity in the amount

that represents the indirect interest of the fourth level

entity in the payment entity.

Common Attribution

Common attribution means crediting payments made

to a person or legal entity collectively to one limitation

due to a unique or specific relationship between the

persons or legal entities. Common attribution applies

to a minor child and a parent or legal guardian; and a

parent organization over a secondary organization

when the parent organization exercises control over the

secondary organization.

Ownership Interest for Direct Attribution

For the purposes of the direct attribution of payments,

ownership interest that a person or legal entity holds in

a legal entity on June 1 of the current year is used.

Direct attribution of payments is not applicable to

cooperative associations of producers. The payments

will instead be attributed to the members of the

association that produced the commodities marketed

by the association on behalf of the members.

Minor Child Rules

June 1 of the current year is the date a child is

considered to be a minor for payment attribution

purposes. Payments received both directly and

indirectly by a minor child are attributed to the parent

or legal guardian.

Payment Limits

Person - Payments made directly or indirectly to a

person cannot exceed the annual amounts specified in

the table on page 4.

Joint Operations and General Partnerships - Payments

made directly or indirectly to a joint operation such as

a general partnership, cannot exceed, for each payment

specified in the table on page 4, the amount

determined by multiplying the maximum payment

amount specified for a program by the number of

persons and legal entities that comprise the ownership

of the joint operation. Payments to the joint operation

will be reduced by an amount that represents the direct

or indirect ownership in the joint operation by any

person or legal entity that has reached the maximum

limitation.

Legal Entities - Payments made directly or indirectly

to a legal entity cannot exceed the annual amounts

specified in the table on page 4. Payments made to a

legal entity will be reduced by an amount that

represents the direct or indirect ownership in the legal

entity by any person or legal entity that has reached the

maximum limitation.

Payment Limitations

This table contains the annual payment limitations for a person or legal entity for programs that are subject to the

provisions of the 2018 Farm Bill.

Overview

Congress and the USDA have established requirements

to ensure that farm program payments only go to

farmers who are “actively engaged in farming”. The

2018 Farm Bill extends the payment eligibility and

payment limitation requirements for the 2019 through

the 2023 program years.

Actively Engaged in Farming

To be considered as “actively engaged in farming,” a

person or legal entity (partnerships, corporations, and

so forth), must provide significant contributions to the

farming operation. Contributions include capital, land,

and/or equipment, and active personal labor and/or

active personal management. The active personal

management contribution must be critical to the

profitability of the farming operation. All contributions

to the farming operation must be at risk of loss.

Who is Eligible

Each partner, stockholder or member with an

ownership interest must on a regular basis contribute

active personal labor and/or active personal

management to the farming operation. The

contribution must be identifiable and documentable,

and separate and distinct from the contributions made

by any other partner, stockholder or member. If any

partner, stockholder or member with an ownership

interest fails to meet this requirement, program

payments will be reduced by the corresponding share

held by that partner, stockholder or member.

Additional Payment Eligibility

Provisions for Joint Operations and

Legal Entities Comprised of

Non-Family Members or Partners,

Stockholders or Persons with an

Ownership Interest in the Farming

Operation

General partnerships and joint ventures comprised of

non-family members must document the actions of the

members who make significant contributions of

management to the farming operation; defined as 500

hours of specific management activities per year, or 25

percent of the total management time necessary for the

success of the farming operation. Most farming

operations conducted by general partnerships and joint

ventures with non-family members will be limited to

only one member who can meet “actively engaged in

farming” requirements and qualify for payments based

solely on the documented contribution of active

personal management. Operations that can

demonstrate that they are large or complex farming

operations, according to newly established standards,

may be allowed an additional manager. Similarly, an

operation that can demonstrate that it is a large and

complex farming operation may qualify a third

manager for payment, but only if all three managers

can document substantial management contributions to

the operation.

The 2018 Farm Bill expands the definition of family

member to include a first cousin, niece and nephew.

The addition of first cousin, niece and nephew to the

definition applies to all payment eligibility

determinations, where applicable, effective beginning

with the 2019 program year.

4

PAYMENT ELIGIBILITY AND PAYMENT LIMITATIONS - MAY 2019

USDA is an equal opportunity provider, employer and lender.

How it Works

Exceptions to the General Requirements

A person or legal entity that is also a landowner is

considered “actively engaged in farming” if the person

or legal entity landowner contributes the land to a

farming operation and in return, receives rent or

income for the use of the land. The landowner’s share

of the profits or losses from the farming operation

must also be commensurate with the landowner’s

contributions to the farming operation; the

contributions must be at risk of loss.

If one spouse has been determined to be “actively

engaged in farming,” the other spouse will also be

viewed as having met the significant contribution of

active personal labor or active personal management in

that same farming operation and toward meeting the

requirements of “actively engaged in farming.”

Sharecroppers may be considered “actively engaged in

farming” if the sharecropper makes a significant

contribution of active personal labor to the farming

operation and in return receives a specified share of

the crop or crops produced on the farm. The

sharecropper’s share of the profits or losses from the

farming operation must be commensurate with the

sharecropper’s contributions; the contributions must be

at risk of loss.

A cash-rent tenant is ineligible to receive payments on

cash-rented land unless the tenant makes a significant

contribution of active personal labor. If the cash-rent

tenant does not provide labor, he or she must make a

significant contribution of both active personal

management and equipment to the farming operation.

All other “actively engaged in farming” requirements

apply as well.

Foreign Persons

Foreign persons, other than registered aliens, are not

eligible to receive certain program benefits under some

programs such as the Agriculture Risk Coverage and

Price Loss Coverage programs and other specific

programs, unless the person provides a significant

contribution of capital, land and active personal labor

to the farming operation. Under some other programs

(such as the Supplemental Disaster Assistance

Programs, the Market Facilitation Program, or others)

foreign persons are excluded from program eligibility

altogether regardless of contributions to a farming

operation.

Notification Requirements

Every legal entity earning payment must report to their

local FSA committee the name and social security

number of each person who owns, either directly or

indirectly, any interest in that legal entity. The legal

entity is also required to inform all members of the

rules regarding payment eligibility and payment

limitation.

Direct Attribution

The 2018 Farm Bill establishes a maximum dollar

amount for each program that can be received

annually, directly or indirectly, by each person or legal

entity. Such limitations on payments are controlled by

direct attribution. Program payments made directly or

indirectly to a person are combined with the pro rata

interest held in any legal entity that received payment,

unless the payments to the legal entity have been

reduced by the pro rata share of the person.

Program payments made directly to a legal entity are

attributed to those persons that have a direct and

indirect interest in the legal entity, unless the payments

to the legal entity have been reduced by the pro rata

share of the person. Payment attribution to a legal

entity is tracked through four levels of ownership. If

any part to the ownership interest at the fourth level is

owned by another legal entity, a reduction in payment

will be applied to the payment entity in the amount

that represents the indirect interest of the fourth level

entity in the payment entity.

Common Attribution

Common attribution means crediting payments made

to a person or legal entity collectively to one limitation

due to a unique or specific relationship between the

persons or legal entities. Common attribution applies

to a minor child and a parent or legal guardian; and a

parent organization over a secondary organization

when the parent organization exercises control over the

secondary organization.

Ownership Interest for Direct Attribution

For the purposes of the direct attribution of payments,

ownership interest that a person or legal entity holds in

a legal entity on June 1 of the current year is used.

Direct attribution of payments is not applicable to

cooperative associations of producers. The payments

will instead be attributed to the members of the

association that produced the commodities marketed

by the association on behalf of the members.

Minor Child Rules

June 1 of the current year is the date a child is

considered to be a minor for payment attribution

purposes. Payments received both directly and

indirectly by a minor child are attributed to the parent

or legal guardian.

Payment Limits

Person - Payments made directly or indirectly to a

person cannot exceed the annual amounts specified in

the table on page 4.

Joint Operations and General Partnerships - Payments

made directly or indirectly to a joint operation such as

a general partnership, cannot exceed, for each payment

specified in the table on page 4, the amount

determined by multiplying the maximum payment

amount specified for a program by the number of

persons and legal entities that comprise the ownership

of the joint operation. Payments to the joint operation

will be reduced by an amount that represents the direct

or indirect ownership in the joint operation by any

person or legal entity that has reached the maximum

limitation.

Legal Entities - Payments made directly or indirectly

to a legal entity cannot exceed the annual amounts

specified in the table on page 4. Payments made to a

legal entity will be reduced by an amount that

represents the direct or indirect ownership in the legal

entity by any person or legal entity that has reached the

maximum limitation.

Payment Limitations

This table contains the annual payment limitations for a person or legal entity for programs that are subject to the

provisions of the 2018 Farm Bill.

1/

Decouples the combined $125,000 payment limit for PLC, ARC, from Loan Deficiency Program (LDP) and Market Loan Gain (MLG)

for covered commodities and peanuts.

Beginning with crop year 2019, LDP’s and MLG’s are no longer subject to Payment Limitation or Payment Eligibility

provisions, including “actively engaged in farming” and ‘cash-rent tenant’ provisions for covered commodities and peanuts.

ARC and PLC payment are subject to a combined annual limitation of $125,000.

2/

ECP payment limitation is increased from $200,000 per disaster event to $500,000 per disaster event.

3/

A separate maximum payment limitation is provided of $125,000 on NAP payments for losses to crops with catastrophic coverage and

a $300,000 maximum payment limitation on NAP payments for losses to crops with buy-up coverage.

4/

The $125,000 payment limitation applicable to Emergency Assistance for Livestock, Honey Bees, and Farm Raised Fish Program

(ELAP) payments is removed beginning in 2019. The $125,000 payment limitation applicable to the Livestock Indemnity Program

(LIP) is removed effective January 1, 2017 and subsequent years.

5/

TAP no longer has a dollar limitation; however, there is a per program year acreage limitation of 1,000 acres.

More information

For more information on FSA programs, eligibility and related information, visit fsa.usda.gov.

Find your local USDA Service Center

To locate your local FSA office, visit farmers.gov/service-locator.

Program Payment Type

Commodity Programs

Price Loss Coverage (PLC) and Agricultural Risk Coverage (ARC) - other than peanuts

Price Loss Coverage (PLC) and Agricultural Risk Coverage (ARC) - peanuts

Conservation Programs

Conservation Reserve Program (CRP) - annual rental payment and incentive payment

Emergency Conservation Program (ECP) - per disaster event

Emergency Forest Restoration Program (EFRP) - per disaster event

Conservation Stewardship Program (CSP)

Environmental Quality Incentives Program (EQIP)

Agricultural Management Assistance (AMA)

Disaster Assistance Programs

Livestock Forage Disaster Program (LFP)

Noninsured Crop Disaster Assistance Program (NAP)

Tree Assistance Program (TAP)

Per person or Legal Entity

(or producer for TAP)

Per Year Limitation Amount

2019 Through 2023

$125,000

1/

$125,000

1/

$50,000

$500,000

2/

$500,000

$200,000

$450,000

$50,000

$125,000

4/

$125,000/$300,000

3/

1,000 acres

5/